Brazil Video Streaming Market Overview

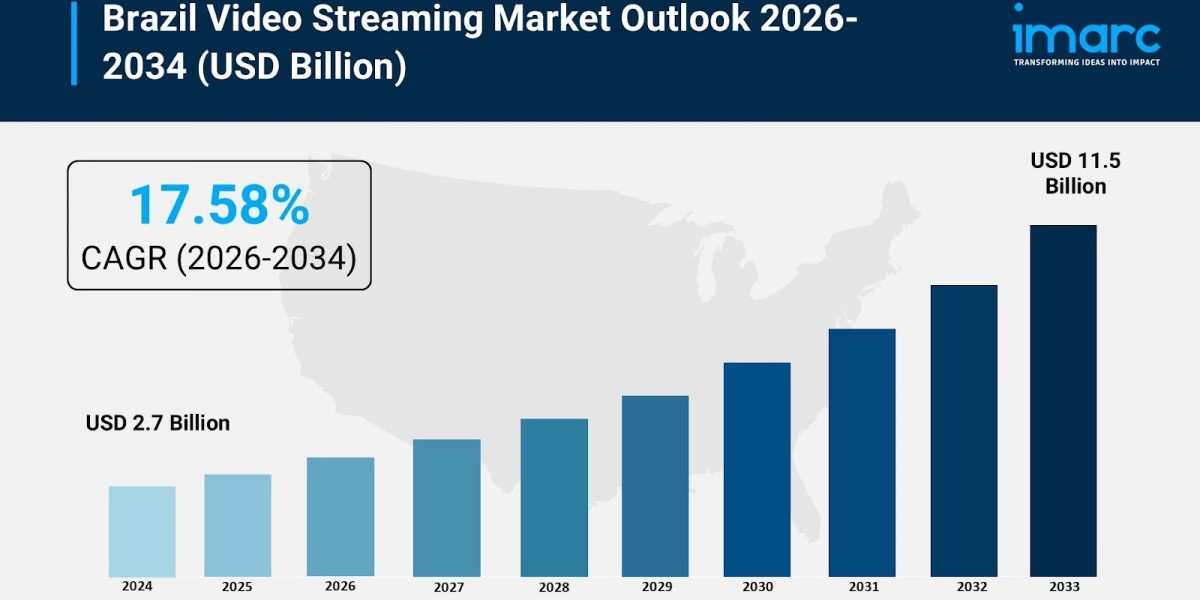

The Brazil Video Streaming Market reached USD 2.7 Billion in 2025 and is expected to reach USD 11.5 Billion by 2034, growing at a CAGR of 17.58% during 2026–2034. Market expansion is driven by rising smartphone penetration, broader access to high-speed internet, and increasing consumer preference for on-demand content. The rapid growth of OTT platforms offering localized and affordable streaming options, combined with the rollout of 5G enhancing viewing quality and low-latency experiences, continues to accelerate adoption across Brazil.

Study Assumption Years

Base Year: 2025

Historical Years: 2020–2025

Forecast Period: 2026–2034

Brazil Video Streaming Market Key Takeaways

- Market Size (2025): USD 2.7 Billion

- CAGR (2026–2034): 17.58%

- OTT platform expansion driven by flexible, on-demand content preferences

- Smartphone adoption and high-speed internet enable seamless streaming

- Broad genre and language diversity increases viewership across demographics

- 5G rollout will strengthen UHD, AR, and VR streaming experiences

- Key regions include Southeast, South, Northeast, North, and Central-West

Brazil Video Streaming Market Growth Factors

The Brazil video streaming market is growing rapidly due to the widespread adoption of OTT platforms delivering localized, on-demand content. Younger consumers are increasingly shifting away from traditional TV toward personalized digital entertainment accessible via smartphones, tablets, and smart TVs. Improved fiber-optic networks and rising high-speed internet availability further strengthen this trend, enabling seamless playback of HD and UHD content. Low subscription pricing and the rise of ad-supported platforms expand accessibility across income groups.

The rollout of 5G technology is another critical growth accelerator. With ultra-fast speeds, low latency, and higher bandwidth capacity, 5G enables streaming of ultra-high-definition (UHD) videos without buffering. It also lays the foundation for immersive technologies such as augmented reality (AR) and virtual reality (VR), offering interactive entertainment experiences. The partnership between TIM Brasil and Nokia, aimed at expanding 5G coverage across 15 states from January 2025, is expected to enhance streaming performance nationwide.

Growing demand for localized content and flexible monetization models also drives the market. Affordable subscription plans and ad-supported video-on-demand (AVOD) services such as the +SBT platform provide free access to premium entertainment, broadening consumer reach. Streaming platforms are increasingly investing in Brazilian movies, series, and independent productions to cater to regional preferences. These developments collectively strengthen platform adoption, accelerate digital content consumption, and promote sustained market growth.

Sample Request Link: https://www.imarcgroup.com/brazil-video-streaming-market/requestsample

Brazil Video Streaming Market Segmentation:

Component Insights

- Solution (IPTV, Over-the-Top, Pay TV)

- Services (Consulting, Managed Services, Training and Support)

Streaming Type Insights

- Live/Linear Video Streaming

- Non-Linear Video Streaming

Revenue Model Insights

- Subscription

- Transactional

- Advertisement

- Hybrid

End User Insights

- Personal

- Commercial

Regional Insights

The market covers Southeast, South, Northeast, North, and Central-West regions. The Southeast region dominates due to high internet penetration, a large urban consumer base, and concentrated OTT adoption. However, detailed regional statistics such as market share or CAGR are not provided in the source. Improvements in connectivity and digital infrastructure across all regions continue to support nationwide market expansion.

Recent Developments & News

Recent industry developments highlight rising FAST channel adoption, platform partnerships, and nationwide digital expansion. In June 2024, Amagi partnered with Globo and AD Digital to launch six free ad-supported channels in Brazil using its cloud-based playout platform. In February 2024, SBT selected Brightcove to power its new streaming app, enabling seamless streaming from over 100 stations across the country. These initiatives underscore the growing demand for high-quality, scalable streaming platforms in Latin America.

Request Customization: https://www.imarcgroup.com/request?type=report&id=29970&flag=E

Key Players

- Accedo

- SBT

- Amagi

- Globo

- AD Digital

- Brightcove

- TIM Brasil

- Nokia

About Us

IMARC Group is a global consulting firm providing market intelligence, industry analysis, and strategic advisory services. The company offers market entry support, feasibility studies, regulatory guidance, competitive benchmarking, procurement strategies, and comprehensive research across a wide range of industries.

Contact Us

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel (India): +91 120 433 0800

United States: +1-201971-6302