Market Overview

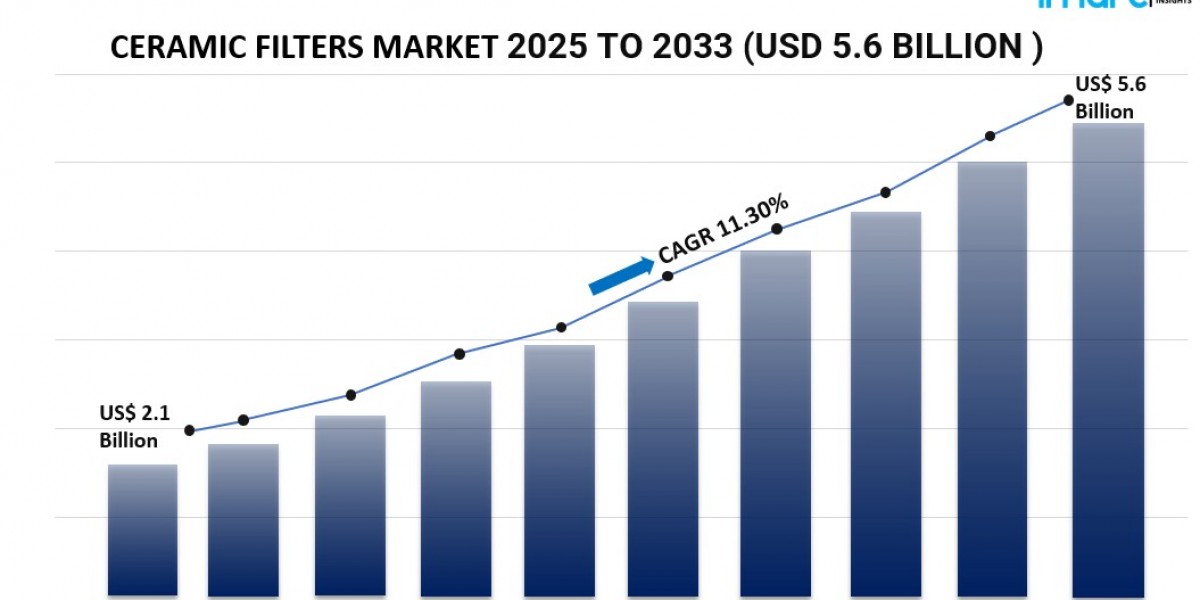

The global ceramic filters market size reached USD 2.1 Billion in 2024 and is projected to reach USD 5.6 Billion by 2033, exhibiting a CAGR of 11.30% during the forecast period from 2025 to 2033. Driven by rapid industrialization, rising demand for clean water, increasing environmental concerns, and product innovations, the market offers sustainable solutions for purifying air and water across residential, commercial, and industrial segments. Ceramic filters are effective in removing contaminants and are gaining adoption due to their eco-friendly and cost-efficient approach.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

Ceramic Filters Market Key Takeaways

• Current Market Size: USD 2.1 Billion (2024)

• CAGR: 11.30%

• Forecast Period: 2025-2033

• Rising demand for safe drinking water across commercial, residential, and industrial sectors is a significant growth driver.

• Increasing environmental concerns encourage adoption of ceramic filters as an eco-friendly water purification alternative.

• Ceramic water filters dominate the product segment due to exceptional purification capabilities and widespread household use.

• Residential applications represent the largest share due to demand for safe drinking water and eco-conscious consumer behavior.

• Asia Pacific holds the largest market share, driven by rapid industrialization, urbanization, and growing health awareness.

Request for sample copy of this report:

https://www.imarcgroup.com/ceramic-filters-market/requestsample

Market Growth Factors

• Rapid industrialization worldwide generates large volumes of wastewater containing chemicals and heavy metals. Ceramic filters provide efficient and cost-effective purification solutions that help industries comply with strict environmental regulations.

• Manufacturing, chemical, and mining industries rely on clean water for processing, and ceramic filters support operational reliability and sustainability.

• Urbanization increases demand for clean drinking water, with ceramic filters widely adopted in households to prevent waterborne health risks.

• Increasing environmental awareness drives consumers toward sustainable, reusable water purification options, reducing reliance on single-use plastic bottles.

• Governments and organizations investing in water infrastructure and regulation further strengthen ceramic filter adoption across large-scale water treatment facilities.

• Product innovations improve filtration performance, enabling removal of bacteria, viruses, and chemical impurities. Advances in materials and design enhance scalability and cost-effectiveness.

• Technological advancements introduce smart filtration features, enabling real-time monitoring and improving reliability, usability, and widespread adoption.

Market Segmentation

Breakup by Product Type:

• Ceramic Water Filter: Dominates the market with exceptional purification capabilities, removing bacteria, viruses, and particulate matter; widely used in households and communities to reduce plastic waste and mitigate health risks.

• Ceramic Air Filter

Breakup by Application:

• Residential: Largest segment, offering safe and clean drinking water; valued for eco-friendly characteristics, cost-effectiveness, ease of use, and suitability for rural and remote areas.

• Commercial

• Industrial: Includes hot gas filtration, oil/water separation, bio-filtration, and various industrial purification uses.

By Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

Asia Pacific holds the dominant share of the ceramic filters market due to its large and growing population, rising water purification needs, and expanding industrial base. Increasing urbanization drives infrastructure development, particularly in water treatment systems. Rapid manufacturing growth boosts demand for industrial filtration solutions. Environmental awareness, government incentives, and disaster-prone regions contribute to rising adoption. China leads the regional market with heightened awareness of water quality and expanding filtration applications.

Recent Developments & News

• 2020: Filtration Group (parent company of Clear Edge) acquired Multisorb Technologies, enhancing air filtration and chemical adsorption capabilities.

• 2021: Pall Corporation (Danaher Corporation) acquired Aldevron to complement its biopharmaceutical filtration offerings.

• 2020: Veolia Environnement S.A. partnered with Nestlé Waters to develop recycling technologies for plastic bottles, including filtration-related materials.

Key Players

• Unifrax I LLC

• 3M Company

• Anguil Environmental Systems Inc.

• Ceramic Filters Company Inc.

• Clear Edge (Filtration Group Corporation)

• Glosfume Technologies Ltd.

• Haldor Topsoe A/S

• KLT Filtration Limited

• Pall Corporation (Danaher Corporation)

• Tri-Mer Corporation

• Veolia Environnement S.A.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for Customization: https://www.imarcgroup.com/request?type=report&id=2288&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302