"Executive Summary Sustainable Finance Market :

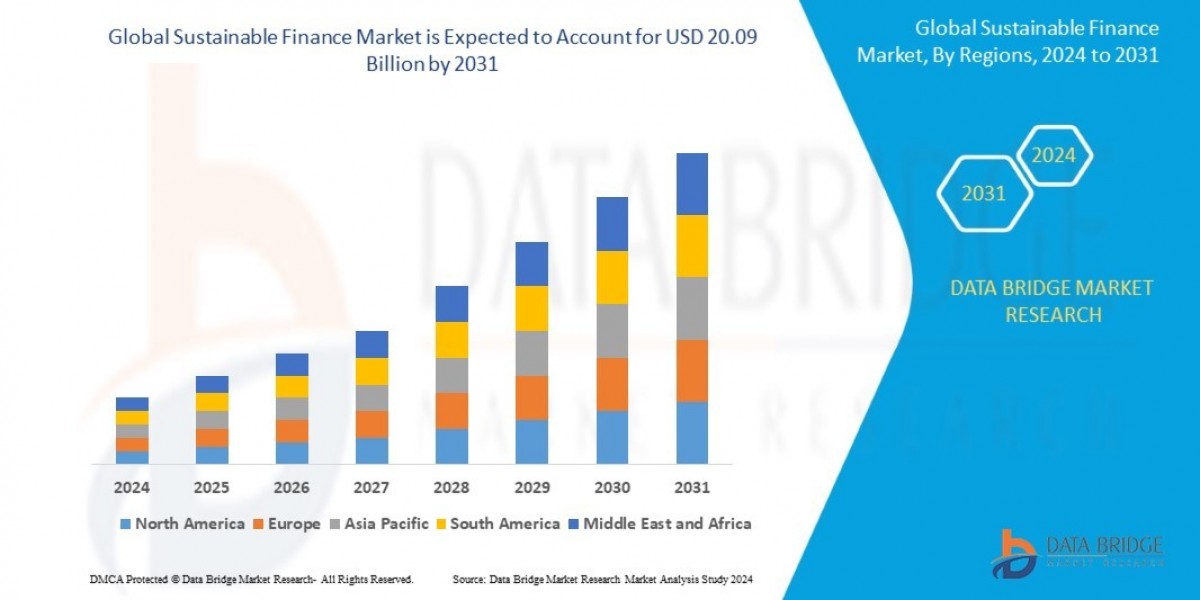

Data Bridge Market Research analyses that the global sustainable finance market which was USD 4.56 billion in 2023, would rocket up to USD 20.09 billion by 2031, and is expected to undergo a CAGR of 20.36% during the forecast period.

An all-inclusive data and information of promptly changing market landscape such as what is already present in the market, future trends or market expectations, the competitive environment, and competitor strategies can be obtained from this Sustainable Finance Market business report. Besides this, it categorizes the breakdown of global data by manufacturers, region, type and application, and also analyzes the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, and distributors. With such data and facts, it becomes easy to have actionable ideas, enhanced decision-making and better mapping business strategies.

One of the major objectives of this report is to research, analyze and study the global sales, value, status (2013 - 2017) and forecast (2018 - 2025). It also puts a light on the recent developments, product launches, joint ventures, mergers and acquisitions that have been adopted by the several key players and brands. The report also analyzes the global and key regions market potential and advantage, opportunity and challenge, restraints and risks. In the report, market segmentation is performed in detail based on various parameters that include applications, verticals, deployment model, end user, and geographical region.

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Sustainable Finance Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/global-sustainable-finance-market

Sustainable Finance Market Overview

**Segments**

- **Banking**

- **Insurance**

- **Investment**

The global sustainable finance market is segmented based on the type of financial services provided, including banking, insurance, and investment. Banking services in the sustainable finance market focus on providing loans and financial products that support environmentally friendly and socially responsible initiatives. Insurance services within this market offer products that cover risks related to climate change, environmental damages, and other sustainable issues. Investment services in the sustainable finance market involve funding projects and companies that prioritize sustainability and ethical practices.

**Market Players**

- **JP Morgan Chase & Co**

- **Bank of America Corporation**

- **Citi**

- **Morgan Stanley**

- **HSBC Holdings plc**

Key market players in the global sustainable finance market include JP Morgan Chase & Co, Bank of America Corporation, Citi, Morgan Stanley, and HSBC Holdings plc. These financial institutions are at the forefront of incorporating sustainable finance practices into their operations, offering a range of sustainable financial products and services to their clients. JP Morgan Chase & Co, for example, focuses on sustainable investing and green financing to promote environmental conservation and social responsibility. Bank of America Corporation has a strong focus on sustainable financing initiatives that support renewable energy projects and carbon reduction efforts. Citi is committed to sustainable growth and environmental stewardship through its financing and investing activities. Morgan Stanley emphasizes sustainable finance solutions that address climate change and support sustainable development goals. HSBC Holdings plc is dedicated to sustainable finance practices that contribute to a low-carbon economy and sustainable future.

The global sustainable finance market is experiencing significant growth, driven by increasing awareness and emphasis on environmental and social responsibility. One key trend shaping the market is the integration of sustainable finance principles into traditional financial services across banking, insurance, and investment sectors. This integration is driven by consumer demand for ethical and sustainable financial products and services, as well as regulatory pressure to address climate change and other sustainability challenges. Market players are increasingly focusing on sustainability as a core aspect of their business strategies, aligning with the global shift towards a more environmentally conscious and socially responsible economy.

