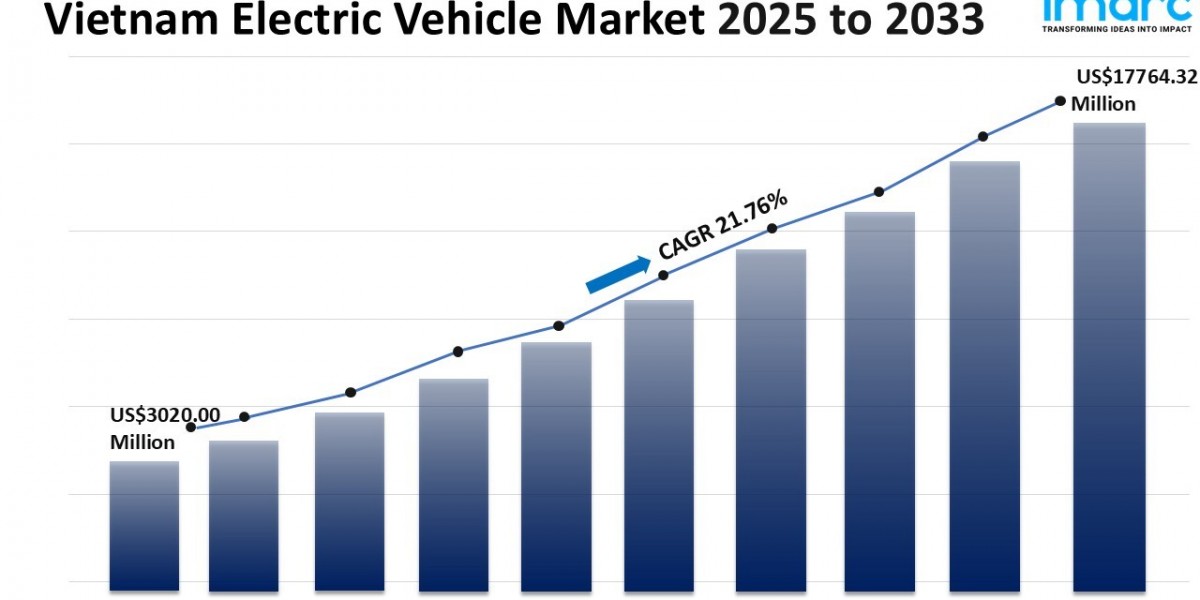

The Vietnam electric vehicle market reached a size of USD 3,020.00 Million in 2024 and is projected to surge to USD 17,764.32 Million by 2033, advancing at a CAGR of 21.76% during the forecast period 2025-2033. Growth is driven by heightened environmental awareness, government incentives, technological advancements in EVs, and expanding charging infrastructures. Domestic and international investments are accelerating innovation, especially in battery efficiency and drive system improvements.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Vietnam Electric Vehicle Market Key Takeaways

- The market size reached USD 3,020.00 Million in 2024, with a forecast to reach USD 17,764.32 Million by 2033.

- The market is expected to grow at a CAGR of 21.76% during 2025-2033.

- The electric two-wheeler sector is rapidly expanding, driven by rising fuel prices and environmental concerns.

- Government incentives such as registration fee exemptions stimulate wider EV adoption.

- Enhanced charging infrastructure and battery swapping options are improving consumer convenience.

- Domestic and foreign players are investing heavily, driving competition and innovation.

- Consumer attitudes are shifting towards viewing EVs as practical and sustainable commuting options.

Sample Request Link: https://www.imarcgroup.com/vietnam-electric-vehicle-market/requestsample

Market Growth Factors

The Vietnam electric vehicle market is propelled by the significant growth of the electric two-wheeler sector, which is becoming a major force in the nation's transportation landscape. Electric scooters and motorcycles offer low-cost, environmentally friendly alternatives to traditional vehicles, appealing especially to students, office workers, and small business owners. The government reported a dramatic rise in electric motorbike registrations in April 2025, reflecting a major shift in personal transport preferences. Additionally, the growing availability of charging points and battery-swapping facilities is reducing user downtime and enhancing convenience, further fuelling sector expansion.

Increasing consumer adoption is another key driver. The market benefits from favorable government policies including tax relief and registration fee exemptions, particularly impactful in urban areas facing pollution and traffic issues. A March 2025 government report highlighted a steep increase in electric vehicle registrations, indicating heightened public interest. Consumer perspectives are evolving, with rising numbers seeing EVs not only as environmentally responsible but also as efficient choices for daily commutes. Improved availability of charging networks and supportive policies are fostering consumer confidence and sustained adoption.

Policy support and infrastructure development are critical enablers of market growth. The Ministry of Finance extended registration fee exemptions for battery electric vehicles in March 2025, underscoring governmental commitment to electrification. Concurrently, there is an active expansion of charging infrastructure across urban and intercity regions, supported by new technical standards and energy sector planning. These coordinated efforts build a strong foundation for widespread EV adoption, enabling practical usability and fostering a conducive environment for continued market growth.

Market Segmentation

- Component Insights: The market analysis includes segmentation by battery cells & packs, on-board charger, and fuel stack, providing detailed breakup and trends for each component.

- Charging Type Insights: Market segments include slow charging and fast charging types, reflecting infrastructure and consumer usage preferences.

- Propulsion Type Insights: The report covers battery electric vehicle (BEV), fuel cell electric vehicle (FCEV), plug-in hybrid electric vehicle (PHEV), and hybrid electric vehicle (HEV), offering comprehensive analysis of propulsion technologies.

- Vehicle Type Insights:The market is segmented into passenger vehicles, commercial vehicles, and others, capturing usage and demand across vehicle categories.

Regional Insights

The Vietnam electric vehicle market encompasses Northern Vietnam, Central Vietnam, and Southern Vietnam regions. While no specific market share percentages are provided, the report covers all major regions comprehensively, indicating balanced attention to regional trends and development. The segmentation implies strategic growth opportunities distributed across these geographic areas.

Recent Developments & News

In August 2025, VinFast, Vietnam’s leading EV manufacturer, inaugurated its first overseas EV assembly plant located in Thoothukudi, Tamil Nadu, India. This expansion is a significant milestone in VinFast’s global growth strategy, aiming to produce right-hand-drive models of its VF 6 and VF 7 SUVs. The initiative underscores Vietnam’s expanding role in Asia’s electric vehicle ecosystem and positions India as a manufacturing and export hub for the company.

Key Players

- VinFast

Additional Sections

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302