Market Overview

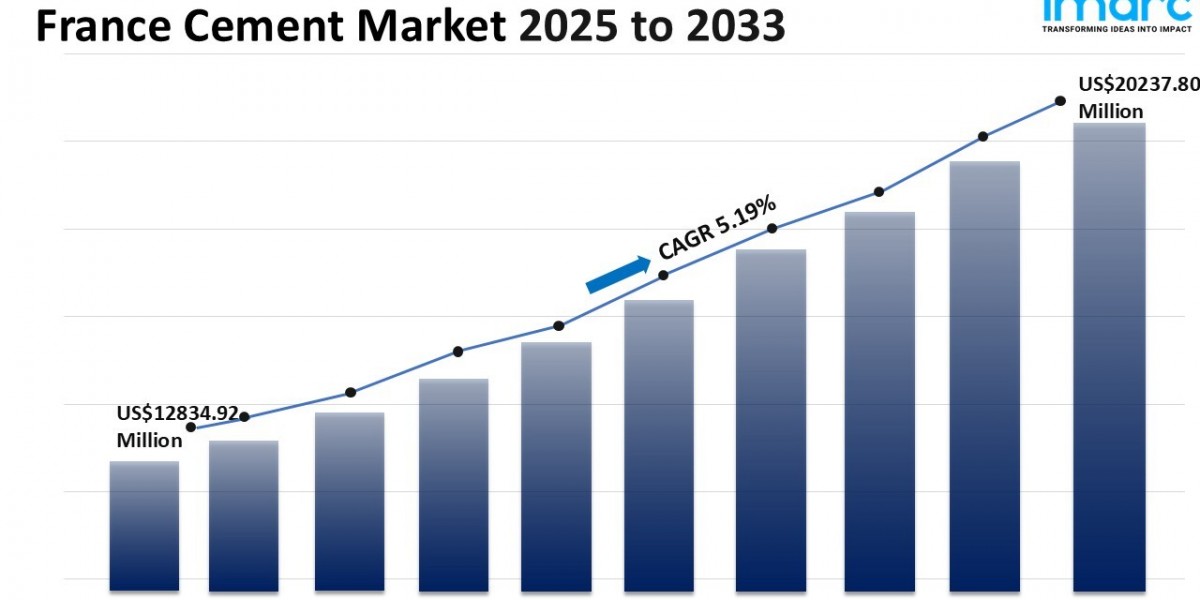

The France cement market size stood at USD 12,834.92 Million in 2024 and is expected to grow to USD 20,237.80 Million by 2033, reflecting a CAGR of 5.19% over the forecast period from 2025 to 2033. The market growth is driven by infrastructure investments, rising residential construction demand, and a transition to low-carbon cement technologies. Urban development and renovation of aging structures further support steady consumption.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

France Cement Market Key Takeaways

- Current Market Size: USD 12,834.92 Million in 2024

- CAGR: 5.19%

- Forecast Period: 2025-2033

- The market is largely driven by government investments in infrastructure renewal and increased residential construction demand.

- There is a strong shift toward low-carbon cement technologies to reduce carbon emissions in the building sector.

- Cement producers are investing in blended cement types such as slag, fly ash, and calcined clays to lower emissions.

- Industrial investment growth and government initiatives like "France Reliance" and "France 2030" boost infrastructure-related cement demand.

- Urban development and renovation activities support steady cement consumption.

Sample Request Link: https://www.imarcgroup.com/france-cement-market/requestsample

Market Growth Factors

Investment in the refurbishment of public infrastructure by the government is an important driver for growth in the French cement market. Large construction projects require site preparation, upgrades to transportation infrastructure, warehouses, and utilities, all of which consume high amounts of cement. Pro-business tax, labor and foreign direct investment reforms by the government make the country a favorable destination for manufacturing, logistics and data centers. France is expected to be the top destination in Europe for industrial investment in 2024, with 415 new industrial projects, over 25% of foreign manufacturing investments. Cement per capita consumption for infrastructure and industrial developments is expected to increase owing to the same.

Another reason cement demand rises is for residential housing from urbanization and renovating existing buildings. Residential construction should continue to grow because government initiates programs and housing plus infrastructure develops on a sustainable trend.

In response the cement industry substitutes cement clinker with low carbon options like slag fly ash and calcined clays because of regulatory pressure and national climate change action plans that target reduced GHG emissions from cement. For example, a target of 50% reduction by 2030 against a 1990 baseline and non-carbon-based energy use of 58%. The piloting of CCS technologies, environmental product declarations and lifecycle assessments will foster competitiveness and compliance with decarbonization programs and create synergies with other climate programs, in addition to promoting innovation, market development and breakthrough technologies for cement production.

Market Segmentation

Type Insights:

- Blended: Includes blended cement types which are used to lower carbon emissions by substituting clinker with alternatives like slag and fly ash.

- Portland: A standard type of cement widely used in construction.

- Others

End-Use Insights:

- Residential: Cement used primarily for housing construction and related residential infrastructure.

- Commercial: Cement utilized in commercial buildings and facilities construction.

- Infrastructure: Cement used in large-scale infrastructure projects including roads, bridges, and utility installations.

Regional Insights

The report categorizes the France cement market across key regions including Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others. Among these, Paris Region and Auvergne-Rhône-Alpes are significant contributors to market growth due to higher urbanization and industrial activity. France’s position as the top recipient of European industrial investment in 2024 reinforces robust cement demand across these regions.

Recent Developments & News

On 21 May 2025, Ecocem announced a EUR 170 Million (about USD 194.06 Million) investment to construct four new cement production lines in Fos-sur-Mer and Dunkirk, and an additional EUR 50 Million (around USD 57 Million) investment in its Dunkirk ACT line. Scheduled to be operational between 2028 and 2030, these facilities will produce 1.9 Mta of low-carbon ACT cement and reduce CO₂ emissions by 800,000 tonnes annually. The French government supports this initiative with operational and financial backing, and the project will create 60 permanent jobs.

Key Players

- Ecocem

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302