Market Overview

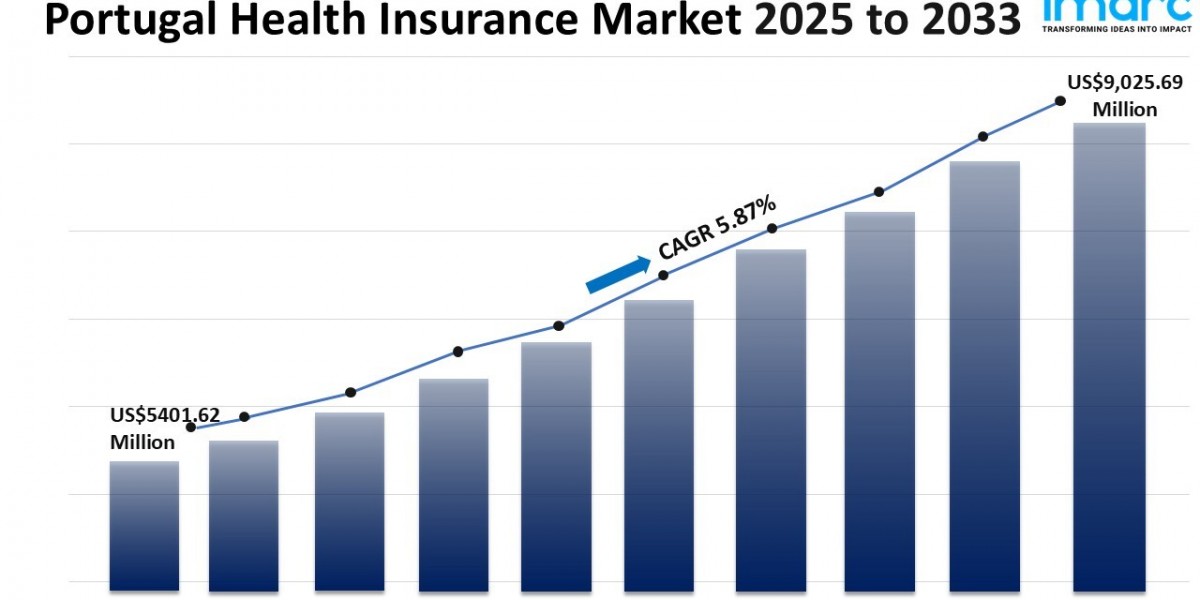

The Portugal Health Insurance Market was valued at USD 5,401.62 Million in 2024 and is projected to reach USD 9,025.69 Million by 2033. The market is expected to grow at a CAGR of 5.87% during the forecast period 2025-2033. Growth is driven by factors including an ageing population, rising healthcare costs, and long waiting times in the public healthcare system, which are prompting increased demand for private health coverage.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Portugal Health Insurance Market Key Takeaways

- Current Market Size: USD 5,401.62 Million in 2024

- CAGR: 5.87% during 2025-2033

- Forecast Period: 2025-2033

- The market is evolving under pressure from an ageing population, increasing healthcare costs, and long wait times in public healthcare.

- Rising demand for private insurance coverage is pushing insurers to innovate with digital services, wellness offerings, and flexible plan options.

- Regulatory oversight has increased, focusing on transparency, risk management, and consumer protection.

- Many companies are expanding through partnerships, acquisitions, and enhanced distribution networks.

- Standardization of policy features and consumer protection regulations are key market trends enhancing clarity and fairness.

Sample Request Link: https://www.imarcgroup.com/portugal-health-insurance-market/requestsample

Market Growth Factors

The growth of private health insurance in Portugal is mainly associated with demographic factors and the characteristics of the health system. The increasing aging of the population corresponds to increased demand for health services, which results in increased demand for health insurance coverage, as people get older. Increasing health care costs lead both individuals and employers to directly purchase private health insurance to benefit from timely and individualized care. Long wait times and limited appointments within the public healthcare system are driving consumers to seek private health insurance, fostering market growth projected at a 5.87% compound annual growth rate (CAGR) from 2025 to 2033.

In response to this demand, providers are developing new digital solutions, wellness initiatives, along with more customizable insurance plans. Tighter regulatory scrutiny also prompts product evolution. Transparency and consumer protection gain emphasis. The market is thus becoming more confident and well-equipped with products that safeguard consumers. The market should grow from USD 5,401.62 Million in 2024 to USD 9,025.69 Million in 2033.

The Portuguese Insurance and Pension Funds Supervisory Authority (ASF) has set out standard conditions toward making comparison and comprehension of health insurance contracts easier. For new contracts concluded as of June 2025, these must state the minimum insured amount, capital ceilings and co-payment between the insurance company and the policyholder, and may not discriminate against those who have ameliorated a previous health risk. Such measures have the dual benefit of protecting the consumer and strengthening the relationship between the insurer and the policymaker.

A transition to private health care, driven by consumer demand, is likely with a preference for more convenience and faster access to health care. Estimates suggest that up to four million people in Portugal will have private health insurance by the end of 2024. Insurers implement online processes and simplify the claims process in response to this demand for service intensive use, enabling market expansion.

Market Segmentation

The Portugal health insurance market is segmented as follows based on the report:

- Provider Insights:

- Private Providers

- Public Providers

Includes detailed analysis and breakup of market shares by provider type.

- Type Insights:

- Life-Time Coverage

- Term Insurance

Provides comprehensive breakdown of coverage types within the market.

- Plan Type Insights:

- Medical Insurance

- Critical Illness Insurance

- Family Floater Health Insurance

- Others

Details segmentation based on insurance plan types offered.

- Demographics Insights:

- Minor

- Adults

- Senior Citizen

Analyzes health insurance uptake and market trends by demographic group.

- Provider Type Insights:

- Preferred Provider Organizations (PPOs)

- Point of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

Examines market shares and dynamics among differing provider models.

- Regional Insights:

- Norte

- Centro

- A. M. Lisboa

- Alentejo

- Others

Comprehensive regional market analysis and segmentation.

Regional Insights

The report provides a comprehensive analysis of the major regional markets of Portugal including Norte, Centro, A. M. Lisboa, Alentejo, and Others. The dominant region is not explicitly identified in the source, nor are specific market shares or CAGR values by region provided. Thus, detailed regional growth statistics or dominant market segments are not provided in the source.

Key Players

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent Developments & News

Not provided in source.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302