Brazil Air Operated Double Diaphragm Pumps Market Overview

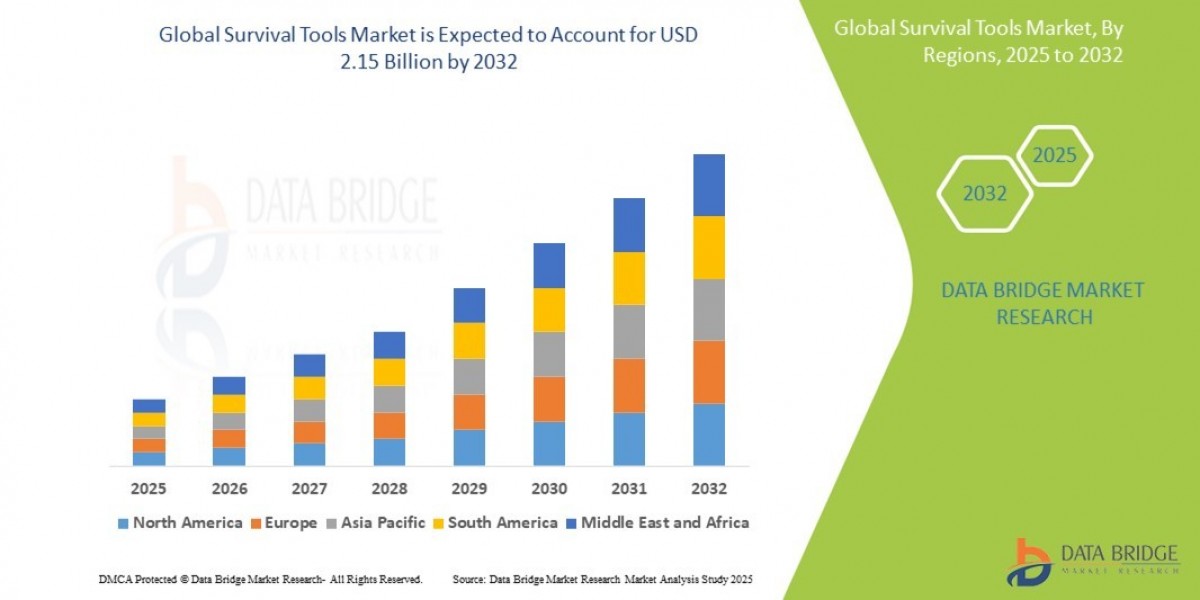

The Brazil Air Operated Double Diaphragm Pumps Market reached USD 44.9 Million in 2025 and is projected to reach USD 65.5 Million by 2034, exhibiting a CAGR of 4.30% during 2026–2034. Market growth is driven by rising demand from chemical, water treatment, and food industries, expansion of oil & gas and mining sectors, increasing automation in fluid handling processes, stringent environmental regulations, and growing investments in large-scale infrastructure projects, collectively strengthening the Brazil air operated double diaphragm pumps market share.

Study Assumption Years

Base Year: 2025

Historical Period: 2020–2025

Forecast Period: 2026–2034

Brazil Air Operated Double Diaphragm Pumps Market Key Takeaways

Market Size in 2025: USD 44.9 Million

Market Forecast for 2034: USD 65.5 Million

CAGR during 2026–2034: 4.30%

Growing demand from chemical and water treatment industries

Expansion of mining and oil & gas activities supporting pump adoption

Automation trends increasing use of AODD pumps in fluid handling

Infrastructure investments improving long-term market outlook

Sample Request Link:- https://www.imarcgroup.com/brazil-air-operated-double-diaphragm-pumps-market/requestsample

Brazil Air Operated Double Diaphragm Pumps Market Growth Drivers

The Brazilian market for Air Operated Double Diaphragm (AODD) pumps is a critical segment within the broader industrial equipment landscape, serving as a primary driver for fluid handling efficiency across the nation’s diverse manufacturing base. As the largest industrial economy in South America, Brazil presents a unique demand profile for AODD technology, primarily due to its inherent versatility in handling abrasive, shear-sensitive, and high-viscosity fluids.

Industrial Versatility and the Demand for Robust Fluid Transfer

The adoption of AODD pumps in Brazil is heavily concentrated in sectors that require the movement of challenging materials under rigorous conditions, such as mining, oil and gas, and heavy chemicals. In the mining sector—particularly in states like Minas Gerais and Pará—these pumps are indispensable for slurry transfer and dewatering applications where the presence of suspended solids would cause catastrophic failure in centrifugal systems. The technology’s ability to run dry without damage and its self-priming capabilities make it a preferred choice for remote field operations.

