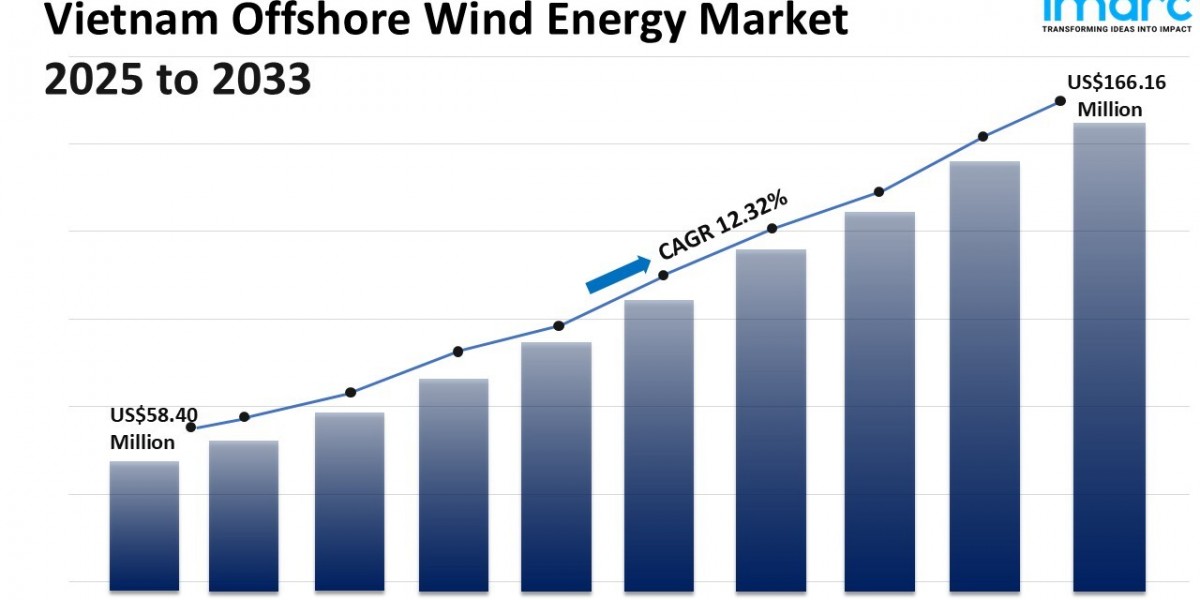

The Vietnam offshore wind energy market size was valued at USD 58.40 Million in 2024 and is anticipated to reach USD 166.16 Million by 2033, growing at a CAGR of 12.32% during the forecast period of 2025-2033. This growth is fueled by increasing investments in renewable power and government initiatives promoting clean energy. Rising energy security needs and large-scale coastal projects also support market expansion.

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Period: 2025-2033

Vietnam Offshore Wind Energy Market Key Takeaways

The market size reached USD 58.40 Million in 2024 and is projected to grow to USD 166.16 Million by 2033.

The market is expected to grow at a CAGR of 12.32% during 2025-2033.

Government initiatives including renewable energy targets and tax incentives are major growth drivers.

Vietnam's extensive coastline and favorable wind conditions enable large-scale offshore wind projects.

Increasing foreign collaborations and investments provide access to advanced technologies and financing.

Technological advancements such as larger turbines and floating platforms expand project potential.

Growing local manufacturing and digital technologies improve efficiency and competitiveness.

Sample Request Link: https://www.imarcgroup.com/vietnam-offshore-wind-energy-market/requestsample

Market Growth Factors

The policy framework eases private and international investment in utilities with renewable energy targets and tax exemptions. It is compatible with Vietnam's Power Development Plan VIII, which prioritizes offshore wind as a key technology for the country's long-term energy transition and sustainability. The government targets emissions to reduce them and commits to achieving net-zero by 2050, which gives confidence to the industry. Vietnam has a long coastline and winds that suit it, so it could be an ideal offshore market in Southeast Asia.

Joint ventures, project financing and technology transfer with multinationals and private equity firms is on the rise, giving local manufacturers access to modern turbine designs, grid connection technologies and operational experience. These technologies, in particular will be needed as the domestic industry develops. Investments by companies from the European and Asian markets highlight the confidence in Vietnam's renewable energy potential. To create a healthy ecosystem for offshore wind development, Vietnamese firms are helping with supply chain and workforce development.

Developments include larger, more efficient turbines, and a new class of floating substructures which allow offshore wind power to work at greater water depths. Grid integration improves and enables stable transmission in the grid with lower energy losses. AI enables surveillance and analysts predict in development for improving productivity with reduced downtime. Local production facilities get better so imports are less necessary. In addition, Vietnam's offshore wind market is innovative and is an area for sustainable investment with high scalability.

Market Segmentation

Component Insights:

Turbine: Core component harnessing wind energy.

Substructure: Supports offshore turbines structurally.

Electrical Infrastructure: Encompasses power transmission and grid connections.

Others: Includes ancillary components supporting the system.

Foundation Type Insights:

Fixed Foundation: Traditional, stable foundations anchored to seabed.

Floating Foundation: Allows turbines in deeper waters beyond fixed foundations.

Capacity Insights:

Less Than 5 MW: Smaller scale offshore wind turbines.

Greater than or Equal to 5 MW: Large-scale turbines for significant power generation.

Location Insights:

Shallow Water: Areas close to shore with lesser depths.

Transitional Water: Intermediate depths between shallow and deep waters.

Deep Water: Farther offshore with considerable depths, requiring advanced technology.

Regional Insights

The market segmentation includes Northern Vietnam, Central Vietnam, and Southern Vietnam. The report provides comprehensive analysis of all major regional markets; however, explicit dominant region statistics or market shares are not provided.

Recent Developments & News

In August 2025, Copenhagen Infrastructure Partners (CIP) and PETROVIETNAM entered a joint agreement to develop an offshore wind project in Vietnam. This project, supported by CIP’s Growth Market Fund II, strengthens Vietnam’s energy security and encourages a local supply chain, fostering expansion of the offshore wind energy market.

Key Players

Copenhagen Infrastructure Partners (CIP)

PETROVIETNAM

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302