"Executive Summary Cryptocurrency Custody Software Market :

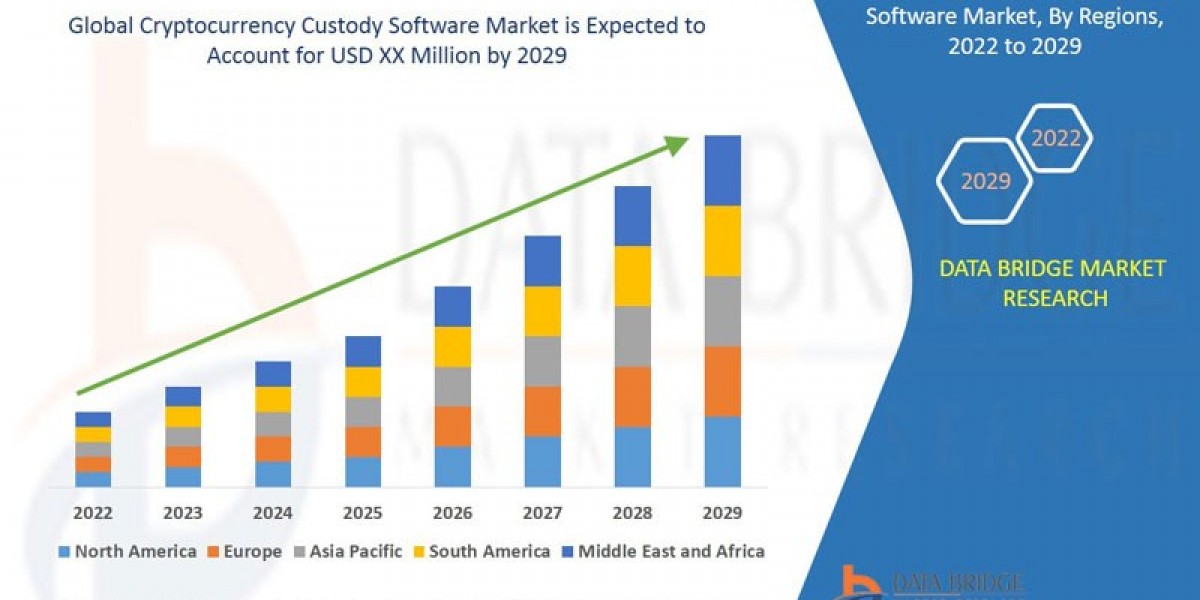

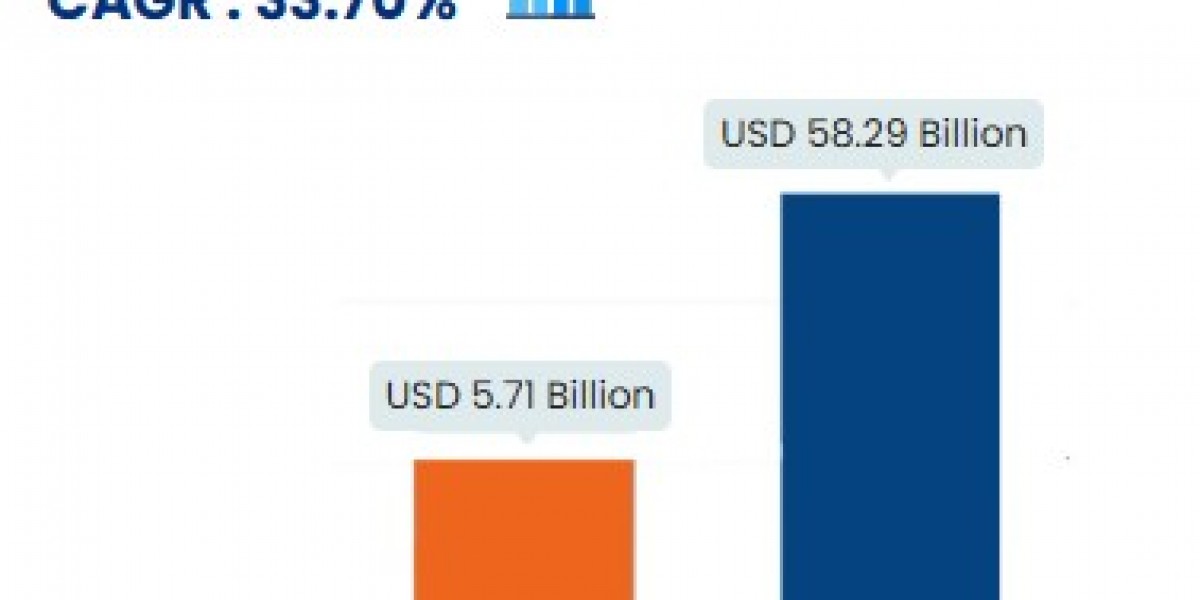

Data Bridge Market Research analyses that the cryptocurrency custody software market will exhibit a CAGR of 6.80% for the forecast period of 2022-2029.

