"Executive Summary Japan Tax IT Software Market :

Data Bridge Market Research analyses that the Japan tax IT software market is expected to reach a value of USD 4.66 billion by 2032, from USD 2.58 billion in 2024, growing at a CAGR of 7.7% during the forecast period of 2025 to 2032.

The base year for calculation in Japan Tax IT Software Market business report is taken while the historic year which will tell how the market will perform in the forecast years by informing what the market definition, classifications, applications, and engagements are. This report is also all-embracing of the data which covers market definition, classifications, applications, engagements, market drivers and market restraints that are based on the SWOT analysis. The large scale Japan Tax IT Software Market report is a comprehensive study about the market which tells about the market status in the forecast period .

An excellent Japan Tax IT Software Market research report can be generated only with the leading attributes such as highest level of spirit, practical solutions, committed research and analysis, innovation, talent solutions, integrated approaches, most up-to-date technology and dedication. Hence, all the above aspects are firmly followed by DBMR team while building this market report for a client. Furthermore, influencing factors such as market drivers, market restraints and competitive analysis is studied with the SWOT analysis which is the most established tool when it comes to generate market research report. With Japan Tax IT Software Market report, build a strong organization and make better decisions that take business on the right track.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Japan Tax IT Software Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/japan-tax-it-software-market

Japan Tax IT Software Market Overview

**Segments**

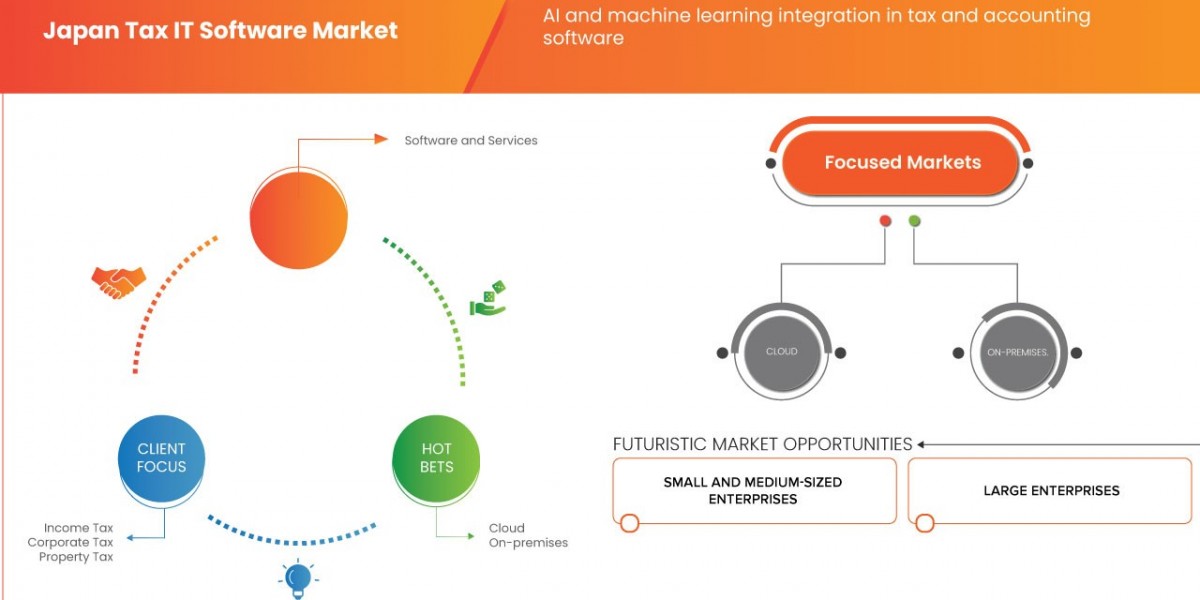

- **Solutions**: This segment includes various tax IT software solutions such as tax compliance software, tax calculation software, tax filing software, and tax planning software. These solutions help businesses and individuals accurately calculate, file, and plan their taxes in compliance with Japanese tax laws and regulations.

- **Deployment Mode**: The deployment mode segment covers on-premise and cloud-based tax IT software solutions. On-premise software is installed and operated from a company's in-house server, while cloud-based software is hosted and managed by a third-party provider over the internet.

- **End-User**: This segment consists of different end-user industries such as BFSI, healthcare, retail, manufacturing, and others that utilize tax IT software solutions to streamline their tax processes and ensure compliance with tax laws.

**Market Players**

- **Intuit Inc.**: Intuit Inc. offers a range of tax software solutions tailored for small businesses and individuals in Japan. Their software includes features for tax calculation, filing, and compliance.

- **Thomson Reuters Corporation**: Thomson Reuters Corporation provides comprehensive tax IT software solutions for businesses of all sizes in Japan. Their software integrates tax research, compliance, and planning tools.

- **H&R Block**: H&R Block is a prominent player in the Japan tax IT software market, offering user-friendly tax software for individuals and small businesses. Their software includes features for maximizing deductions and credits.

- **Avalara Inc.**: Avalara Inc. specializes in cloud-based tax compliance software for businesses in Japan. Their software automates tax calculations, filings, and reporting to ensure accuracy and efficiency.

- **Vertex, Inc.**: Vertex, Inc. offers tax software solutions for global businesses operating in Japan. Their software integrates with ERP systems to provide automated tax determination and compliance.

