Market Overview

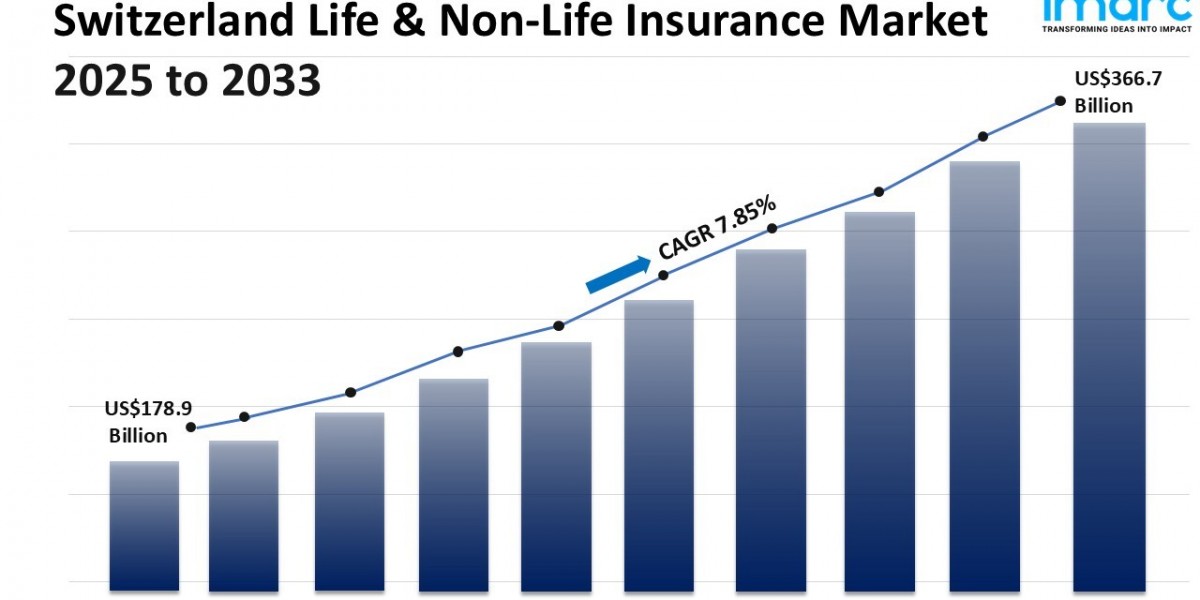

The Switzerland Life & Non-Life Insurance Market reached a size of USD 178.9 Billion in 2024. The market is expected to expand robustly to USD 366.7 Billion by 2033, growing at a CAGR of 7.85% during the forecast period from 2025 to 2033. This growth is driven by rising consumer awareness, economic stability, a favorable regulatory environment, and ongoing technological advancements. The market also benefits from increasing health and retirement needs and the presence of strong global insurance companies providing innovative solutions.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Switzerland Life & Non-Life Insurance Market Key Takeaways

- The market size was USD 178.9 Billion in 2024 and is forecast to reach USD 366.7 Billion by 2033.

- The market is expected to grow at a CAGR of 7.85% during the forecast period 2025-2033.

- Growth drivers include increasing consumer awareness, economic stability, technological advancements, and a favorable regulatory environment.

- Digital transformation features prominently, with AI, ML, big data analytics, and blockchain enhancing service quality and efficiency.

- Demographic shifts such as an aging population and preferences of tech-savvy younger generations are shaping product offerings.

- The regulatory environment including the Solvency II directive and ESG factors is influencing market practices and risk management.

Sample Request Link: https://www.imarcgroup.com/switzerland-life-non-life-insurance-market/requestsample

Market Growth Factors

The Switzerland life and non-life insurance market growth is propelled by the increasing consumer awareness and economic stability that bolster demand for comprehensive insurance products. The presence of a favorable regulatory environment supports market growth, with Swiss regulators such as FINMA implementing stricter frameworks to ensure market integrity and capital adequacy. This fosters greater trust and adoption among consumers and businesses alike.

Technological advancements significantly drive market expansion. Insurers are leveraging artificial intelligence (AI), machine learning (ML), and big data analytics to improve risk assessment, streamline claims processing, and customize insurance products for individual needs. The adoption of blockchain technology enhances transparency and security in policy management. Digital platforms also improve customer experience by facilitating seamless online purchases and management of policies.

Demographic shifts in Switzerland contribute as another key growth factor. The country’s aging population with one of the highest life expectancies globally demands more life insurance, retirement planning, and long-term care products. Additionally, younger, tech-savvy consumers prefer digital transactions and personalized services, motivating insurers to enhance their digital offerings and innovate new product lines tailored to diverse consumer segments.

Market Segmentation

Insurance Type Insights:

- Life Insurance: Categorized into individual and group life insurance, catering to personal and employee benefits respectively. This segment includes products tailored for retirement and health coverage.

- Non-Life Insurance:Includes home, motor, health, and the rest of non-life insurance categories. Each sub-segment addresses specific risk protection needs of consumers, such as property, automobile, and health insurance.

Distribution Channel Insights:

- Direct: Insurers sell policies directly to consumers, enhancing customer engagement and reducing intermediary costs.

- Agency: Insurance agents act as intermediaries, providing personalized advice and policy management.

- Banks: Distribution through banking institutions leverages existing customer relationships for policy sales.

- Online: Digital channels facilitate ease of policy purchase and management with growing preference among younger consumers.

- Others:Includes miscellaneous channels not categorized under the main groups.

Regional Insights

The report includes detailed analysis of key regional markets in Switzerland: Zurich, Espace Mittelland, Lake Geneva Region, Northwestern Switzerland, Eastern Switzerland, Central Switzerland, and Ticino. While exact market shares or CAGR by region are not disclosed, these regions collectively represent the core geographical scope, shaping market dynamics across the country.

Recent Developments & News

In June 2023, the international insurance broker Howden acquired two brokers: Argenius Risk Experts AG and RVA Versicherungsbroker AG. The acquisition of RVA is managed by Born Consulting AG, which joined Howden Switzerland in 2022. In October 2023, Appian partnered with Swiss Re to launch Connected Underwriting for Life Insurance, a platform designed to unify workflows and data in an automated, end-to-end underwriting process.

Key Players

- Howden

- Argenius Risk Experts AG

- RVA Versicherungsbroker AG

- Born Consulting AG

- Appian

- Swiss Re

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302