Market Overview

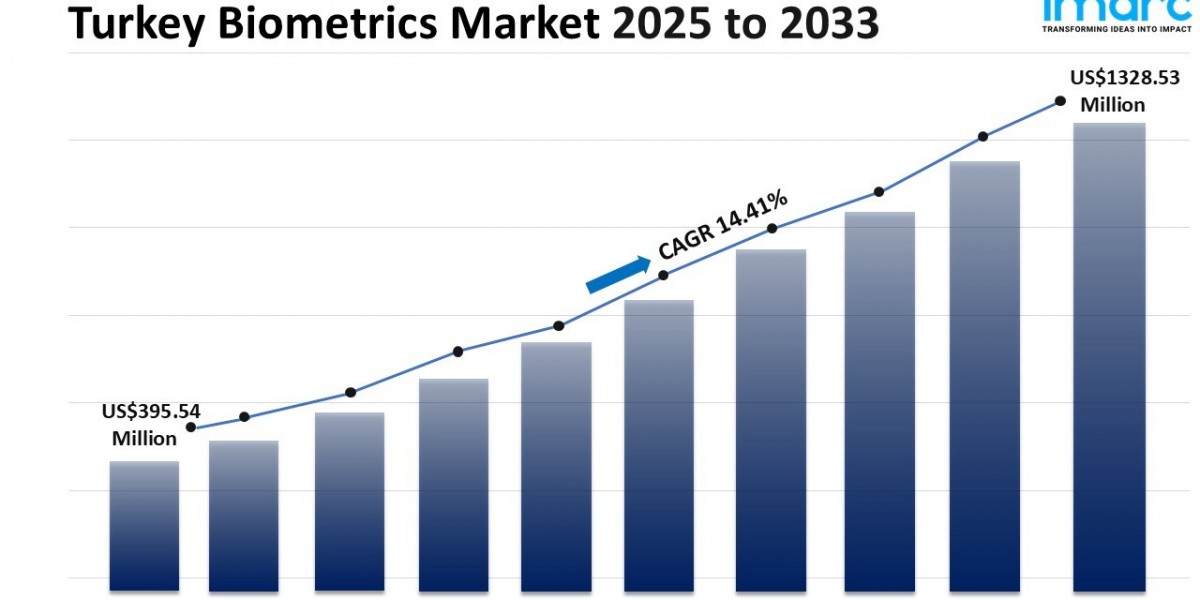

The Turkey biometrics market size was valued at USD 452.54 Million in 2025 and is expected to reach USD 1,452.41 Million by 2034, growing at a CAGR of 13.83% during 2026-2034. The market growth is driven by increased investments in secure identity verification and access control solutions by public and private sectors. Key adoption areas include banking, telecom, border management, and corporate security, supported by advancements in facial recognition, fingerprint technologies, and mobile biometrics.

Study Assumption Years

- Base Year: 2025

- Historical Period: 2020-2025

- Forecast Period: 2026-2034

Turkey Biometrics Market Key Takeaways

- The Turkey biometrics market size was valued at USD 452.54 Million in 2025 with a CAGR of 13.83% projected from 2026 to 2034.

- Non-AFIS technology dominates with a market share of 35.64% in 2025, favored for fingerprint and facial recognition in banking and border control.

- Contact-based biometrics lead functionality segment with 54.25% share, mainly due to fingerprint scanning in government and enterprise time-attendance.

- Hardware forms the largest component at 84.03% market share, driven by investment in scanners and cameras.

- Single-factor authentication accounts for 67.43% of the market, extensively adopted in consumer electronics and access control.

- Government is the largest end user with 21.41% share, backed by national identity and border security programs.

Sample Request Link: https://www.imarcgroup.com/turkey-biometrics-market/requestsample

Market Growth Factors

The Turkey biometrics market growth is fueled by increasing use of biometrics in banking and fintech sectors. With a fintech market size reaching USD 1,919.39 Million in 2024 and projected to hit USD 7,220.45 Million by 2033, banks integrate facial recognition, fingerprint, and voice verification for secure login, payments, and onboarding. This commitment to fraud reduction and customer trust drives wider biometric adoption.

Government expansion of biometric solutions in public services further accelerates market growth. Turkey's 2025 biometric passport upgrade includes facial and fingerprint recognition, streamlining travel and improving border security aligned with international standards. Biometric systems are increasingly used in e-government, civil registration, and law enforcement, enhancing security and operational efficiency.

Healthcare is another key driver as providers adopt biometrics to improve patient identification and safeguard medical data. The healthcare IT market, sized at USD 3,186.1 Million in 2024 and forecasted to reach USD 9,959.2 Million by 2033, propels adoption of fingerprint and facial recognition technologies. These systems reduce errors, ensure precise treatment, and control electronic health record access, essential in Turkey's advancing digital healthcare ecosystem.

Market Segmentation

Technology

- Non-AFIS: Dominates with 35.64% share in 2025 by offering faster processing and lower complexity. Widely adopted in banking, telecom, and enterprise security for rapid identity verification without extensive database comparisons.

Functionality

- Contact: Leads with 54.25% share in 2025, driven by widespread fingerprint recognition in government, banking, and corporate time-attendance systems. Known for high accuracy, cost-effectiveness, and reliable infrastructure compatibility.

Component

- Hardware: Largest segment at 84.03% market share in 2025, reflecting investment in scanners, cameras, sensors, and access terminals across public and private sectors for secure authentication.

Authentication

- Single-Factor Authentication: Commands 67.43% of the market in 2025 due to simplicity, speed, and cost efficiency, ideal for routine verification tasks like access control and attendance.

End User

- Government: Holds 21.41% share in 2025, encompassing biometric use in national ID programs, border control, law enforcement, and e-government services focused on security and identity management.

Regional Insights

The Marmara region leads biometric technology adoption driven by dense urban populations and advanced public services. Demand from banking, transportation, and government sectors supports integration of biometric authentication across daily operations. Central Anatolia also shows growing use as government and commercial entities modernize security. Overall, these regions demonstrate strong market traction in biometrics within Turkey.

Recent Developments & News

In November 2024, Turkish Airlines announced plans to implement biometric facial recognition technology at Istanbul and Izmir airports to enhance passenger security and streamline travel, emphasizing data privacy by securely storing biometric data solely for travel purposes. In January 2025, the Turkish government incorporated blockchain technology with biometrics to upgrade the digital identity system, with 83 million citizens registered for smart ID cards, supporting e-government and banking services. Companies like Colle AI align their technologies with this initiative, while cryptocurrency regulations enforce secure transactions.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302