Is your deadline for quarterly payroll taxes coming up soon? You can easily and accurately submit federal Form 941 using QuickBooks Desktop, which simplifies an important compliance duty for your company.

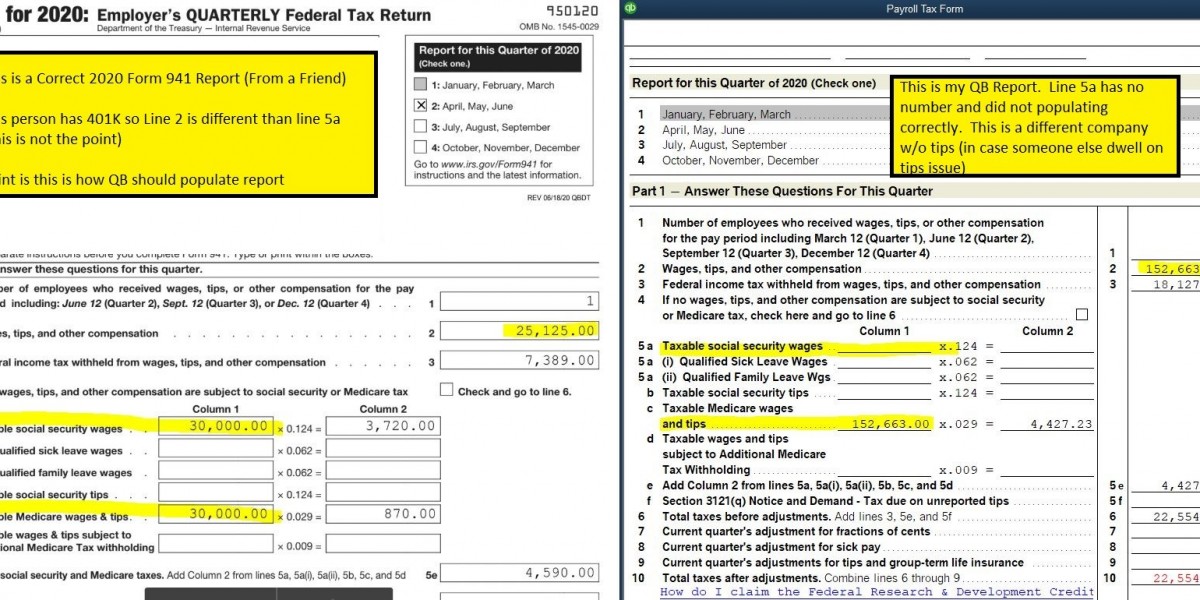

Submitting the Employer's Quarterly Federal Tax Return (Form 941) is vital for reporting withheld income taxes as well as Social Security and Medicare taxes. QuickBooks Desktop Payroll makes this task easier by automatically filling in the form with your documented wage and tax information, greatly minimizing the chances of errors from manual data entry. It is essential to ensure that this form is submitted correctly and punctually to prevent expensive penalties and interest from the IRS.

To get started, check that all your payroll information for the quarter is finalized and balanced within QuickBooks. Go to the Employees menu, pick Payroll Tax Forms & W-2s, and select Process Payroll Forms. QuickBooks will help you choose Federal Form 941/941-SS. The software will fill in the necessary fields, which include wages that are subject to withholding, the total taxes deposited, and any adjustments. Before you make the final submission, examine each line thoroughly against your own records and bank statements.

After verification, you have the option to e-file the form directly using QuickBooks or print it for mailing. Leveraging the automation of QuickBooks Form 941 saves you countless hours of manual labor, reduces the likelihood of errors, and gives you a digital copy of your submission. Always make sure to confirm a successful e-filing and keep copies of all submitted forms as part of your business documentation. This cohesive method turns a complicated quarterly requirement into a more straightforward and manageable task.

Conclusion

We appreciate your continued support so far! The most crucial information regarding QuickBooks Form 941 has been covered to help guarantee on-time payments. Non-agricultural companies with a tax liability of $1,000 or less use Form 941. Your e-tax filing process will be simpler if you adhere to the instructions in this blog.

Talk to our senior QuickBooks specialist at +1(866)500-0076 if you require help filing your e-tax Form 941.