The Japan tax IT software market is witnessing significant growth due to the increasing complexity of tax laws and regulations, driving the demand for advanced tax software solutions. One emerging trend in the market is the integration of artificial intelligence (AI) and machine learning capabilities in tax software to enhance tax planning, compliance, and prediction of tax liabilities. This technological advancement is enabling businesses to automate their tax processes, improve accuracy, and reduce the risk of non-compliance.

Another key factor shaping the market is the rising adoption of cloud-based tax IT software solutions. Cloud-based software offers flexibility, scalability, and cost-efficiency compared to traditional on-premise solutions. Businesses across various industries in Japan are increasingly opting for cloud-based tax software to streamline their tax operations, access real-time tax data, and ensure compliance with changing tax laws.

Moreover, the market is witnessing intensifying competition among key players such as Intuit Inc., Thomson Reuters Corporation, H&R Block, Avalara Inc., and Vertex, Inc. These companies are focusing on innovation, strategic partnerships, and mergers and acquisitions to expand their product offerings and strengthen their market presence in Japan. Additionally, players are emphasizing user-friendly interfaces, customization options, and integration capabilities to cater to the diverse tax requirements of businesses and individuals in the Japanese market.

Furthermore, regulatory compliance and data security are becoming paramount concerns for businesses selecting tax IT software solutions in Japan. With the increasing scrutiny from tax authorities and the growing volume of sensitive financial data, businesses are prioritizing software providers that offer robust security measures, compliance with data protection regulations, and regular software updates to mitigate security risks and ensure data privacy.

Overall, the Japan tax IT software market is poised for continued growth driven by technological advancements, increasing adoption of cloud-based solutions, intense market competition, and a focus on regulatory compliance and data security. Businesses in Japan are increasingly recognizing the importance of implementing advanced tax software solutions to streamline their tax processes, optimize tax planning, and ensure compliance with the evolving tax landscape in the country.The Japan tax IT software market is a dynamic and rapidly evolving industry that is driven by several key factors. One prominent driver is the increasing complexity of tax laws and regulations in Japan, which is fueling the demand for advanced tax software solutions. Businesses and individuals alike are turning to tax IT software to accurately calculate, file, and plan their taxes in compliance with the stringent Japanese tax laws. This growing demand for tax software is creating significant opportunities for market players to innovate and develop solutions that cater to the unique needs of businesses operating in Japan.

Another major trend shaping the market is the integration of artificial intelligence (AI) and machine learning capabilities in tax software. By leveraging AI and machine learning technologies, tax software providers are enhancing tax planning, compliance, and prediction of tax liabilities for their users. This technological advancement is revolutionizing the way businesses manage their tax processes, enabling automation, improving accuracy, and reducing the risk of non-compliance. As AI continues to evolve, we can expect further advancements in tax software solutions that offer enhanced efficiency and decision-making capabilities.

Furthermore, the increasing adoption of cloud-based tax IT software solutions is reshaping the market landscape in Japan. Cloud-based software provides businesses with flexibility, scalability, and cost-efficiency compared to traditional on-premise solutions. As a result, businesses across various industries in Japan are increasingly migrating to cloud-based tax software to streamline their operations, access real-time tax data, and ensure compliance with changing tax laws. This shift towards cloud-based solutions is expected to continue driving growth in the market as businesses seek more agile and modern tax software solutions.

In conclusion, the Japan tax IT software market presents significant growth opportunities fueled by the complexity of tax laws, the integration of AI and machine learning capabilities, and the rising adoption of cloud-based solutions. Market players that can effectively innovate, provide user-friendly interfaces, and prioritize data security and regulatory compliance will be well-positioned to capitalize on these trends and drive success in the competitive Japanese market. As businesses increasingly recognize the value of advanced tax software solutions in optimizing tax processes and ensuring compliance, the market is set to experience continued growth and innovation in the years to come.

The Japan Tax IT Software Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/japan-tax-it-software-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Pointers Covered in the Japan Tax IT Software Market Industry Trends and Forecast

- Japan Tax IT Software Market Size

- Japan Tax IT Software Market New Sales Volumes

- Japan Tax IT Software Market Replacement Sales Volumes

- Japan Tax IT Software Market By Brands

- Japan Tax IT Software Market Procedure Volumes

- Japan Tax IT Software Market Product Price Analysis

- Japan Tax IT Software Market Regulatory Framework and Changes

- Japan Tax IT Software Market Shares in Different Regions

- Recent Developments for Market Competitors

- Japan Tax IT Software Market Upcoming Applications

- Japan Tax IT Software Market Innovators Study

Browse More Reports:

Global Mono Ammonium Phosphate Fertilizers Market

Asia-Pacific Electromagnetic Tracking Systems Market

Canada Beverage Coolers Market

Europe Advanced Wound Care Market

Europe Vital Signs Monitoring Market

Global Flight Management Systems (FMS) and Stable Market

Global Handheld X-Ray Imaging Devices Market

Global Industrial Vacuum Evaporation Systems Market

Global Cheese Sauce Market

Global Laser Hair Removal Market

Middle East and Africa ELISpot and FluoroSpot Assay Market

Global Virtual Desktop Infrastructure (VDI) Market

Global Agriculture Robots Market

Global Electronics Shutter Market

Global Self-Heating Food Packaging Market

Global Cloud ITSM Market

Global Canes and Crutches Market

Global Laser Eyewear Market

Global Estrogen Receptor Modulators Market

North America Beverage Coolers Market

Global Electronic Design Automation (EDA) Tools Market

Europe Blood Screening Market

Global Single Cell Battery Market

Global Epoxy Resin Market

North America Application Programming Interfaces (API) Management Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com