Market Overview

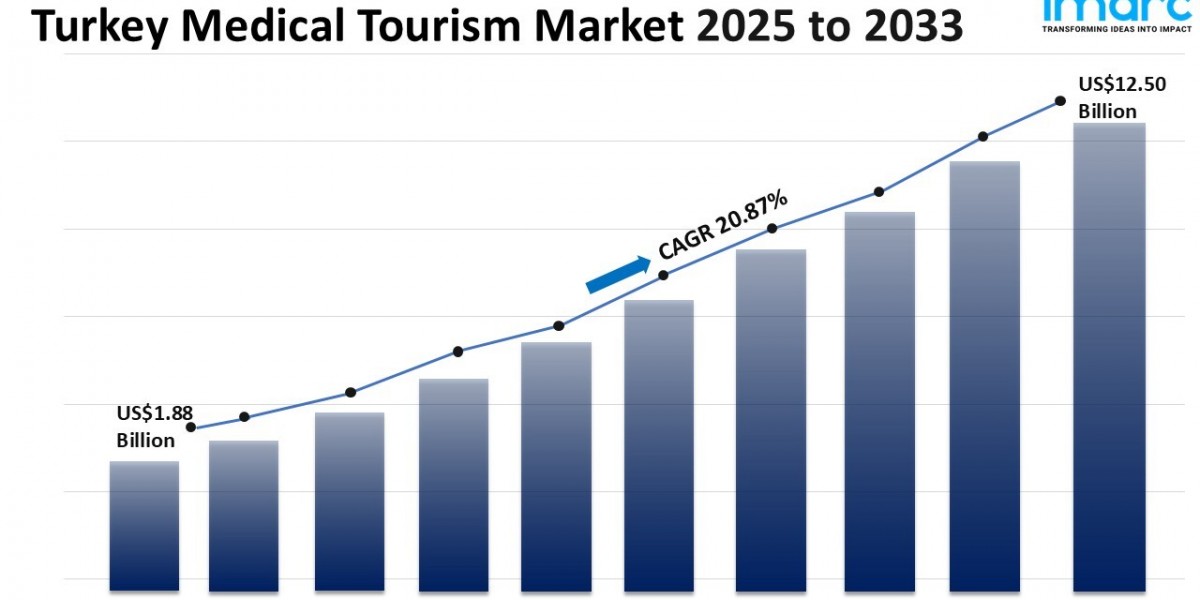

The Turkey medical tourism market size reached USD 1.88 Billion in 2024 and is forecasted to expand to USD 12.50 Billion by 2033, with a CAGR of 20.87% during the forecast period from 2025 to 2033. This growth is driven by Turkey’s expertise in elective and transplant surgeries, extensive government infrastructure investments, and cost-efficient multilingual medical services. The market benefits from streamlined recovery logistics and internationally accredited hospitals enhancing international patient flow.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Turkey Medical Tourism Market Key Takeaways

- The market size was USD 1.88 Billion in 2024.

- The market is expected to grow at a CAGR of 20.87% from 2025 to 2033.

- Forecasted to reach USD 12.50 Billion by 2033.

- Turkey is recognized worldwide for expertise in elective and transplant surgeries supported by internationally accredited hospitals.

- The country offers cost efficiency with savings of 50–70% on procedures compared to domestic markets in Western Europe, Balkans, North Africa, and Central Asia.

- Convenient medical access is supported by government-led infrastructure investments and airport-based facilities.

Sample Request Link: https://www.imarcgroup.com/turkey-medical-tourism-market/requestsample

Market Growth Factors

Turkey’s medical tourism market is propelled by its global recognition in elective and transplant surgery excellence. Clinics in key cities provide advanced procedures like hair transplants, rhinoplasty, and organ transplants at significantly lower costs than Europe and the U.S. With over 40 internationally accredited hospitals and Joint Commission International (JCI)-accredited institutions such as Acıbadem and Memorial, Turkey ensures adherence to global standards, attracting patients from the UK, Germany, Russia, and the Middle East.

Cost efficiency drives market growth, with patients from Western Europe, the Balkans, North Africa, and Central Asia saving between 50% and 70% on medical procedures compared to their home countries. For instance, hair transplant procedures cost roughly USD 2,120 in Turkey, markedly lower than the USD 12,500 charged in the U.S. Bundled packages including diagnostics, surgery, accommodations, and transport enhance affordability and convenience, while the average stay ranges from 12 to 19 days, combining treatment with tourism.

The market is further boosted by government infrastructure investment which enhances airport-based medical access facilitating international patient flow. Multilingual medical staff, transparent pricing, concierge services, priority scheduling, and telemedicine tools streamline patient journeys from inquiry to post-operative care. A robust private healthcare sector provides price stabilization and competitive quality, and partnerships with international insurers reduce access barriers. These combined factors position Turkey as a cost-effective and reliable medical tourism destination with operational consistency and high-volume global patient handling capabilities.

Market Segmentation

Type Insights:

- Outbound

- Inbound

- Intrabound

These categories include patients traveling out of, into, or within Turkey for medical treatments, reflecting market dynamics across various patient flows.

Treatment Type Insights:

- Cosmetic Treatment

- Dental Treatment

- Cardiovascular Treatment

- Orthopaedic Treatment

- Bariatric Surgery

- Fertility Treatment

- Ophthalmic Treatment

- Others

Each treatment segment offers specialized care, with Turkey well-known for aesthetic, ophthalmic, and transplant surgeries.

Regional Insights

The Turkey medical tourism market spans multiple regions, including Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia. The Marmara region, housing Istanbul—the country’s medical tourism hub—dominates due to internationally accredited hospitals and superior facilities, attracting a majority of international patients and driving the market’s growth and reputation globally.

Recent Developments & News

On April 30, 2025, Turkey introduced new medical tourism regulations focused on safety and quality enhancement. These include mandatory integration of all health institutions and intermediaries with the "HealthTürkiye" digital platform, compulsory complication insurance for surgeries, 24/7 multilingual call centers, and accreditation by the Health Care Quality and Accreditation Institute (TUSKA). These reforms aim to raise the standards of Turkey’s medical tourism sector, reassuring international patients and supporting sector growth.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302