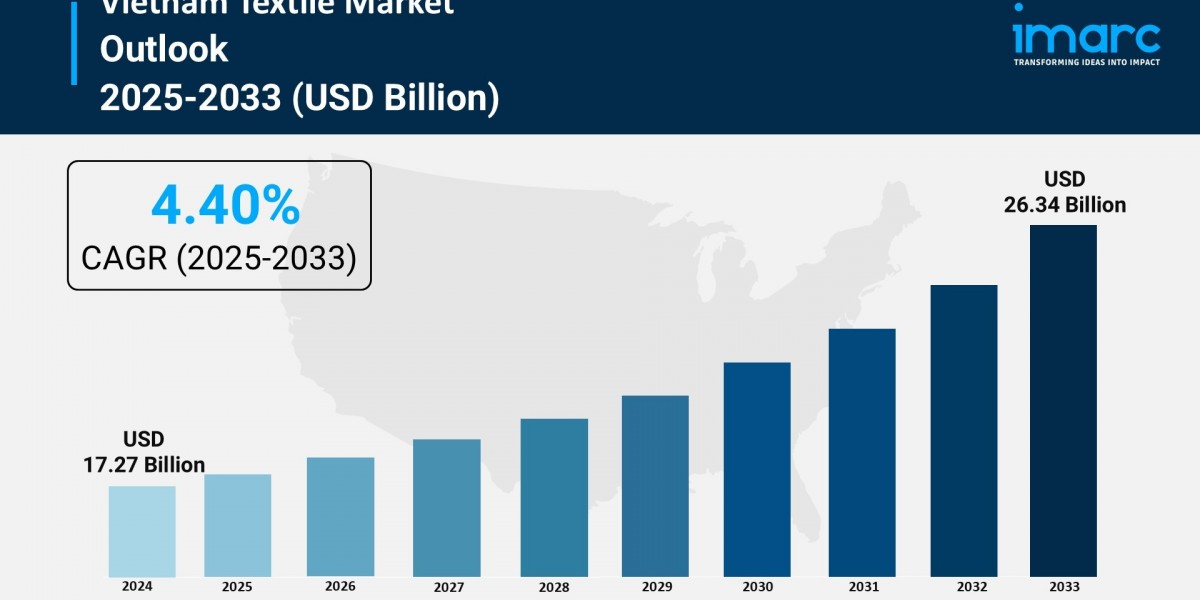

The Vietnam textile market was valued at USD 17.27 Billion in 2024 and is projected to reach USD 26.34 Billion by 2033. The market is expected to grow at a CAGR of 4.40% during the forecast period from 2025 to 2033. This growth is driven by strong export demand supported by favorable free trade agreements, cost advantages compared to competitors, and increasing domestic consumption.

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Period: 2025-2033

Vietnam Textile Market Key Takeaways

The Vietnam textile market size was USD 17.27 Billion in 2024 with a forecast to reach USD 26.34 Billion by 2033.

The market CAGR is 4.40% during 2025-2033.

Southern Vietnam held the largest market share at around 43.2% in 2024.

The market is driven by robust export demand facilitated by FTAs such as CPTPP and EVFTA, enhancing competitiveness in markets like the EU, US, and Japan.

Vietnam's cost advantage in labor compared to China attracts significant foreign investment.

Growing domestic consumption fueled by a rising middle class is strengthening the market further.

Sustainability-focused innovations and supply chain diversification are improving Vietnam's textile production capabilities.

Sample Request Link: https://www.imarcgroup.com/vietnam-textile-market/requestsample

Market Growth Factors

As the Vietnamese textile market is mainly driven by export, trade deals such as CPTPP, EVFTA can benefit the market through preferential tariffs on the exports to key markets such as the EU, the US and Japan, helping the textile industry grow. Vietnam has finished 20 FTAs. Sixteen are in effect. Talks about trade continue with Qatar, United Arab Emirates, Saudi Arabia, the Eurasian Economic Union, and also Israel. Estimates place total trade for 2024 at more than USD 786 billion. A projected surplus of USD 24.7 billion exists. The target is achieving a 12% increase in exports by 2025.

