Market Overview

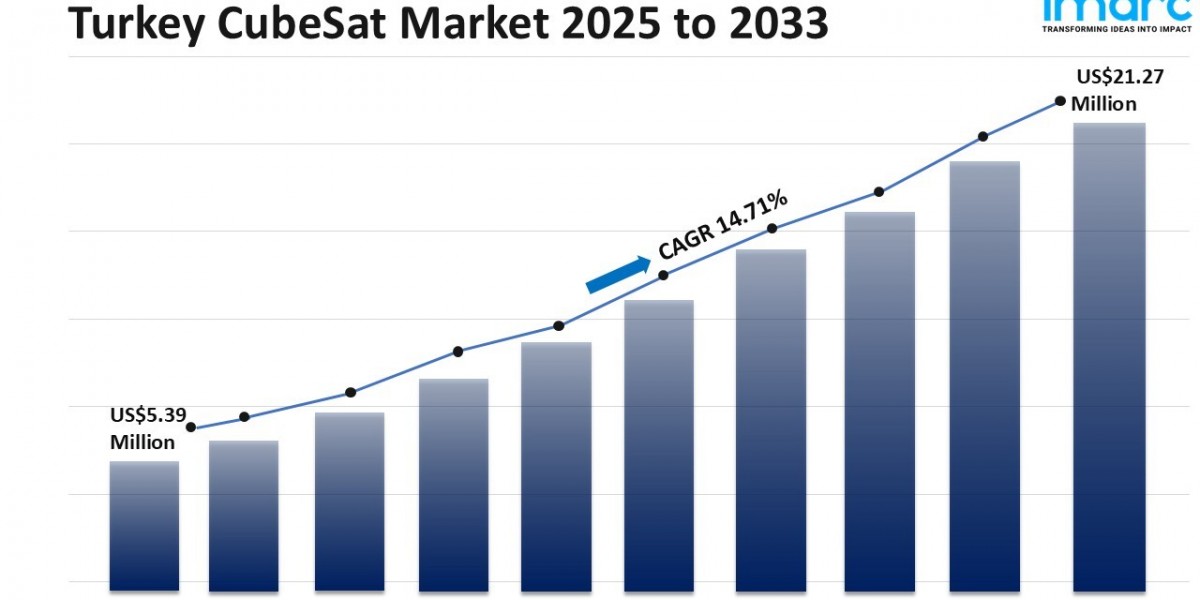

The Turkey CubeSat market size was valued at USD 5.39 Million in 2024 and is expected to reach USD 21.27 Million by 2033, registering a CAGR of 14.71% during the forecast period of 2025-2033. This growth is fueled by strategic government initiatives for space infrastructure and regional positioning systems, the rise of innovative commercial startups, and expanding aerospace educational programs. Turkey’s national space program ambitions and defense applications further support the market expansion.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Turkey CubeSat Market Key Takeaways

- Current Market Size: USD 5.39 Million (2024)

- CAGR: 14.71%

- Forecast Period: 2025-2033

- The market growth is propelled by government-led strategic initiatives for space infrastructure development and regional positioning systems.

- Innovative commercial small satellite startups leveraging indigenous technologies and private capital are rapidly emerging.

- Expanding educational programs are building a robust pipeline of aerospace talent.

- Turkey's national space program goals and rising defense applications significantly support market growth.

- Modular designs and partnerships with commercial launch providers enable rapid deployment of satellite constellations.

Sample Request Link: https://www.imarcgroup.com/turkey-cubesat-market/requestsample

Market Growth Factors

Infrastructure development for space and an independent regional positioning system are two important projects in calculated plans for the Turkish CubeSat market. Development of small satellites is a high priority in the National Space Program, which considers technology independence. This provides opportunities for research and development, manufacturing and collaboration between university and industry, and also improves the country's position within the CubeSat market.

Technology miniaturization enables 6U and 12U CubeSats, allowing satellite missions to become more efficient and reliable. Furthermore, atomic clocks advance and embedded computing occurs in the satellite to increase accuracy for positioning and timing, and reduces reliance on imported technologies. These modular and standardized designs keep costs low and reduce production lead time. Agreements with commercial launch providers like SpaceX allow rapid injection of still more of the satellites into the constellation for civilian or military purposes.

CubeSats increasingly connect for IoT, farm smartly with agriculture, monitor the environment, manage in disaster, and apply likewise, offering inexpensive real-time data to collect and process. Defense and national security may drive commercialization since geopolitical uncertainty is mounting. Private organizations such as Plan-S and Baykar are developing CubeSats utilizing domestic software and hardware, deploying satellites for IoT networks and Earth observation purposes. These initiatives aim for independence and cost reduction through local component production, taking advantage of CubeSats' mass production capabilities.

Market Segmentation

Size Insights:

- 0.25U to 1U: Smallest CubeSats with compact design, ideal for simple, lightweight missions.

- 1 to 3U: Mid-sized CubeSats balancing capability and size for varied applications.

- 3U to 6U: Larger CubeSats allowing more advanced payloads and longer mission durations.

- 6U to 12U: Larger modular CubeSats with enhanced miniaturization enabling reliable complex functionalities.

- 12U and Above: Largest CubeSats providing extended capabilities for sophisticated missions.

Application Insights:

- Earth Observation and Traffic Monitoring: Utilized for imaging, monitoring geographical and traffic patterns.

- Science Technology and Education: Applied in academic and technological research and educational programs.

- Space Observation: Used for monitoring and research purposes in outer space.

- Communication: Facilitate IoT data transmission, connectivity, and communication services.

- Others: Additional niche applications beyond the main categories.

End User Insights:

- Government and Military: Primary users focusing on defense, national security, and public sector applications.

- Commercial: Private sector firms leveraging CubeSats for business and commercial services.

- Others: Additional users outside government and commercial sectors.

Subsystem Insights:

- Payloads: Instruments and technology packages performing primary satellite functions.

- Structures: Physical frameworks supporting satellite components.

- Electrical Power Systems: Systems providing power management and supply.

- Command and Data Handling: Systems managing operational commands and data processing.

- Propulsion Systems: Mechanisms enabling satellite movement and orbit adjustments.

- Attitude Determination and Control Systems: Systems controlling satellite orientation and stability.

- Others: Other supporting subsystems not categorized above.

Regional Insights

The report covers major Turkish regions including Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia. However, the source does not specify a dominant region or provide exact statistics or market shares by region.

A comprehensive regional market analysis is included, but no distinct region is highlighted as dominant with explicit data.

Recent Developments & News

- June 2025: Türkiye advanced its CubeSat segment with a 6U CubeSat project under the BKZS initiative, validating atomic clock integration. This boosted domestic expertise and demand for advanced CubeSat software, enhancing market growth through improved reliability, security, and regional GNSS applications.

- June 2025: Plan-S expanded Türkiye’s CubeSat market by launching four satellites via SpaceX Falcon 9 under the Transporter-14 mission. These satellites feature homegrown software-driven IoT systems, boosting data processing efficiency, connectivity, and strengthening demand for CubeSat software while promoting global IoT integration markets.

Key Players

- Plan-S

- Baykar

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302