Market Overview

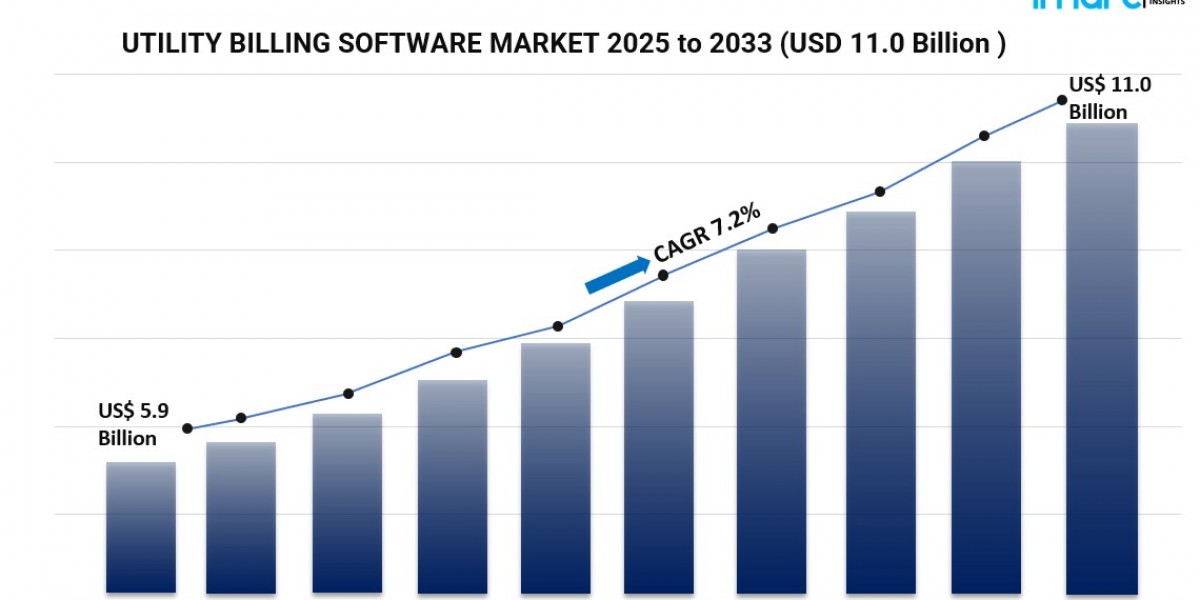

The global Utility Billing Software Market was valued at USD 5.9 Billion in 2024 and is expected to reach USD 11.0 Billion by 2033, exhibiting a CAGR of 7.2% during 2025-2033. This growth is driven by rising energy conservation awareness, stringent regulatory mandates, rapid urbanization, technological advancements such as IoT and smart meters, and increasing customer expectations for transparency and real-time billing.

Study Assumption Years

Base Year: 2024

Historical Years: 2019-2024

Forecast Period: 2025-2033

Utility Billing Software Market Key Takeaways

- Current Market Size: USD 5.9 Billion in 2024

- CAGR: 7.2%

- Forecast Period: 2025-2033

- Cloud-based deployment holds the largest market share due to scalability, cost-efficiency, and accessibility benefits.

- Power distribution is the leading end user segment, driven by a large consumer base and strict regulatory scrutiny.

- North America commands the largest market share due to a mature utility sector and high adoption of smart meters and IoT.

- The market is highly competitive with key players expanding globally through acquisitions and partnerships.

Request for Sample Copy: https://www.imarcgroup.com/utility-billing-software-market/requestsample

Market Growth Factors

The market is primarily driven by a global focus on energy efficiency. Rising environmental sustainability awareness encourages utilities to provide real-time insights into consumption patterns, helping customers reduce waste. Government regulations and incentives strengthen this trend by promoting responsible consumption and empowering utilities to optimize resource allocation. UBS solutions enable these capabilities by offering accurate monitoring and billing functionalities.

Regulatory compliance is another major driver. Increasing scrutiny and evolving regulations require utility companies to maintain accurate, transparent billing systems and meet strict billing standards. UBS platforms are designed to comply with complex frameworks, generate detailed reports, maintain audit trails, and reduce non-compliance risks, thereby building trust and improving operational efficiency.

Customer expectations have increased due to digitalization. UBS addresses these demands through self-service portals and mobile applications, offering instant access to billing data, usage alerts, and transparent statements. Enhanced engagement increases customer loyalty, which is essential in a competitive utility industry. Providers are investing heavily in modern billing systems to deliver personalized, real-time services—further driving UBS adoption.

Market Segmentation

Breakup by Deployment Mode

- On-premises

- Cloud-based: Largest segment due to scalability, cost-effectiveness, remote access, and enhanced security.

Breakup by Type

- Platform as a Service: Provides a development-ready environment reducing time-to-market.

- Infrastructure as a Service: Offers virtual machines, storage, and networking services to support rapid provisioning and updates.

- Software as a Service: Scalable platforms that adapt to changes in user numbers, service expansion, and data volume.

Breakup by End User

- Water

- Power Distribution: Largest segment requiring robust billing solutions and compliance with regulatory standards.

- Oil and Gas

- Telecommunication

- Others

Breakup by Region

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Regional Insights

North America dominates the global market, supported by a highly developed utility sector, strong emphasis on sustainability, and extensive adoption of IoT technologies and smart meters. These advancements enable utilities to deliver real-time billing and consumption data, contributing to the region’s strong market outlook.

Recent Developments & News

- December 2022: Harris Computer acquired Service-Link to expand its Utilities Group with a mobile workforce management solution.

- October 2022: Exceleron Softwares Inc. upgraded its MyUsage solution to support Amazon Web Services and tier-1 private cloud environments for enhanced scalability.

- January 2020: Ireland-based AMCS acquired Utilibill Pvt. Ltd. for an undisclosed amount.

Key Players

- Banyon Data Systems, Inc.

- Continental Utility Solutions Inc. (CUSI)

- EnergyCAP, LLC

- ePsolutions Inc.

- Exceleron

- Harris Computer (Constellation Software Inc.)

- Jayhawk Software

- Jendev

- Methodia Group

- Oracle

- SkyBill

- TEAM Energy

- United Systems & Software

Customization Request: https://www.imarcgroup.com/request?type=report&id=5190&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302