UK Electric Vehicle Charging Market Overview

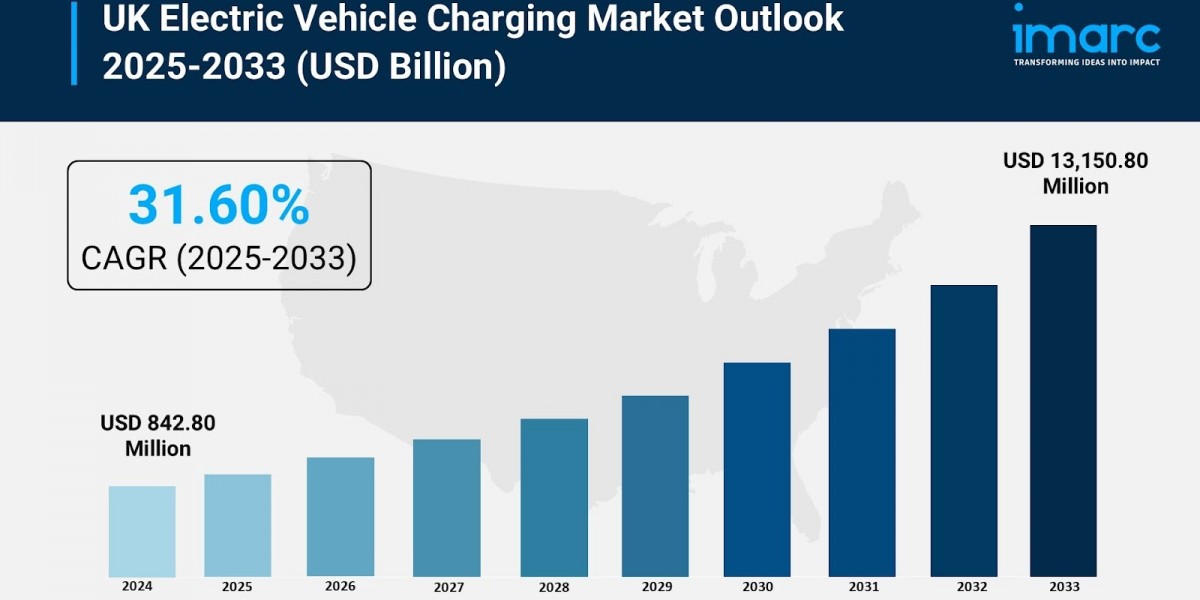

The UK Electric Vehicle Charging Market reached USD 842.80 Million in 2024 and is projected to rise to USD 13,150.80 Million by 2033, exhibiting a strong CAGR of 31.60% during 2025–2033. Market expansion is supported by rapidly increasing electric vehicle adoption, strengthened government incentives, and extensive investments in public charging infrastructure—particularly in densely populated cities where many drivers lack access to private parking. The UK’s charging network now includes more than 74,000 chargers, with government commitments aiming to install 300,000 public charge points by 2030. London continues to lead the market with a 38.7% share in 2024, supported by high EV penetration, active decarbonization policies, and significant public–private partnerships. Advancements in charging technologies, strategic collaborations, and accelerated development of rapid and ultra-rapid chargers further reinforce the UK’s electric mobility transition and progress toward national net-zero objectives.

Study Assumption Years

- Base Year: 2024

- Historical Period: 2019–2024

- Forecast Period: 2025–2033

UK Electric Vehicle Charging Market Key Takeaways

- Market Size (2024): USD 842.80 Million

- CAGR (2025–2033): 31.60%

- London holds 38.7% share in 2024

- UK public network exceeds 74,000 chargers

- Slow chargers account for 59.7% share

- £1.6 Billion commitment targets 300,000 public charge points

- Collaborations improve charging speed and accessibility

UK Electric Vehicle Charging Market Growth Factors

The UK Electric Vehicle Charging Market is being increased by government support and charging point infrastructure, to help achieve targets for the uptake of EVs in the UK. In March 2025, the Local EV Infrastructure Fund announced a £40.8 Million funding package for over 16,000 new chargers in the Midlands. In addition to the £1.6 Billion Government commitment, there is an ambition to grow the public charge network to 300,000 charge points by 2030 including more provision in homes, workplaces and the public area. This will be supported by the increasing number of EVs, financial incentives to businesses installing chargers and increasing access for those without private parking.

This is further stressed by new environmental pressure and consumer demand. In August 2024, battery electric vehicles up made 23.2% of the new registrations, the highest share since December 2022. In April 2024, the public charging network saw 49% year-over-year growth. As U.S. citizens continuously adopt EVs, public and private entities also continuously deploy slow, fast, and rapid EV charging stations, which fill gaps among at-home, at-work, and on-the-road charging opportunities for EV drivers.

Building on the hardware and planned partnerships to deliver future-proofed and efficient charging infrastructure, in March 2025, AUTEL Energy Europe, part of AUTEL Energy, and Mer announced a partnership that will see AUTEL Energy's full range of state-of-the-art MaxiCharger AC products deployed on the UK and European charging networks to deliver fast charging with an improved user experience. Other partnerships and investments around rapid charging hubs will further drive down charging times and improve reliability across the UK charging network to meet future demand and provide new opportunities for decarbonisation.

Sample Request Link:- https://www.imarcgroup.com/uk-electric-vehicle-charging-market/requestsample

UK Electric Vehicle Charging Industry Segmentation

Charging Type Insights

- AC

- DC

Power Output Insights

- Rapid Chargers

- Fast Chargers

- Slow Chargers

Location Insights

- Street Parking

- Depot

- Highways

- Workplaces

- Retail Spaces

- Others

Phase Insights

- Single Phase

- Three Phase

Regional Insights

London remains the leading region in the UK Electric Vehicle Charging Market, accounting for 38.7% of total market share in 2024. This dominance is attributed to the city’s extensive public charging network, high urban EV adoption rates, and robust infrastructure investments. London’s deployment of slow, fast, and rapid chargers in residential zones, commercial hubs, and on-street locations supports drivers without private driveways. Other regions, including South East, North West, Scotland, and West Midlands, also show strong expansion, though the source does not specify additional regional dominance or market share data.

Recent Developments & News

- May 2025: Sainsbury’s launched its Smart Charge business using Kempower technology, targeting over 750 ultra-rapid charging bays across more than 100 UK locations.

- April 2025: Atlante, Ionity, Fastned, and Electra formed the Spark alliance to build Europe’s largest public EV charging network, including 1,700 stations across 25 countries.

- February 2025: bp opened a dedicated EV charging hub in Hammersmith, London, offering 300 kW ultra-fast bp pulse chargers.

- February 2025: Wallbox partnered with Believ to deploy DC chargers up to 220 kW across the UK, beginning installations in Scotland.

Key Players

- Sainsbury’s

- Kempower

- Atlante

- Ionity

- Fastned

- Electra

- bp

- Wallbox

- Believ

Request Customization:- https://www.imarcgroup.com/request?type=report&id=29511&flag=E

About Us

IMARC Group is a global consulting firm providing market research, competitive intelligence, feasibility studies, regulatory advisory, and strategic support across diverse industries.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

India: +91 120 433 0800

United States: +1-201971-6302