Market Overview

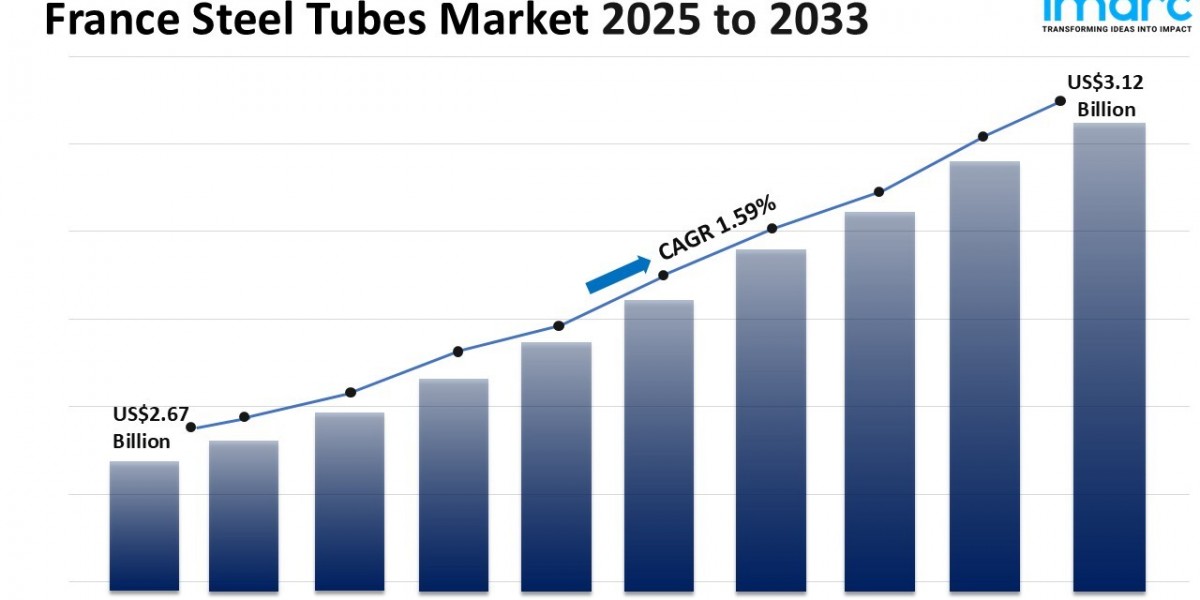

The France steel tubes market size was USD 2.67 Billion in 2024 and is projected to reach USD 3.12 Billion by 2033, with a CAGR of 1.59% during the forecast period 2025-2033. Growth is driven by demand in construction, automotive, energy, and industrial manufacturing sectors. Innovations in seamless and welded tube technologies, along with sustainability and supply chain advancements, are shaping the evolving market landscape. Regional and global trade dynamics and policy support for green infrastructure also influence market strategies.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

France Steel Tubes Market Key Takeaways

- Current Market Size: USD 2.67 Billion (2024)

- CAGR: 1.59%

- Forecast Period: 2025-2033

- France’s steel production showed a clear recovery in 2024, improving raw material availability crucial for steel tube manufacturing.

- Export shipments of seamless steel tubes and hollow profiles to key markets like the United States have expanded.

- Market players focus on advanced product development, sustainability, and supply chain optimization.

- The steel tubes market meets diverse demands including construction, automotive, petrochemicals, and water treatment sectors.

- Regional trade dynamics and policy support for green infrastructure impact market strategies.

- Adaptability and resilience characterize manufacturers responding to evolving end-user needs.

Sample Request Link: https://www.imarcgroup.com/france-steel-tubes-market/requestsample

Market Growth Factors

France steel tubes market benefits from stability in production from several industries supporting demand for raw materials. The French Ministry of Economy and Finance stated production further rebounded in 2024. This greater availability of steel can be formed into tubes by manufacturers supplying the construction, automotive and power generation industries. This will allow a standard supply of steel, which reduces costs when markets fluctuate and encourages further investment to increase and improve capacity so it can meet growing demand from designers and buyers.

In addition, France exported more smooth steel tubes and hollow profiles into the United States in October 2024. Beyond their domestic use for the country, these exports provide additional revenue streams, as well as opportunities to upgrade production technology and increase production capacity. Importers have high quality and timeliness requirements, especially for energy and electricity. An export expansion from Canada would help to improve logistics and supply chain resiliency and reduce risks in the global market.

A diverse need across sectors enables market adjustments. Steel is essential to Europe's clean and digital transition across construction, automotive, medical technology, and electric mobility, despite cost pressures and imbalances. However, given such wide-ranging industrial usage, the tube market must be flexible and reliable in supply from structural tubes to specialist industrial profiles. Manufacturers will respond to such flexible demand by varying batching and grade manufacture which encourages investment and confidence in tube markets. This adaptability strengthens the market's foundation and supports long-term growth.

Market Segmentation

Product Type Insights:

- Seamless Steel Tubes

- Welded Steel Tubes

These segments cover steel tubes manufactured either without seams for strength and uniformity or with welded seams for various applications.

Material Type Insights:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

Segments classified by material composition, reflecting different applications requiring varying corrosion resistance, strength, and durability.

End Use Industry Insights:

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

End-use sectors where steel tubes serve structural, transportation, and processing applications, addressing industry-specific requirements.

Regional Insights:

- Paris Region

- Auvergne-Rhône-Alpes

- Nouvelle-Aquitaine

- Hauts-de-France

- Occitanie

- Provence Alpes Côte d’Azur

- Grand Est

- Others

Major regional markets within France, each contributing to the overall steel tubes demand influenced by local economic activities and industrial presence.

Regional Insights

The report covers key regions including the Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others. Specific market share or CAGR by region is not provided in the source. These regions collectively form the backbone of the steel tubes market in France, driven by industrial, infrastructure, and manufacturing activities.

Recent Developments & News

In March 2024, Vallourec, a leading French steel pipe and tube manufacturer, received significant industrial backing when ArcelorMittal took a strategic minority stake in the company. This partnership reinforces Vallourec's position in the premium tubular market, particularly in the energy and industrial sectors, while enhancing its low-carbon manufacturing capabilities. The collaboration spans operations in Europe, the US, and Brazil, aligning shared goals of sustainable growth, value-added product development, and strengthening France’s tubular solutions industry.

Key Players

- Vallourec

- ArcelorMittal

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302