Furthermore, the inherent safety of pneumatic power is a decisive factor in Brazil’s petrochemical plants, where explosive atmospheres necessitate equipment that complies with strict safety standards without the risk of electrical sparking. Market analysis indicates that industrial end-users are increasingly prioritizing pumps with advanced diaphragm materials, such as modified PTFE and high-grade elastomers, to extend mean time between failures (MTBF). This focus on reliability is a direct response to the high cost of unplanned downtime in Brazil’s capital-intensive industries, where the total cost of ownership is increasingly scrutinized over initial procurement price.

The Sanitation Revolution and Energy Efficiency Optimization

A significant catalyst for the expansion of the AODD pump market is the ongoing modernization of Brazil’s public and industrial water treatment infrastructure. With the implementation of new regulatory frameworks for sanitation, there is a surge in investment toward wastewater treatment plants that utilize AODD pumps for chemical dosing and sludge management. These pumps are favored for their precision and ability to handle the corrosive chemicals used in water purification processes. Simultaneously, the Brazilian market is witnessing a profound shift toward energy-efficient pneumatic systems.

Traditionally, AODD pumps were criticized for their high compressed air consumption; however, technological advancements in air distribution systems (ADS) have significantly reduced "stalling" and air waste. Modern designs featured in the Brazilian market now incorporate pilot valves and flow-optimization geometries that allow for lower operating pressures. Data considerations highlight that energy costs represent a substantial portion of an industrial plant's operational budget in Brazil, leading to a higher adoption rate of "smart" AODD systems that can be integrated into automated control loops to optimize air usage based on real-time demand.

Competitive Landscape and the Strategic Role of the Aftermarket

The competitive environment in Brazil is defined by a sophisticated mix of global original equipment manufacturers (OEMs) and a robust network of specialized local distributors who provide essential technical support. Major international players dominate the high-specification segments, leveraging their global research and development capabilities to offer pumps that meet international environmental and performance standards. However, the true strength of the Brazilian market lies in the aftermarket and Maintenance, Repair, and Operations (MRO) sector. Given the abrasive nature of many Brazilian industrial processes, the demand for replacement diaphragms, balls, and seats is constant.

Strategic resilience in this market is often determined by a manufacturer’s ability to maintain local inventory and provide rapid onsite service, as logistical bottlenecks in the interior of the country can otherwise delay critical repairs. Analysis of the supply chain suggests a growing trend toward "service-as-a-product," where vendors provide comprehensive fluid management solutions rather than just hardware. This includes vibration monitoring and predictive maintenance services that help Brazilian manufacturers transition from reactive to proactive maintenance cycles. As the industry moves toward more sustainable manufacturing practices, the ability to refurbish and recycle pump components is becoming a key differentiator for brands looking to align with corporate ESG mandates.

Brazil Air Operated Double Diaphragm Pumps Market Segmentation

Pump Type Insights

- Explosion-Proof AODD Pumps

- Metallic AODD Pumps

- Non-metallic AODD Pumps

- Sanitary AODD Pumps

- Submersible AODD Pumps

Valve Type Insights

- Ball Valve

- Flap Valve

Material Insights

- Aluminum

- Cast Iron

- Stainless Steel

Discharge Pressure Insights

- Up to 5 bar

- 5 bar – 10 bar

- Above 10 bar

End User Insights

- Chemicals and Petrochemicals

- Food and Beverage

- Oil and Gas

- Pharmaceuticals

- Water and Wastewater

Regional Insights

- Southeast

- South

- Northeast

- North

- Central-West

Competitive Landscape

The report provides a comprehensive assessment of the competitive landscape, including market structure, key player positioning, leading strategies, competitive dashboard analysis, and company evaluation quadrants, along with detailed profiles of major companies operating in the market.

Recent Developments & News

February 2025: Vale announced a USD 12.2 Billion investment to expand its Carajás complex, increasing iron ore and copper output and driving demand for durable AODD pumps capable of handling abrasive and viscous materials.

October 2024: Grupo Potencial invested USD 109 Million to expand biodiesel production at its Paraná facility, increasing the requirement for reliable AODD pumping solutions for fluid processing and transfer.

Request Customization:- https://www.imarcgroup.com/request?type=report&id=29136&flag=E

IMARC Group is a global management consulting firm providing comprehensive market research, feasibility studies, and strategic advisory services.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

India: +91 120 433 0800

United States: +1-201-971-6302