Japan Remittance Market: Strategic Insights and Growth Trends Driving Financial Mobility

Market Analysis:

The Japan remittance market is witnessing steady growth driven by increasing cross-border labor migration, rising digital banking infrastructure, and evolving financial regulations supporting faster and cheaper money transfers. In 2023, the total remittance volume in Japan reached approximately USD 2.05 billion, with a growing shift from traditional bank-based transfers to digital platforms. Outbound remittances form a significant portion of the market, primarily sent by foreign workers residing in Japan to countries like the Philippines, Vietnam, China, Nepal, and Indonesia. Inbound remittances, although smaller, are also increasing as Japanese nationals working overseas send funds back home. The demand for affordable, efficient, and transparent remittance services is increasing, especially among blue-collar workers and students. Japan’s aging population and labor shortages have led to an influx of migrant workers, boosting the remittance economy. The market is expected to grow at a CAGR of 4.296% from 2025 to 2035, with digital channels accounting for more than 60% of transactions due to the convenience and competitive exchange rates they offer.

Market Key Players:

Key players in the Japan remittance market include both global money transfer companies and local financial service providers. Leading international companies such as Western Union, MoneyGram, and Wise (formerly TransferWise) hold a significant share due to their wide network coverage and robust digital platforms. Western Union remains a dominant player with its extensive reach and agent locations throughout Japan, while MoneyGram is actively expanding its digital capabilities to offer faster online and mobile transfers. Wise continues to gain popularity for its transparent fee structure and mid-market exchange rate policy. Among local players, SBI Remit stands out as one of Japan's largest domestic remittance companies, offering services through both digital channels and in-person kiosks. Japan Post Bank also plays a significant role by facilitating remittance services in collaboration with international partners. Additionally, fintech companies such as Remitly, PaySend, and Rakuten Remit are expanding their presence by targeting younger users and migrant communities through mobile-first strategies.

Get An Exclusive Sample of the Research Report at - https://www.marketresearchfuture.com/sample_request/8412

Market Segmentation:

