Market Overview

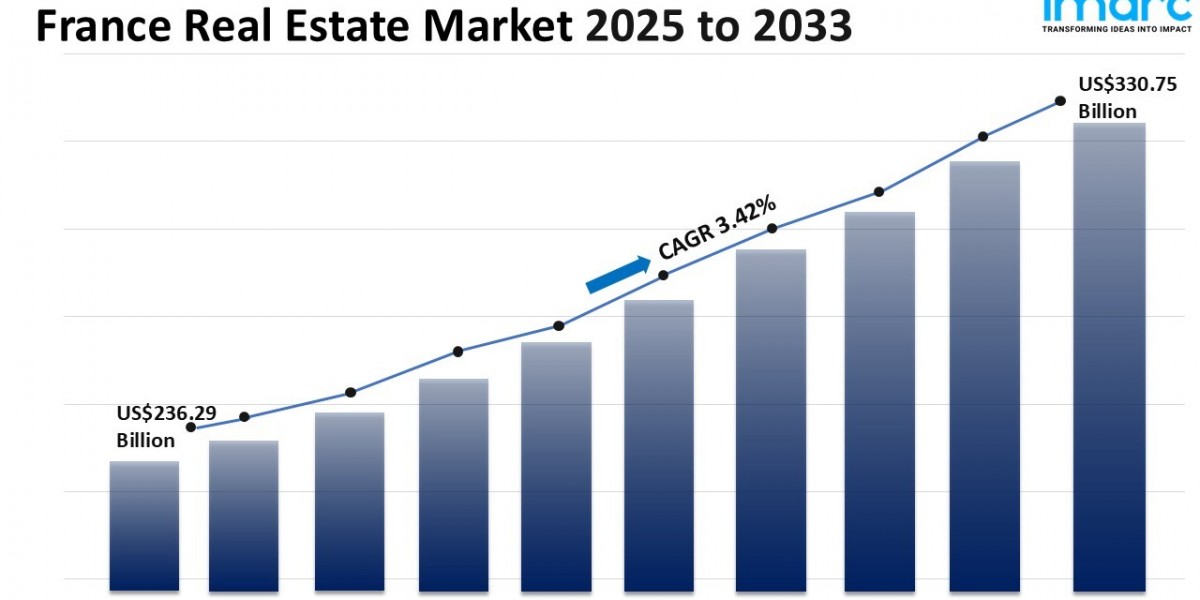

The France real estate market reached a size of USD 236.29 Billion in 2024 and is expected to grow to USD 330.75 Billion by 2033. Forecasted to expand at a CAGR of 3.42% during 2025-2033, the market is influenced by evolving buyer preferences, government renovation schemes for energy efficiency, and shifting residential demand toward secondary cities. Improved mortgage conditions and policy incentives support this growth phase amid ongoing urban regeneration and sustainability efforts.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

France Real Estate Market Key Takeaways

- The France real estate market size was valued at USD 236.29 Billion in 2024.

- The market is forecasted to grow at a CAGR of 3.42% from 2025 to 2033.

- By 2033, the market size is expected to reach USD 330.75 Billion.

- Urban regeneration is actively reshaping cities through mixed-use development and improved public transit connectivity.

- Green innovations such as energy-efficient construction and sustainability certifications are pivotal in market trends.

- Secondary cities like Lyon and Nantes are gaining prominence due to decentralization strategies and enhanced housing standards.

- Improved mortgage conditions are encouraging renewed buyer activity.

Sample Request Link: https://www.imarcgroup.com/france-real-estate-market/requestsample

Market Growth Factors

The French real estate market growth is driven by government-backed renovation schemes promoting energy-efficient living. These programs influence demand and property values by encouraging energy-efficient homes supported by policies such as renovation subsidies. This focus on eco-friendly housing aligns with consumer demand for sustainable, cost-efficient living environments, enhancing the market appeal.

Urban regeneration initiatives constitute another significant growth driver. Programs like the Plan Local d’Urbanisme intercommunal (PLUi) and Opération de Revitalisation de Territoire (ORT) are renewing outdated urban areas into vibrant mixed-use neighborhoods. The addition of Metro stations on the Grand Paris Express line in February 2025 bolsters transit connectivity, promoting transit-oriented living and increasing property value in the northeastern Paris suburbs.

The rise of secondary city residential markets also supports growth. Cities such as Lyon, Nantes, Bordeaux, and Montpellier benefit from government decentralization policies and sustainable urban strategies. These efforts harmonize land use, improve housing quality through energy performance diagnostics, and cultivate livable communities with modern infrastructure and comprehensive transport networks, broadening residential choices beyond metro centers.

Market Segmentation

Property Insights

- Residential: The growing preference for energy-efficient and affordable housing fuels demand in this segment.

- Commercial: Mixed-use urban developments and retail assets in key locations attract investment.

- Industrial: Sustainable development trends influence adaptation of industrial properties.

- Land: Land use is regulated through zoning and density guidelines to support redevelopment.

Business Insights

- Sales: Strengthened by improved mortgage conditions and renewed buyer interest.

- Rental: Supported by migration to secondary cities and affordable living demands.

Mode Insights

- Online: Increasing use of digital platforms for real estate transactions is noted.

- Offline: Traditional real estate sales and rentals remain significant in market dynamics.

Regional Insights

The Paris Region stands out as a dominant market area with significant urban renewal initiatives including new Metro stations improving transit connectivity in 2025. This region benefits from coordinated redevelopment policies fostering mixed-use, transit-oriented projects. These factors contribute to enhancing its market appeal, accessibility, and long-term investment potential.

Recent Developments & News

In January 2025, Kering, the luxury group owning brands like Gucci and Saint Laurent, agreed to sell a majority stake in three prime Paris retail properties to Ardian, a French private equity firm. The deal includes properties on Place Vendôme and Avenue Montaigne and reflects luxury conglomerates optimizing real estate investments.

In February 2025, retailing firm Henderson Park, in collaboration with Paris-based asset manager Atream, acquired five Novotel Suites hotels across France. While Accor continues management, Henderson Park plans upgrades to enhance energy efficiency and streamline operations, aiming to strengthen competitiveness in France’s tourism sector.

Competitive Landscape

The market research report has provided a comprehensive analysis of the competitive landscape covering market structure, key player positioning, winning strategies, competitive dashboard, and company evaluation quadrant, along with detailed profiles of all major companies.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302