Cryptocurrency Custody Software Market research report is the comprehensive analysis on the study of industry. Further, manufacturer can adjust production according to the conditions of demand which are analysed here. Analysis and discussion of important industry trends, market size, and market share estimates are revealed in the report. Additionally, the report helps the manufacturer in finding out the effectiveness of the existing channels of distribution, advertising programmes or media, selling methods and the best way of distributing the goods to the eventual consumers. The world class Cryptocurrency Custody Software Market report also supports to secure economies in the distribution of products and find out the best way of approaching the potential.

By understanding and keeping into focus customer requirement, one method or combination of many steps have been employed to structure the most excellent Cryptocurrency Custody Software Market research report. The report is generated with the systematic gathering and analysis of information about individuals or organizations which is conducted through social and opinion research. This global market report analyses key factors of the industry which offers precise and accurate data and information for the business growth. What is more, competitive analysis gives a clear idea about the strategies used by the major competitors in the Cryptocurrency Custody Software Market that perks up their penetration in the market.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Cryptocurrency Custody Software Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-cryptocurrency-custody-software-market

Cryptocurrency Custody Software Market Overview

**Segments**

- **By Component**: The market can be segmented based on the component into software and services. The software segment is expected to dominate the market due to the increasing adoption of cryptocurrency custody software by financial institutions and enterprises to securely store digital assets. On the other hand, the services segment is also witnessing significant growth as the need for consulting, maintenance, and support services is on the rise to ensure the smooth operation of custody solutions.

- **By Deployment Type**: Cryptocurrency custody software market can be categorized into cloud-based and on-premises deployment models. With the growing trend towards cloud-based solutions for their scalability, flexibility, and cost-efficiency, the cloud-based deployment segment is anticipated to hold a larger market share. However, the on-premises deployment segment still appeals to organizations that prioritize data control and security.

- **By End-User**: The end-user segmentation includes cryptocurrency exchanges, financial institutions, and other end-users. Cryptocurrency exchanges are expected to be the major end-users of custody software due to the need to secure large volumes of digital assets traded on their platforms. Financial institutions are increasingly entering the market, creating a demand for custody solutions to cater to institutional investors. Other end-users such as individual investors or small businesses are also adopting custody software to safeguard their digital assets.

**Market Players**

- **BitGo, Inc.**: BitGo offers institutional-grade custody solutions for cryptocurrencies, providing secure storage and management services for digital assets. The company's products are known for their robust security features and high level of compliance with regulatory standards.

- **Coinbase, Inc.**: Coinbase is a leading cryptocurrency exchange that also provides custody services through Coinbase Custody. The platform offers secure storage solutions for a wide range of digital assets, catering to institutional clients seeking reliable custody options.

- **Anchorage Digital, Inc.**: Anchorage Digital is a blockchain-based custodian that utilizes secure and efficient technology to protect digital assets. The company's institutional-grade custody services cater to various cryptocurrencies, ensuring safe storage and management for clients.

- **Vo1t**: Vo1t is a provider of cold storage solutions for digital assets, offering secure custody services for institutional clients. The company focuses on storage solutions that prioritize security and protection against potential cyber threats.

- **Metaco SA**: Metaco specializes in digital asset custody solutions for financial institutions, offering secure storage and management services for cryptocurrencies. The company's technology aims to streamline custody processes and enhance operational efficiency for clients in the financial sector.

The cryptocurrency custody software market is witnessing a significant shift towards more advanced and sophisticated solutions to meet the increasing demand for secure storage and management of digital assets. One emerging trend in the market is the integration of multi-signature wallets and biometric authentication features to enhance security measures and combat potential threats such as hacking and theft. This trend highlights the industry's focus on improving security protocols to instill confidence among institutional investors and enterprises looking to adopt cryptocurrency custody solutions.

Another key development in the market is the rise of decentralized finance (DeFi) platforms that offer non-custodial solutions for managing digital assets. While traditional custody providers still dominate the market, the growing popularity of DeFi protocols poses a potential challenge to custodial services by providing users with greater control and autonomy over their assets. This shift towards decentralized solutions could influence the strategies of established market players and drive innovation in custody software to remain competitive in a rapidly evolving landscape.

Moreover, regulatory developments continue to shape the cryptocurrency custody software market, with increasing scrutiny from regulatory authorities worldwide. Compliance with anti-money laundering (AML) and know your customer (KYC) regulations is becoming paramount for custody providers to ensure transparency and regulatory adherence. As the regulatory environment evolves, market players are expected to invest in compliance technologies and frameworks to address regulatory requirements and build trust among investors and stakeholders.