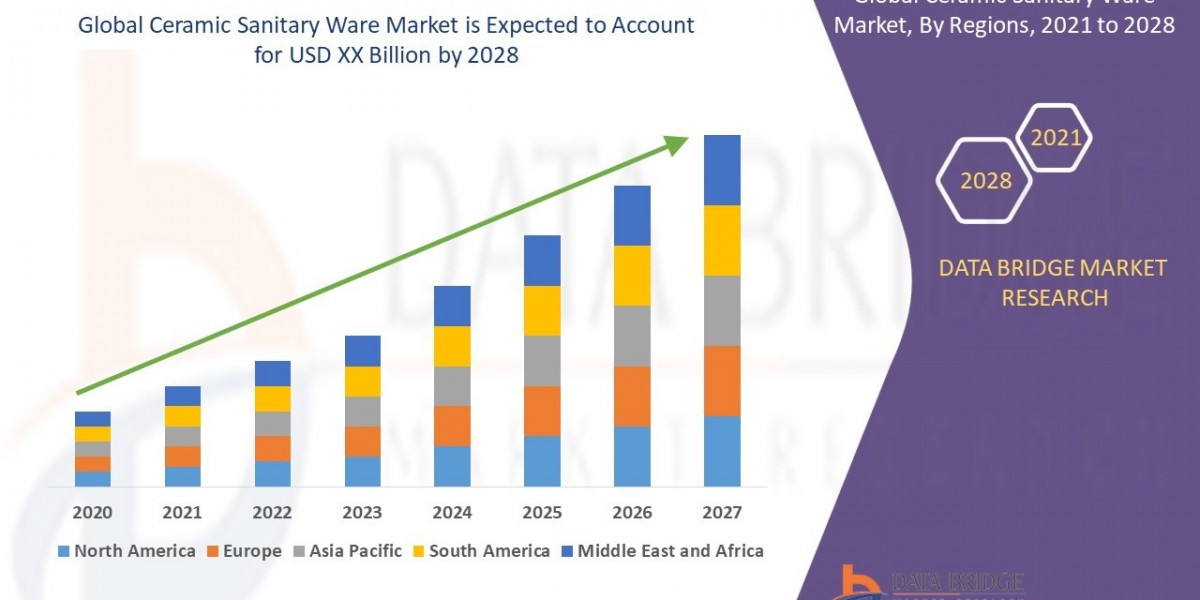

The Japan remittance market can be segmented based on remittance type, channel, end-user, and receiving region. By remittance type, the market is divided into inbound and outbound transfers. Outbound remittances dominate, accounting for nearly 88% of the total remittance volume in 2023. Channel-wise, the market is segmented into banks, money transfer operators (MTOs), and digital platforms. Digital platforms are showing the fastest growth, expected to surpass traditional banks by 2027 due to increased smartphone penetration and user-friendly mobile applications. In terms of end-users, migrant workers, students, and expatriates are the primary contributors to outbound transfers, while retirees and Japanese citizens abroad drive inbound remittances. When segmented by receiving region, Southeast Asia leads the list, particularly the Philippines, Vietnam, and Indonesia, as these countries account for a high percentage of Japan's foreign labor force. South Asia, including Nepal and India, also represents a growing segment, reflecting increasing migration trends from these countries to Japan.

Market Dynamics:

The Japan remittance market is influenced by several dynamic factors including labor migration patterns, regulatory policies, exchange rate fluctuations, and technological innovation. Japan’s recent reforms in its immigration policies and expanded visa programs for technical interns and skilled workers have significantly increased the foreign workforce, thereby expanding the volume of outbound remittances. The strengthening of the Japanese Yen relative to many Southeast Asian currencies further encourages remittance flows by increasing the real value of money sent home. On the regulatory front, the Japanese government and the Financial Services Agency (FSA) have introduced guidelines to ensure compliance, transparency, and anti-money laundering practices across financial institutions, supporting consumer trust in digital remittance solutions. Technological advancement remains a central growth driver, with AI-powered apps, blockchain solutions, and mobile wallets reducing transaction costs and processing times. However, challenges such as high transfer fees via traditional banks, foreign exchange risks, and lack of financial literacy among certain migrant communities continue to affect market efficiency and adoption.

Recent Development:

In recent years, the Japan remittance market has seen considerable innovation and expansion initiatives. SBI Remit entered into partnerships with RippleNet to leverage blockchain technology for near-instant and low-cost remittance services, especially between Japan and Southeast Asia. Western Union expanded its digital services in Japan by launching mobile app functionalities that allow users to track and send funds with greater ease and security. Rakuten Remit has integrated real-time updates and multi-language support in its app to enhance customer experience for international workers. Meanwhile, Wise has launched campaigns promoting transparent pricing and has increased its local bank integrations to streamline fund disbursement. Fintech firms like Remitly and InstaReM have recently ramped up their marketing efforts in Japan, focusing on mobile-first users and new immigrants. In addition, the Japanese government has supported the modernization of remittance services by encouraging digital payment innovations and fintech collaborations under its broader goal of creating a cashless society.

Regional Analysis:

From a regional perspective, major remittance activity is concentrated in metropolitan hubs such as Tokyo, Osaka, Nagoya, and Fukuoka, which host the largest foreign worker populations. Tokyo leads in remittance volume due to its diversified workforce and high density of financial institutions. Osaka and Nagoya follow, driven by their industrial zones and manufacturing sectors that employ thousands of foreign technical interns. Fukuoka is emerging as a key center for remittance due to its proximity to Southeast Asia and increasing immigration from neighboring countries. In terms of recipient countries, the Philippines continues to top the list, followed by Vietnam and Indonesia, reflecting long-standing labor migration ties. Nepal and Bangladesh are also growing rapidly as source countries for skilled and semi-skilled workers in Japan. With increased digitization, even rural areas are witnessing improved access to international money transfers through mobile apps and agent-assisted services. As regional migration continues and fintech infrastructure expands, the remittance market in Japan is expected to grow in both volume and efficiency, reshaping the cross-border financial ecosystem.

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/japan-remittance-market-46511

Top Trending Report -

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

Contact Us:

Market Research Future (Part of Wantstats Research and Media Private Limited)

99 Hudson Street, 5Th Floor

New York, NY 10013

United States of America

+1 628 258 0071 (US)

+44 2035 002 764 (UK)

Email: sales@marketresearchfuture.com