Market Overview

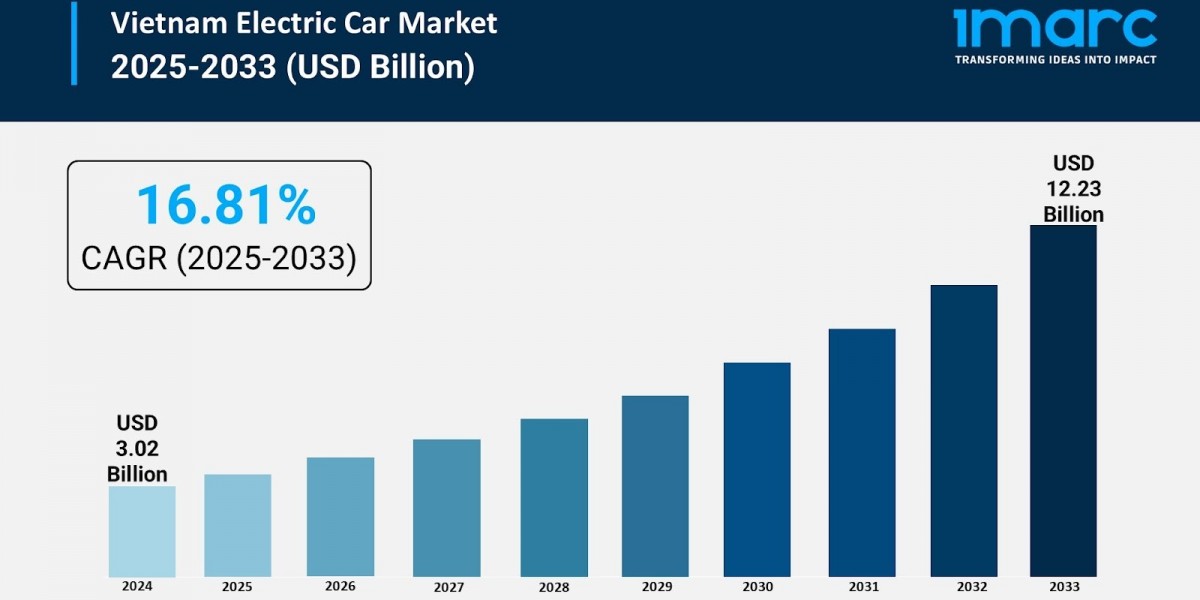

The Vietnam electric car market size was valued at USD 3.02 Billion in 2024 and is forecasted to reach USD 12.23 Billion by 2033, growing at a CAGR of 16.81% during the period from 2025 to 2033. The market growth is driven by rising sustainability concerns, government investments in EV charging infrastructure, expanding middle-class population, and the increasing demand for cleaner transportation options.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Vietnam Electric Car Market Key Takeaways

- Current Market Size: USD 3.02 Billion in 2024

- CAGR: 16.81% from 2025-2033

- Forecast Period: 2025-2033

- Vietnam’s government incentives, such as tax reductions and waived registration fees, have accelerated EV adoption.

- The country is investing in a comprehensive charging infrastructure to overcome accessibility challenges.

- Environmental awareness and urban pollution concerns are significant factors driving consumer interest.

- Domestic automakers like VinFast are making EVs more affordable and accessible.

- International EV manufacturers are entering Vietnam, bringing advanced technologies and competition.

Sample Request Link: https://www.imarcgroup.com/vietnam-electric-car-market/requestsample

Market Growth Factors

The Vietnamese EV market is promoted by the government with various incentives, such as tax exemptions, registration fee exemption and other green transportation regulations. According to the World Bank, to meet the country's commitment to decarbonize by 2050 and to transition to clean energy, Vietnam must invest up to USD 9 billion additionally per year between now and 2030 so the nation can expand power to generate infrastructure. Yearly financing should increase by USD 14 billion from 2031 to 2050. This infrastructure and policy is critical for further market development.

Consumers show increasing interest regarding clean vehicles because they grow concerned about air quality's deterioration and traffic's congestion increase inside cities and urban centers. Public campaigns and reporting to address climate change have additionally raised green mobility awareness. Along with interest increasing and demand growing, EV technology improving and affordability rising help expand the national market.

