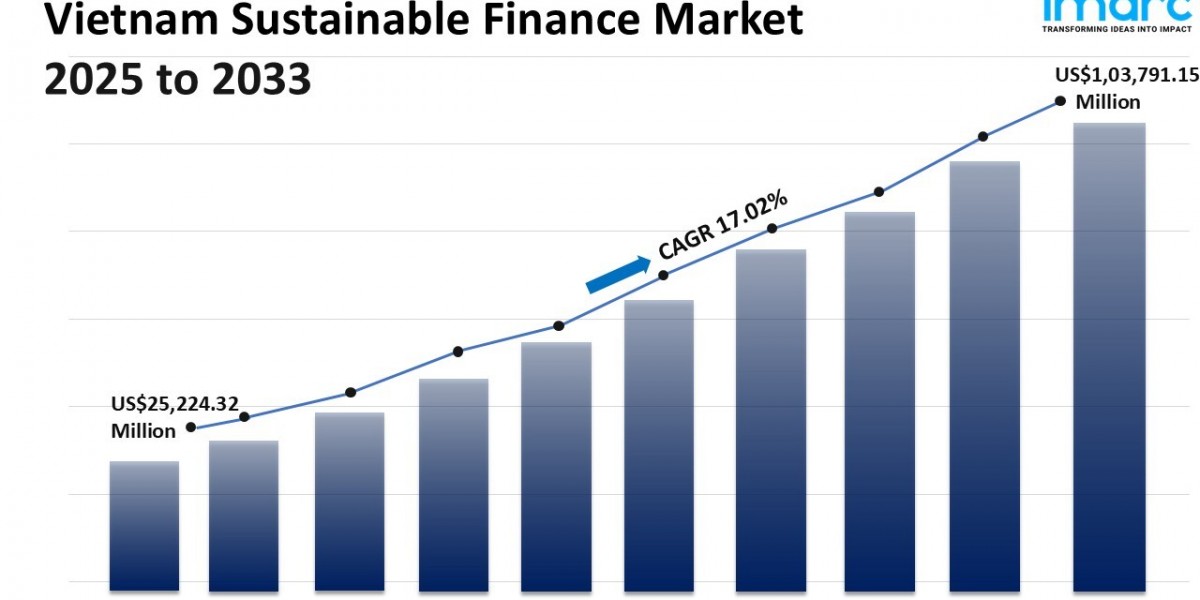

The Vietnam Sustainable Finance Market reached a size of USD 25,224.32 Million in 2024. It is forecasted to grow at a CAGR of 17.02% from 2025 to 2033, reaching USD 103,791.15 Million by 2033. This growth is driven by the rising adoption of green bonds, sustainability-linked loans, and ESG-focused investments, supported by government commitments toward net-zero emissions and stronger policy frameworks fostering capital inflows into renewable energy and eco-friendly businesses.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Vietnam Sustainable Finance Market Key Takeaways

The Vietnam sustainable finance market size reached USD 25,224.32 Million in 2024.

The market is projected to grow at a CAGR of 17.02% during 2025-2033.

The forecast period for the market is from 2025 to 2033.

Growing adoption of green bonds and sustainability-linked loans drives market expansion.

Government commitment toward net-zero emissions by 2050 fosters investments.

Regulatory frameworks are evolving to promote ESG reporting and ethical investing.

Increasing investor confidence from domestic and foreign players is strengthening market growth.

Sample Request Link: https://www.imarcgroup.com/vietnam-sustainable-finance-market/requestsample

Market Growth Factors

The volume of green finance is increasing in Vietnam with investment in renewable energy, green transport and sustainable agriculture. In part, financial services sector sustainability targets drive it, with including ESG integration in lending portfolios. Multilateral banks and international development agencies advanced green bonds and sustainability-linked loans through offering lower-cost long-term financing and supporting green project initiatives.

By 2050, Vietnam commits to achieve a net-zero emission target by then. This makes chances for infrastructure investment and renewable energy development. Transparency in reporting on ESG is increased. Investment becomes more responsible. These factors help form a sustainable finance ecosystem which balances profit and the environment, attracting more domestic and international investors.

Digital and fintech tools have been vital in the growth of Vietnam's sustainable finance sector. Digital finance has allowed financial institutions to keep track of ESG-related assets and assess impacts using data processing, blockchain-based reporting, and AI-assisted credit appraisal. Digital green bond issuance platforms have the potential to drive more data and risk analytics to capital market participants, and provide a hedge against greenwashing. There are fintech startup and bank partnerships providing sustainable microfinance and online loans for climate-friendly SMEs.

Market Segmentation

Investment Type:

Equity: Represents one of the key investment types providing capital in Vietnamese sustainable finance.

Fixed Income: Comprises debt instruments such as green bonds supporting sustainable initiatives.

Mixed Allocation: Combines elements of equity and fixed income investments to diversify financing.

Transaction Type:

Green Bond: Bonds specifically issued to finance environmentally sustainable projects.

Social Bond: Bonds targeting financing of projects with positive social impact.

Mixed-Sustainability Bond: Bonds that combine environmental and social financing goals.

Industry Vertical:

Utilities: Sustainable finance supporting energy and water utilities focused on eco-friendly operations.

Transport and Logistics: Investments into sustainable transportation and logistics infrastructure.

Chemicals: Funding for chemical industry projects aligned with sustainability criteria.

Food and Beverage: Sustainable finance directed to eco-friendly food production and processing.

Government: Government-related sustainable finance programs and initiatives.

Others: Includes other industries participating in sustainable finance activities.

Regional Insights

The Vietnam sustainable finance market comprises three major regional segments: Northern Vietnam, Central Vietnam, and Southern Vietnam. The report provides comprehensive analysis for each region to capture localized market trends and investment opportunities. The market is supported by widespread regional policy initiatives aligned with national sustainability goals.

Recent Developments & News

In May 2025, the State Bank of Vietnam launched the Environmental and Social Risk Management System (ESMS) Handbook. This initiative guides credit institutions to promote sustainable finance and enhance ESG-based risk management. It supports the expansion of green credit and aligns with Vietnam's national green growth strategy, reflecting government efforts to integrate sustainability into financial sector practices.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302