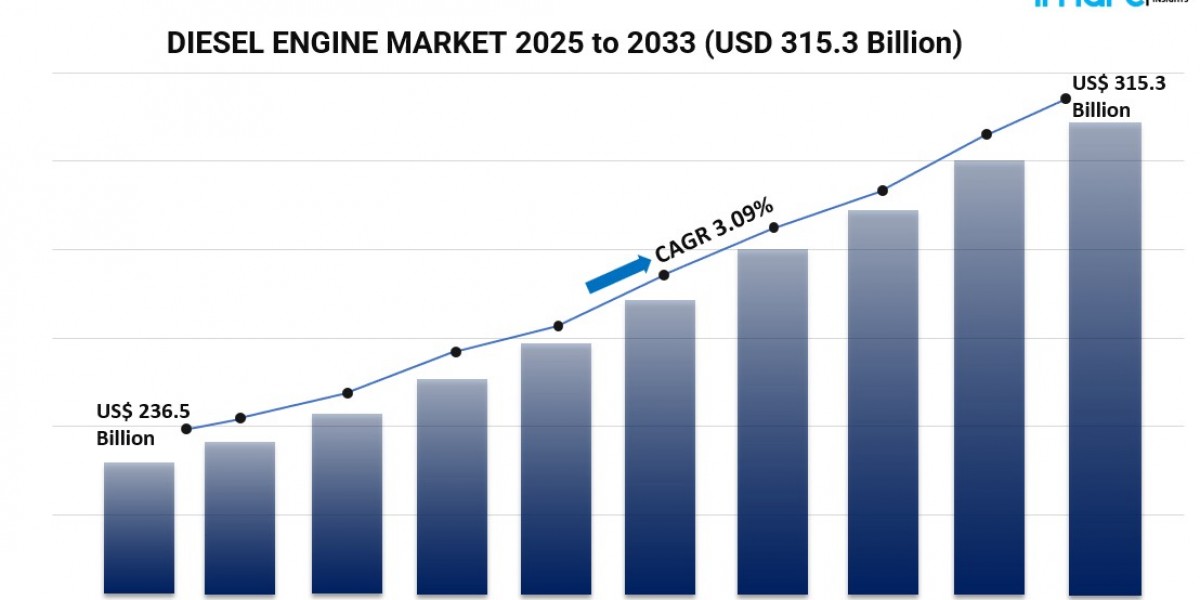

The global Diesel Engine Market reached a size of USD 236.5 Billion in 2024 and is projected to hit USD 315.3 Billion by 2033, growing at a CAGR of 3.09% during 2025-2033. Market growth is supported by expanding industrial and commercial applications, rising demand for power generation, increased use in maritime industries, and advancements in cleaner diesel engine technologies.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Diesel Engine Market Key Takeaways

- Current Market Size (2024): USD 236.5 Billion

- CAGR (2025-2033): 3.09%

- Forecast Period: 2025-2033

- Diesel engines' fuel efficiency and durability make them preferred for heavy-duty applications such as trucks, buses, industrial equipment, and construction machinery.

- The automotive segment, including on-road and off-road vehicles, dominates the market.

- Asia Pacific holds the largest market share, supported by industrialization, infrastructure expansion, and growth in agriculture and mining.

- Ongoing R&D focuses on developing cleaner and more fuel-efficient engines to meet stringent environmental regulations.

Sample Request Link: https://www.imarcgroup.com/diesel-engine-market/requestsample

Market Growth Factors

Growth in the global diesel engine market is driven primarily by expanding industrial and commercial sectors. Diesel engines offer reliable power for construction machinery, generators, and heavy-duty equipment used across infrastructure, building, and road development projects. Their durability, high torque, and fuel efficiency make them essential for industries such as transportation, mining, and agriculture, especially in rapidly industrializing regions.

The automotive industry represents a major growth driver. Diesel engines deliver strong torque output, long driving range, and superior fuel economy, making them well-suited for commercial vehicles including trucks, vans, and SUVs. Despite increasing adoption of electric and hybrid vehicles, diesel engines continue to hold relevance due to their towing capabilities and durability. Expansion of logistics and e-commerce sectors further increases demand for diesel-powered fleets.

Strong demand from the mining and off-road vehicle sectors also contributes to market expansion. Diesel engines power heavy machinery used for hauling, excavation, and pumping in demanding terrains. Their proven ability to operate under extreme conditions aligns well with the operational requirements of mining and construction industries. Global growth in resource extraction and infrastructure development sustains demand for robust diesel-driven equipment.

Market Segmentation

Breakup by Power Rating:

- 0.5 MW–1 MW: Dominant segment powering generators for hospitals, data centers, manufacturing facilities, and heavy machinery in construction, mining, and agriculture.

- Up to 0.5 MW

- 2 MW–5 MW

- 1 MW–2 MW

- Above 5 MW

Breakup by End-User:

- Automotive: Includes on-road (light vehicles, medium/heavy trucks, light trucks) and off-road (industrial/construction equipment, agriculture equipment, marine applications). This is the dominant segment due to heavy-duty vehicle usage and logistics activity.

- Non-Automotive

Regional Insights

Asia Pacific leads the global market, driven by rapid industrialization, increasing infrastructure projects, and expanding agriculture and mining operations. The region’s growing e-commerce and logistics industries reinforce demand for diesel-powered delivery fleets and heavy commercial vehicles. Manufacturers are also investing in cleaner diesel technologies to comply with environmental standards.

Recent Developments & News

- 2024: AGCO Corporation developed the CORE family of diesel engines designed to support future fuels such as hydrogen and gas, with potential to reduce emissions by up to 90% using renewable HVO fuels.

- August 2023: Cummins Inc. received approval for its full line of diesel high-horsepower engines to operate on renewable diesel fuels for industries such as mining, rail, marine, defense, and oil and gas.

- July 2023: General Motors and Ford Motor Company reaffirmed their investment in internal combustion engine vehicles powered by diesel and gasoline, highlighting continued relevance despite EV commitments.

Key Players

- AGCO Corporation

- China First Automobile Works (FAW) Group Corporation

- Robert Bosch GmbH

- Deere & Company

- Continental AG

- Delphi Automotive System Private Limited

- Mitsubishi Heavy Industries, Ltd.

- Ford Motor Company

- General Motors Company

- MAN SE

- Wärtsilä Oyj Abp

- Cummins, Inc.

- Caterpillar

- Rolls-Royce Motor Cars Limited

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=1290&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The company provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation support, factory setup guidance, regulatory approvals, licensing navigation, branding, marketing strategies, competitive benchmarking, pricing analysis, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302