Labor cost advantages: Vietnam has lower production costs in textile, as production labor costs are cheaper than China. Vietnam is seeing a growing foreign investment in textile. Government policies grant various tax incentives as well as improved infrastructure. Because people demand inexpensive, high-quality clothing, Vietnam produces items for many well-known, established international clothing brands at an offshore location. Companies also move production to Vietnam amid continuing trade disputes and rising costs in China. The companies thereby further diversify the global textile supply chain.

The burgeoning middle class drives domestic consumption in this market because the class's disposable income grows and it becomes more aware of fashion. If production processes are sustainable and materials are eco-friendly and productivity and efficiency increase through digitalization and production processes use automation, the country's textile and clothing sector will remain one of the world's key suppliers. As salaries are projected to increase to VND 7.7 Million per month (USD 308) by 2024 and the National Digital Transformation Program encourages Industry 4.0 adoption, automation is becoming a priority.

Market Segmentation

By Product:

Polyesters: Largest segment in 2024 with around 47.6% market share; favored for cost-effectiveness, durability, versatility, and adaptability to blends, suitable for mass apparel, sportswear, and home textiles. Vietnam's expanding synthetic fiber capacity ensures steady supply.

Natural Fibers, Nylon, Others: Listed in segmentation but specific data not provided.

By Raw Material:

Chemical: Leads with approximately 48.6% market share in 2024; essential for fiber production, dyeing, and fabric treatment. Reliant on imports from China, South Korea, and Thailand; government incentives and investments target reduced import reliance.

Cotton, Wool, Silk, Others: Listed but no specific data provided.

By Application:

Fashion and Clothing: Largest segment with around 63.2% market share in 2024; driven by Vietnam's role as a garment manufacturing hub. Supported by skilled workforce, competitive labor costs, FTAs, and rising domestic demand for trendy apparel. Polyester-based fabrics dominate due to affordability and versatility.

Household, Technical, Others: Listed but no specific data provided.

Regional Insights

Southern Vietnam dominates the textile market with over 43.2% share in 2024. This is attributed to Ho Chi Minh City’s commercial hub status and surrounding provinces' dense industrial parks and export-processing zones. Superior infrastructure, including deep-sea ports like Cat Lai, facilitates logistics. Major foreign investments cluster in Binh Duong, Dong Nai, and Long An provinces. Southern Vietnam hosts the highest number of textile-dyeing-finishing complexes, enabling vertical integration and attracting premium buyers from export markets such as the EU and US.

Recent Developments & News

In April 2025, Syre, a subsidiary of Sweden-based fashion retailer H&M, signed an MoU with Binh Dinh authorities to establish Vietnam's first giga-scale textile recycling facility, backed by USD 100 million in Series A funding. In February 2025, the International Labor Organization (ILO) and Viet Nam Textile and Apparel Association (VITAS) released reports guiding the sector towards sustainability, digitalization, and inclusivity. January 2025 saw CLO Virtual Fashion open a new office in Ho Chi Minh City to meet demand for 3D garment design. In September 2024, Vietnam's Ministry of Industry and Trade announced plans for a raw materials center for textiles and footwear to launch in 2025, aimed at reducing import reliance and strengthening domestic supply chains.

Competitive Landscape

The competitive landscape of the market is characterized by strategic vertical integration and technological modernization among key players. Leading manufacturers are investing heavily in automated production lines and smart factories to enhance efficiency while reducing labor dependency. Many are expanding into higher-value segments including technical textiles and sustainable fabrics to differentiate themselves in export markets. Forward-thinking players are establishing closed-loop production systems, incorporating recycled materials and water-saving technologies to meet stringent international sustainability standards. Several large conglomerates are pursuing backward integration into fiber production to secure raw material supplies and improve cost control. The textile market in Vietnam also sees increasing specialization, with some players focusing on niche premium segments while others optimize mass production capabilities. Strategic partnerships with global fashion brands are becoming crucial, as are compliance with changing international trade regulations and certification requirements. The report provides a comprehensive analysis of the competitive landscape in the Vietnam textile market with detailed profiles of all major companies.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302