Market Overview

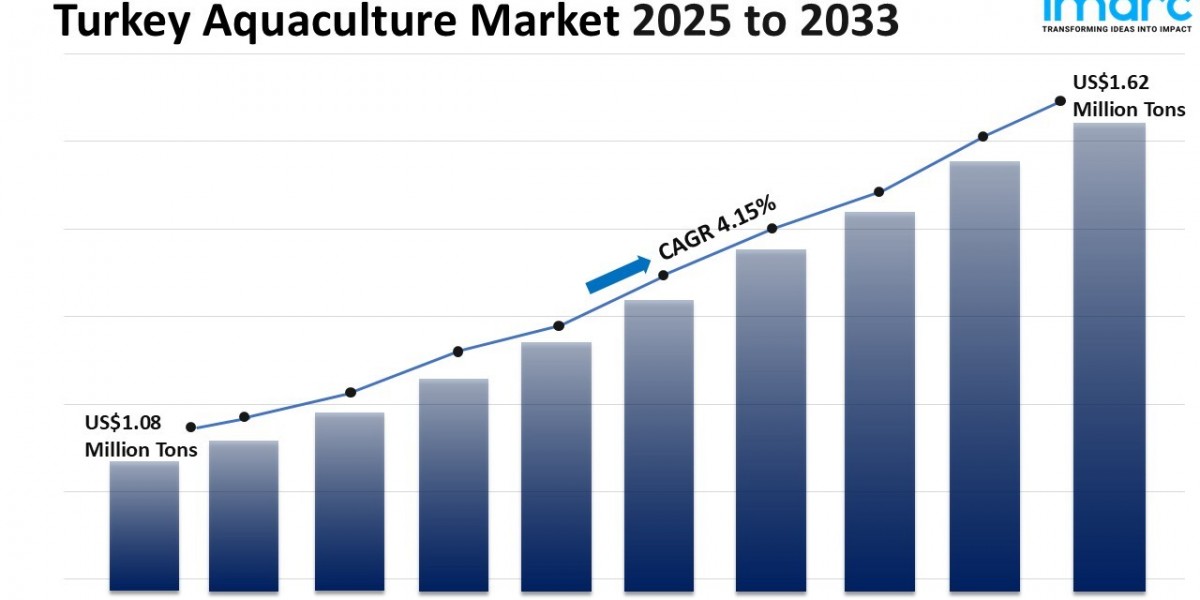

The Turkey aquaculture market size reached 1.08 million tons in 2024 and is projected to grow to 1.62 million tons by 2033, reflecting a compound annual growth rate (CAGR) of 4.15% during the forecast period of 2025 to 2033. This growth is driven by strong export demand, favorable marine environments, government incentives, and increased investment in modern fish farming infrastructure. The focus on sea bass and sea bream farming has especially boosted market share.

Study Assumption Years

- Base Year: 2024

- Historical Period: 2019-2024

- Forecast Period: 2025-2033

Turkey Aquaculture Market Key Takeaways

- The market size in 2024 stood at 1.08 million tons.

- The compound annual growth rate (CAGR) is 4.15% for 2025-2033.

- Forecasted market size is 1.62 million tons by 2033.

- Seafood exports reached $2.02 billion in 2024, aiming for $2.5 billion by 2027.

- Turkish salmon exports increased 17 times in five years, reaching 100,000 tons and $498 million in 2024, with projections to hit $650 million by year-end and $1 billion within five years.

- The sector follows a zero-waste approach with strong sustainability commitments.

- Government support includes subsidies, licensing streamlining, and trade partnerships targeting EU markets.

Sample Request Link: https://www.imarcgroup.com/turkey-aquaculture-market/requestsample

Market Growth Factors

The Turkey aquaculture market is propelled by robust export demand, particularly to EU countries like Italy, Spain, and Greece. In 2024, seafood exports reached $2.02 billion, supported by strategic government incentives, subsidies, and a streamlined licensing system. This export-oriented production model fosters competitiveness by aligning with stringent EU standards and certifications, allowing Turkish producers to expand their market share across Europe and the Middle East.

Domestic industry growth is also strengthened by ventures such as the ramped-up production of high-protein, species-specific aquafeed, reducing dependency on imports. Turkish feed manufacturers are investing in advanced production facilities and R&D, often in collaboration with European technology providers. Local feed production cuts logistics costs, ensures supply stability, and promotes quality control, further enhancing the industry's growth.

Significant investments in infrastructure underpin the market’s expansion, exemplified by AKVA Group Turkey’s project launching 16 Polarcirkel 220-meter pens and three Akvasmart CCS feeding systems for Turkey’s largest bass and bream farm in Güllük Bay. Construction completion slated for summer 2026 highlights ongoing modernization and scale-up efforts critical to sustaining production growth and industry competitiveness.

Market Segmentation

- Fish Type Insights: Freshwater Fish, Molluscs, Crustaceans, Others. The market analysis includes detailed breakup and trends across these fish types, covering freshwater and marine species.

- Environment Insights: Fresh Water, Marine Water, Brackish Water. The segmentation explores production environments, with corresponding analysis of market share and growth.

- Distribution Channel Insights: Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others. Evaluation of sales channels outlines consumer access and market penetration.

Regional Insights

The report covers Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia regions. Among these, the Marmara region is dominant due to favorable conditions and infrastructure supportive of aquaculture expansion. These regions collectively contribute to the evolving landscape of Turkey’s aquaculture industry.

Recent Developments & News

- In July 2024, Metro Türkiye partnered with Hatko Aquaculture and Denmark’s Alpha Aqua to build Turkey’s first retail-sector aquaponics RAS facility in Muğla. The pilot aims to reduce sea bass grow-out time from 15 to 9 months and cultivate Salicornia, using algae-based feed and recirculating water for improved omega-3 content and sustainability.

- In June 2024, Optimar signed an exclusive agreement with Turkey-based OctoAqua to strengthen its Turkish market presence. OctoAqua represents Optimar’s fish processing and factory solutions, providing customized systems for land- and sea-based operations, addressing growing demand for advanced processing technologies.

Key Players

- AKVA Group Turkey

- Metro Türkiye

- Hatko Aquaculture

- Alpha Aqua

- Optimar

- OctoAqua

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302