Furthermore, the market is witnessing a growing demand for interoperability among custody solutions to facilitate seamless asset transfers and transactions across different platforms. The ability to integrate with various blockchain networks and protocols is becoming essential for custody providers to offer a versatile and interconnected ecosystem for managing digital assets efficiently. This trend towards interoperability underscores the importance of collaboration and partnership initiatives among market players to create a cohesive infrastructure that meets the diverse needs of institutional clients and investors.

In conclusion, the cryptocurrency custody software market is undergoing rapid transformation driven by technological advancements, regulatory developments, and shifting user preferences. Market players need to adapt to these evolving trends by enhancing security measures, embracing decentralized solutions, ensuring regulatory compliance, and fostering interoperability to meet the growing demands of institutional clients and stakeholders in the digital asset ecosystem. The market's dynamic nature presents both challenges and opportunities for custodial service providers to innovate and differentiate themselves in a competitive landscape shaped by technological disruption and regulatory scrutiny.The cryptocurrency custody software market is currently experiencing a paradigm shift towards more sophisticated solutions to address the increasing need for secure storage and management of digital assets. One notable trend in the market is the integration of advanced security features such as multi-signature wallets and biometric authentication to enhance the overall security of custody solutions. These security enhancements are crucial in combating potential threats like hacking and theft, thereby instilling trust and confidence among institutional investors and enterprises looking to adopt cryptocurrency custody software.

Another significant development in the market is the emergence of decentralized finance (DeFi) platforms offering non-custodial solutions for asset management. While traditional custodial services still dominate the market, the rise of DeFi protocols presents a potential challenge by providing users greater autonomy and control over their assets. This trend towards decentralized solutions could potentially influence market strategies of established players, emphasizing the need for innovation in custody software to stay competitive in an evolving landscape.

Regulatory factors also play a pivotal role in shaping the cryptocurrency custody software market, with increasing scrutiny from regulatory bodies globally. Compliance with AML and KYC regulations is becoming increasingly vital for custody providers to ensure transparency and regulatory adherence. As regulations evolve, market players are expected to invest in compliance technologies and frameworks to meet regulatory requirements and build trust among investors.

Furthermore, there is a growing demand for interoperability among custody solutions to facilitate seamless asset transfers and transactions across various platforms. The ability to integrate with different blockchain networks and protocols is crucial for custody providers to create a versatile and interconnected ecosystem for efficient asset management. This trend reinforces the importance of collaboration and partnership initiatives among market players to build a cohesive infrastructure that caters to the diverse needs of institutional clients and investors.

In conclusion, the cryptocurrency custody software market is characterized by rapid changes driven by advancements in technology, evolving regulations, and user preferences. To navigate this dynamic landscape successfully, market players must focus on enhancing security measures, embracing decentralized solutions, ensuring regulatory compliance, and fostering interoperability. Adapting to these trends will be essential for custodial service providers to seize opportunities and differentiate themselves in a competitive market environment defined by technological disruption and regulatory oversight.

The Cryptocurrency Custody Software Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-cryptocurrency-custody-software-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Answers That the Report Acknowledges:

- Market size and growth rate during forecast period

- Key factors driving the Cryptocurrency Custody Software Market

- Key market trends cracking up the growth of the Cryptocurrency Custody Software Market.

- Challenges to market growth

- Key vendors of Cryptocurrency Custody Software Market

- Opportunities and threats faces by the existing vendors in Global Cryptocurrency Custody Software Market

- Trending factors influencing the market in the geographical regions

- Strategic initiatives focusing the leading vendors

- PEST analysis of the market in the five major regions

Browse More Reports:

Global Analytical Standards Market

Global Feed Enzymes Market

Global Spinal Pumps Market

Global Chemical Tanker Shipping Market

Global Sports Apparel Market

Global Cool Roof Coatings Market

Middle East and Africa Electronic Medical Records (EMR) Market

Asia-Pacific IVD Regulatory Affairs Outsourcing Market

Europe Sensors Market

Global Sulphur Dyes Market

Asia-Pacific Dermatology Drugs Market

North America Pea Starch Market

Global Acquired Neuromyotonia Treatment Market

Global UV Cured Acrylic Foam Tapes Market

Global Sodium Thiosulphate Market

Global Cosmetic Antioxidants Market

Global Milking Systems Market

Global Gas Barrier Membrane Market

North America Water Purifier Market

Global Surgical Incision Closure Market

Global Data Quality Tools Market

Global Dairy Starter Culture Market

Global Thermoplastic Polyester Elastomer (TPEE) Market

Global Usher Syndrome Market

Global Marine Ingredients Market

Global Platelet Rich Plasma Market

Global Plant-Based Beverages Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com