Local car manufacturers, with VinFast in the lead, have rapidly introduced affordable electric vehicles which consumers widely accept, and the government pushes to transition with policies such as subsidizing EV purchasers with USD1,000 and offering numerous tax incentives that favor EVs over internal combustion vehicles. International manufacturers throughout Asia and Europe have helped provide more choice to consumers, driven technology development, and competition in the industry, which has contributed to the growth of electrified mobility.

Market Segmentation

By Type:

- Battery Electric Vehicle: Gaining strong momentum due to zero-emission operation and lower running costs, supported by government incentives and charging infrastructure, ideal for urban commuting and environmentally conscious consumers.

- Plug-In Hybrid Electric Vehicle: Offers flexibility by combining electric power with traditional fuel, appealing to consumers concerned about charging outside cities; serves as a transitional option.

- Fuel Cell Electric Vehicle: Remains experimental due to limited hydrogen infrastructure and higher costs; adoption is minimal and requires significant investment and technological advances.

By Vehicle Class:

- Mid-Priced: Experiencing significant growth, driven by demand for affordable, efficient transportation; supported by government incentives and expanding charging facilities; practical for daily urban commutes.

- Luxury: Growing steadily with rising affluence; consumers seek premium vehicles with superior performance and advanced features; international luxury brands and favorable policies enhance accessibility.

By Drive Type:

- Front Wheel Drive: Popular for affordability, efficiency, and suitability for city driving; offers better traction in wet conditions and easier maintenance; common in mid-range EVs.

- Rear Wheel Drive: Caters to performance-oriented drivers seeking better handling; found mostly in mid to high-end models.

- All-Wheel Drive: Gaining interest for safety, stability, and off-road capability; preferred for long-distance and premium segments.

By Region:

- Northern Vietnam: Leads in EV adoption due to dense population, economic hubs like Hanoi, early infrastructure development, strong government presence, and investment in charging stations.

- Central Vietnam: Gradually embracing EVs with adoption centered in urban areas like Da Nang; infrastructure development ongoing but faces rural network challenges; tourism and green initiatives help drive growth.

- Southern Vietnam: Especially Ho Chi Minh City shows strong potential due to economic vibrancy and growing middle class; urban congestion and pollution encourage cleaner transport; private investments and eco-conscious behavior accelerate adoption.

Regional Insights

Northern Vietnam dominates EV adoption with a dense population, economic centrality including Hanoi, and early infrastructure development backed by government action and charging station investments. This makes Northern Vietnam the primary region for production and market penetration. Central Vietnam is increasing EV usage amid infrastructural challenges while Southern Vietnam offers strong growth potential linked to urban pollution mitigation and rising middle-class demand.

Recent Developments & News

- January 2025: VinFast entered the Indian market with VF 7 and VF 6 electric SUVs; plans a $500 million manufacturing plant in Tamil Nadu by end 2025, exchanging incentives under new EV policy and aiming exports to Middle East and Africa.

- December 2024: VinFast is building a production plant in Ha Tinh, Vietnam for small and mid-sized EVs with 300,000 annual capacity; models VF 3 and VF 5 for domestic and international markets; Q3 net loss reduced to USD 550 million.

- October 2024: BYD expanded its Vietnam lineup to five models adding the Han EV sedan and M6 MPV; Han EV starting at USD 58,930 and M6 MPV at VND 756 Million.

- September 2024: VinFast initiated pre-orders for mini electric SUV VF 3 in the Philippines, offering incentives and extensive battery and vehicle warranties.

- September 2024: Chinese luxury brand Zeekr, owned by Geely, entered Vietnam via partnership with Tasco; joins portfolio including Volvo and Lynk & Co; model and infrastructure details undisclosed.

Key Players

- VinFast

- BYD

- Zeekr

Competitive Landscape

The competitive landscape in Vietnam’s electric car market is becoming increasingly dynamic and diverse. Both domestic and international players are entering the space, leading to heightened competition and rapid innovation. Companies focus on affordability, design, and technology to attract a broad consumer base. Investment in localized production, partnerships, and after-sales is intensifying, driving improved products, pricing, and adoption.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302