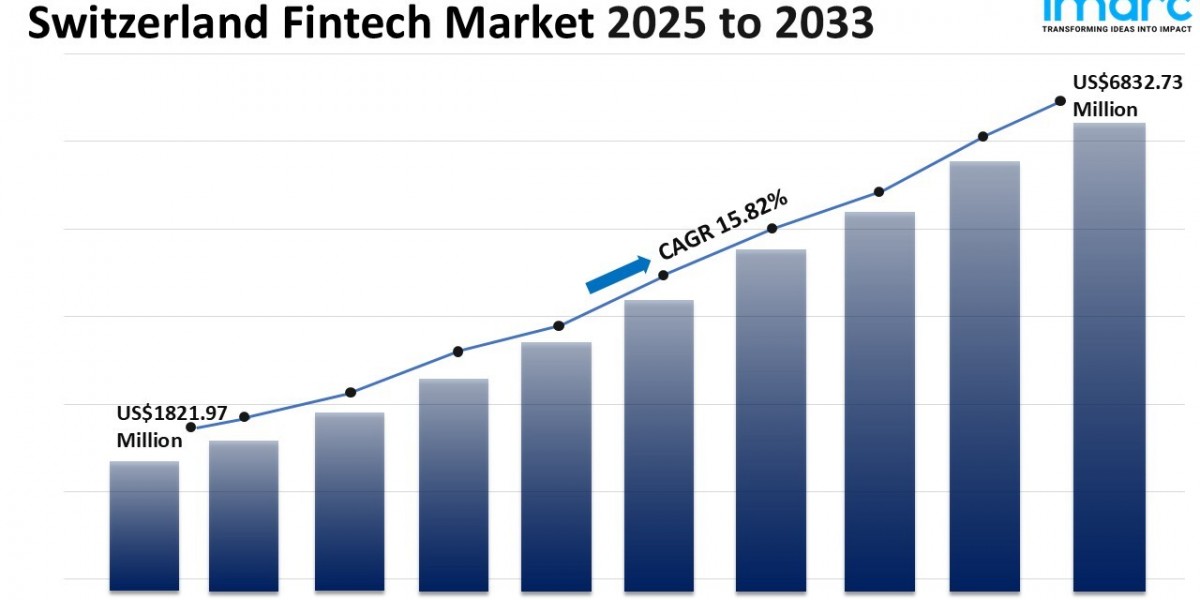

The Switzerland fintech market reached a size of USD 1,821.97 Million in 2024 and is projected to grow to USD 6,832.73 Million by 2033, with a CAGR of 15.82% during the 2025-2033 forecast period. The market growth is driven by increasing digital adoption, innovations such as AI and blockchain integration, and supportive regulatory frameworks. Deployment modes, applications, and user preferences diversify, enhancing competitiveness.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Switzerland Fintech Market Key Takeaways

The Switzerland fintech market size was USD 1,821.97 Million in 2024.

Expected CAGR of 15.82% during 2025-2033.

Market forecast to reach USD 6,832.73 Million by 2033.

Swiss fintech companies are increasingly pivoting toward B2B services and global clients, emphasizing scalable infrastructure solutions.

The sector is maturing, with fintechs becoming trusted partners to established financial systems.

The market is transitioning from rapid expansion to a quality-focused phase with sustainable growth models.

Regulation is fostering innovation by promoting climate-aligned reporting and embedding sustainability into operational practices.

Sample Request Link: https://www.imarcgroup.com/switzerland-fintech-market/requestsample

Market Growth Factors

Fintech companies in Switzerland rise because people rapidly adopt digital technologies and because the financial services industry innovates. Disruptive technologies like artificial intelligence (AI), blockchain technology and mobile banking are changing the way consumers access financial services from banks and other providers. The market is expected to grow at a CAGR of 15.82% from 2025 to 2033 because the technology emerged so it can deploy several modes and applications.

Instead of consumer-facing B2C applications, however, the new breed of Swiss fintechs is focused on B2B applications sold to companies operating globally, leading to the development of infrastructure products, such as ESG reporting, interoperable payment networks, and institutional analytics. B2B models offer more recurring revenue, more tightly integrated solutions, a clearer value proposition, and tend to last longer.

Regulations were designed to enable purpose-oriented innovation. Swiss regulators like FINMA and the SNB call for improved climate reporting standards that push financial institutions to put sustainability at the core of their governance and products. Revised climate risk rules to assess situations for 2025 will prioritize making things transparent, making people accountable, and making things sustainable. These rules will also recommend fintechs adhere to principles for smart innovation and responsible innovation for market success that is sustained.

Market Segmentation

Deployment Mode Insights:

On-Premises

Cloud-Based

These are the two principal deployment modes analyzed, reflecting the technology infrastructure preferences within the Swiss fintech ecosystem.

Technology Insights:

Application Programming Interface

Artificial Intelligence

Blockchain

Robotic Process Automation

Data Analytics

Others

The report categorizes fintech technologies that drive innovation and service delivery.

Application Insights:

Payment and Fund Transfer

Loans

Insurance and Personal Finance

Wealth Management

Others

These applications cover the core financial service areas targeted by fintech solutions in Switzerland.

End User Insights:

Banking

Insurance

Securities

Others

This segmentation details the customer base for fintech services across institutional and sectoral lines.

Regional Insights

Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, and Ticino are the major regional markets covered. The report provides comprehensive analysis across these regions, offering insights into regional market dynamics and segmentation. Specific statistics such as market share or CAGR by region are not detailed in the source.

Recent Developments & News

In August 2025, Thredd was the first to enable real-time payment control for travel agencies under the Mastercard Wholesale Programme, enhancing B2B travel payment visibility and security. The same month, increased cooperation between Baidu and Lyft aimed to introduce self-driving ride-hailing services in Europe, with Switzerland positioned well for future rollout thanks to its infrastructure and innovative culture.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302