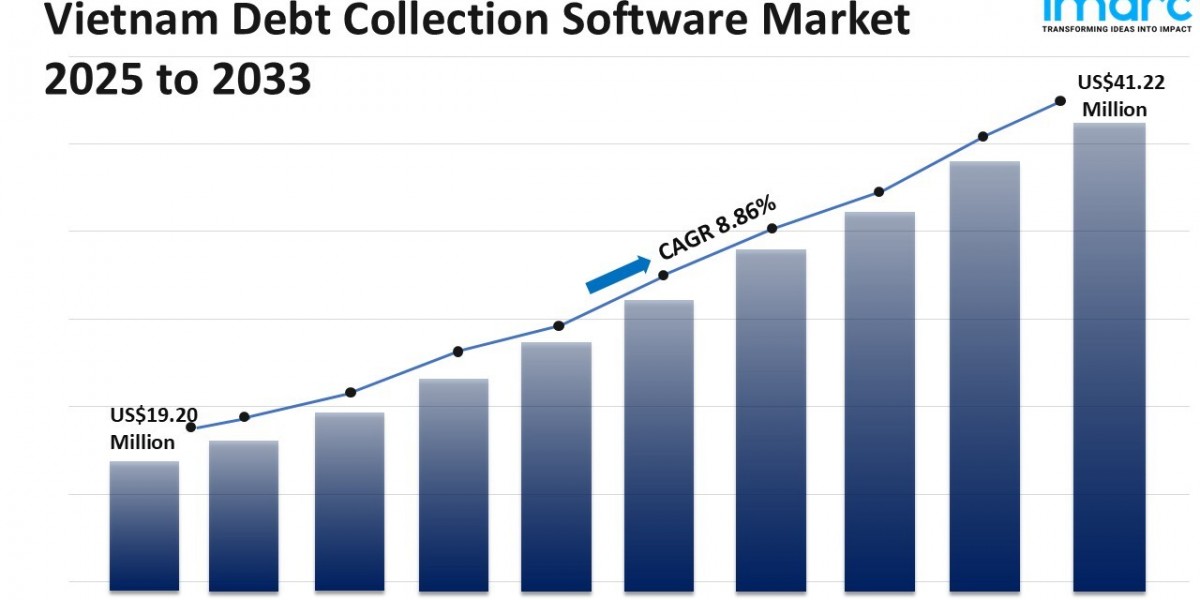

The Vietnam debt collection software market size was USD 19.20 Million in 2024 and is forecasted to reach USD 41.22 Million by 2033, growing at a CAGR of 8.86% during 2025-2033. This growth is driven by the adoption of AI-powered automation and analytics, enhancing debt recovery through machine learning and predictive models. Increasing regulatory compliance focus and borrower data security also fuel investment in advanced software.

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Period: 2025-2033

Vietnam Debt Collection Software Market Key Takeaways

The Vietnam debt collection software market size reached USD 19.20 Million in 2024.

The market is expected to grow at a CAGR of 8.86% from 2025 to 2033.

The forecast period spans from 2025 to 2033.

Automation driven by AI is enhancing collection efficiency while reducing human intervention.

Cloud-based deployments offer scalability, flexibility, and cost savings appealing to SMEs and financial institutions.

Integration with digital payment systems improves collection rates through faster repayments and enhanced customer satisfaction.

Increasing regulatory compliance demands sophisticated software solutions to maintain data security.

Sample Request Link: https://www.imarcgroup.com/vietnam-debt-collection-software-market/requestsample

Market Growth Factors

The Vietnam debt collection software market is experiencing significant growth due to the rapid adoption of AI-powered collection automation and analytics enhancement. AI technologies like machine learning algorithms and predictive modeling are revolutionizing debt recovery processes by enabling debtor behavior analysis, automatic reminders, and improved follow-up scheduling. This automation minimizes human intervention, reduces manual errors and administrative expenses, and scales recovery efficiency, especially for banks and companies striving to shorten recovery times and enhance cash flow predictability.

The surge in cloud adoption is another key growth driver, as cloud-based deployment of debt collection software offers flexibility and considerable cost-saving benefits. Cloud solutions provide scalability, allowing businesses of varied sizes to expand without large upfront IT investments. They enable remote accessibility, real-time updates, and efficient team collaboration. Moreover, cloud platforms ensure data security through encrypted storage and frequent updates, vital for handling sensitive debtor information securely. The cost-effective pay-as-you-go pricing model further enhances appeal, catering to SMEs and large financial institutions alike.

Integration with digital payment systems is becoming increasingly important in Vietnam due to rising e-wallet, mobile banking, and online payment platform usage. This integration allows debtors to benefit from faster, more convenient repayment options, which significantly improves collection rates and customer experience. Real-time transaction tracking, automated reconciliation, and minimized fund transfer delays help enhance overall cash flow management. The seamless linkage between collection software and digital payments simplifies settlements, reducing friction for both creditors and borrowers, thereby making debt recovery operations more accessible, efficient, and transparent in the rapidly digitizing financial landscape of Vietnam.

Market Segmentation

Component Insights:

Software

Services

Both segments are analyzed in detail considering their role in the market growth.

Deployment Mode Insights:

On-premises

Cloud-based

The market analysis includes detailed segments of on-premises and cloud-based solutions.

Organization Size Insights:

Small and Medium Enterprises (SMEs)

Large Enterprises

Market segmentation covers detailed insights into these organizational categories.

End User Insights:

Financial Institutions

Collection Agencies

Healthcare

Government

Telecom and Utilities

Others

Each end-user segment is explored for its contribution to the evolving market.

Regional Insights

The report covers Northern Vietnam, Central Vietnam, and Southern Vietnam as key regional markets. Specific regional market statistics such as share or CAGR are not detailed in the source. These major regional markets are comprehensively analyzed to understand Vietnam's debt collection software landscape.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302