As we project its price outlook toward 2029, it's clear that forecasts vary significantly depending on models, data sources, and market assumptions. velo price prediction 2029 According to CoinCodex, which uses historical data and technical metrics, VELO is expected to steadily appreciate over the next few years, with a projected average price of around and a potential high of by 2029—an estimated over today’s levels That prediction highlights sustained upward momenum fueled by increasing adoption and improved blockchain primitives.

Complementing this view, DigitalCoinPrice projects a bullish peak in 2029, forecasting the token to surpass , with lows near Their analysis anticipates Velo’s infrastructure scaling and deeper partnerships within emerging fintech ecosystems to drive demand.

On a more conservative note, 3Commas’ AI‑powered technical analysis suggests a much tighter trading range—roughly through 2029—with estimates clustering around While less enthusiastic, this scenario still represents modest growth from mid‑2025 values near

Meanwhile, HTX offers a middle‑ground forecast, estimating VELO could reach about by This aligns with CoinCodex’s optimistic median estimate, signaling broad market sentiment skewed toward appreciating value by the decade’s end.

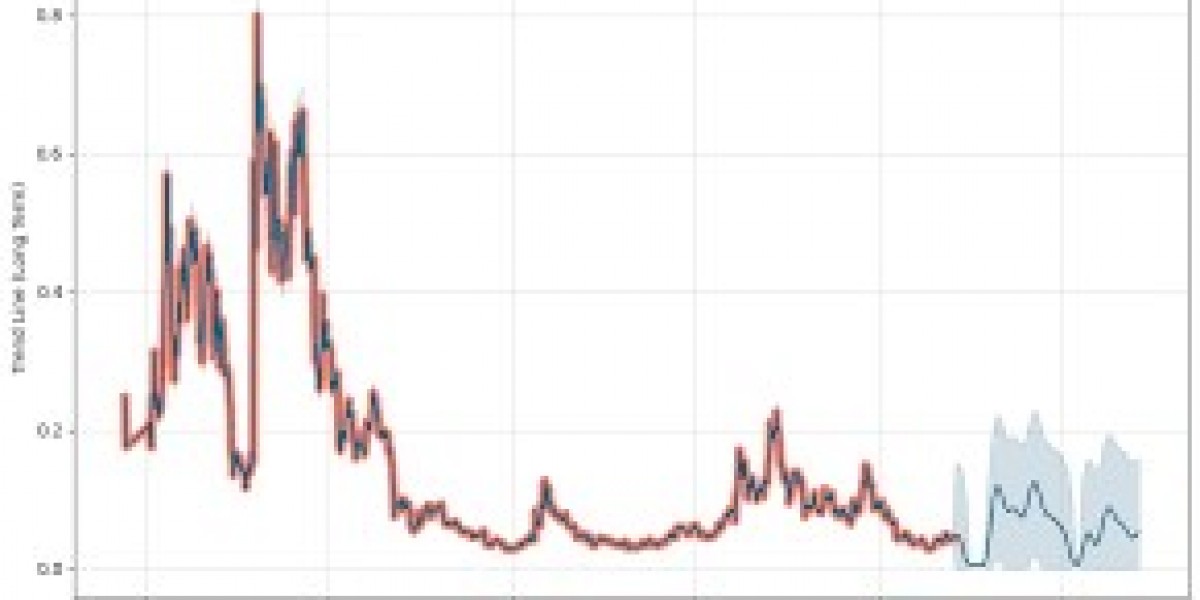

Factoring these projections together, Velo’s 2029 outlook ranges widely—from a cautious in bearish scenarios, to nearly in highly bullish forecasts. This volatility stems from divergent model types—some relying on conservative technical signals and others leveraging macro adoption narratives.

Key drivers behind potential price appreciation include Velo’s continued role in bridging real-world payments and scalable blockchain platforms, alongside the maturation of its ecosystem and enterprise integrations. Projects introducing practical use cases—especially in cross-border remittances or B2B payments—could significantly elevate transactional activity and token utility.

Conversely, risks remain. Macroeconomic headwinds, regulatory scrutiny, network competition, or poor project execution could delay or derail anticipated growth, resulting in values nearer to the range. The disparity between low-end technical estimates and high-end adoption forecasts highlights this dichotomy.

In summary, Velo’s projected trajectory into 2029 is best visualized as a bell‑curve of outcome With current trends, a reasonable midpoint expects VELO to trade around by late 2029 if adoption and ecosystem expansion proceed steadily. As always, investors should weigh potential rewards against volatility, market cycles, and execution risks, keeping an adaptive strategy in place through the forecast horizon.