In terms of banking services, financial institutions are expanding their sustainable finance offerings to include green loans, sustainable mortgages, and other products that support eco-friendly initiatives. This shift towards sustainable banking not only reflects a commitment to environmental stewardship but also presents new opportunities for financial institutions to attract a socially conscious customer base. Insurance companies are also playing a crucial role in the sustainable finance market by creating innovative products that cover risks associated with climate change, such as extreme weather events and natural disasters. These products not only provide financial protection for policyholders but also incentivize sustainable practices that reduce environmental risks.

Within the investment sector, there is a growing emphasis on impact investing, where funds are allocated to projects and companies that have a positive social or environmental impact alongside financial returns. This trend is reshaping traditional investment approaches and driving a greater focus on sustainability metrics and ESG (Environmental, Social, and Governance) criteria in investment decision-making. Market players are increasingly integrating ESG factors into their investment strategies to mitigate risks associated with climate change, resource scarcity, and social inequalities while also capitalizing on emerging opportunities in sustainable industries.

Overall, the global sustainable finance market is poised for continued growth as more financial institutions adopt sustainable practices and incorporate these principles into their core business models. The market presents opportunities for innovation, collaboration, and partnerships that can drive positive change towards a more sustainable and inclusive financial system. As consumer demand for ethical and sustainable financial solutions continues to rise, market players will need to adapt and evolve to meet these evolving trends and expectations. The future of finance lies in sustainability, and the key players in the market are well-positioned to lead the way towards a more sustainable and responsible financial ecosystem.The global sustainable finance market is witnessing a transformative shift towards environmental and social responsibility, driven by evolving consumer preferences, regulatory requirements, and a growing emphasis on sustainable practices. In the banking sector, financial institutions are leveraging sustainable finance principles to offer a wide range of eco-friendly products such as green loans and sustainable mortgages. This expansion not only underscores a commitment to sustainability but also enables banks to tap into a burgeoning market of socially conscious consumers seeking ethical financial solutions. Insurance companies are also making significant strides by introducing innovative products that cover risks associated with climate change, helping policyholders manage environmental uncertainties while promoting sustainable behaviors.

Moreover, the investment landscape is undergoing a notable transformation with the rise of impact investing, where capital is allocated to projects and companies that generate positive social and environmental outcomes alongside financial returns. This trend is reshaping traditional investment methodologies by placing greater emphasis on sustainability metrics and ESG criteria in decision-making processes. Market players are integrating ESG factors into their investment strategies to mitigate risks linked to climate change, resource scarcity, and social disparities while seizing opportunities in sustainable sectors. By aligning investment practices with sustainability goals, financial institutions are not only managing risks more effectively but also driving positive change towards a more sustainable and inclusive financial system.

The increasing focus on sustainability across banking, insurance, and investment sectors underscores a fundamental shift towards a more environmentally conscious and socially responsible economy. Key market players such as JP Morgan Chase & Co, Bank of America Corporation, Citi, Morgan Stanley, and HSBC Holdings plc are leading the charge by incorporating sustainable finance practices into their core business strategies. These institutions are not only meeting the demands of an increasingly eco-aware consumer base but also positioning themselves as pioneers in the transition towards a greener and more sustainable financial ecosystem. As the global sustainable finance market continues to evolve, collaboration, innovation, and strategic partnerships will play a crucial role in driving sustainable development and fostering a more resilient and responsible financial landscape.

The Sustainable Finance Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/global-sustainable-finance-market/companies

DBMR Nucleus: Powering Insights, Strategy & Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Answers That the Report Acknowledges:

- Sustainable Finance Market size and growth rate during forecast period

- Key factors driving the Sustainable Finance Market

- Key market trends cracking up the growth of the Sustainable Finance Market.

- Challenges to Sustainable Finance Market growth

- Key vendors of Sustainable Finance Market

- Opportunities and threats faces by the existing vendors in Global Sustainable Finance Market

- Trending factors influencing the market in the geographical regions

- Strategic initiatives focusing the leading vendors

- PEST analysis of the Sustainable Finance Market in the five major regions

Browse More Reports:

Global Dog Clothing and Accessories Market

Europe Lysosomal Storage Disorder Drugs Market

Global Environmental Friendly and Sustainable Food Market

Asia-Pacific Platelet Rich Plasma Market

Global Copper Fungicides Market

France Process Safety Services Market

Global Smart Indoor Gardening System Market

Global Chemical Sensor Market

Global Flowers and Ornamental Plants Market

Global Cargo Handling Equipment Market

Global Hydrogen Energy Storage Market

Global Chocolate Flavours Market

Global Professional Haircare Products Market

Global Feed Binders Market

Global Residues and Contamination Testing Market

Global Cleanroom Fluorescent Lighting Market

Global Farm Animal Drug Market

Asia-Pacific Hydrogen Sulfide (H2S) Scavengers Market

Global Automotive Adhesive Tape Market

Middle East and Africa Surface Disinfectant Wipes Market

Global Flexible Packaging Materials Market

Global Automotive Transmission Market

Global Cancer Pain Market

Global Water Purifiers Market

Global Bundle Branch Block Market

Global Wiper Motor AfterMarket

Global Gluten-Free Cereals Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com