Secondary Battery Market Overview

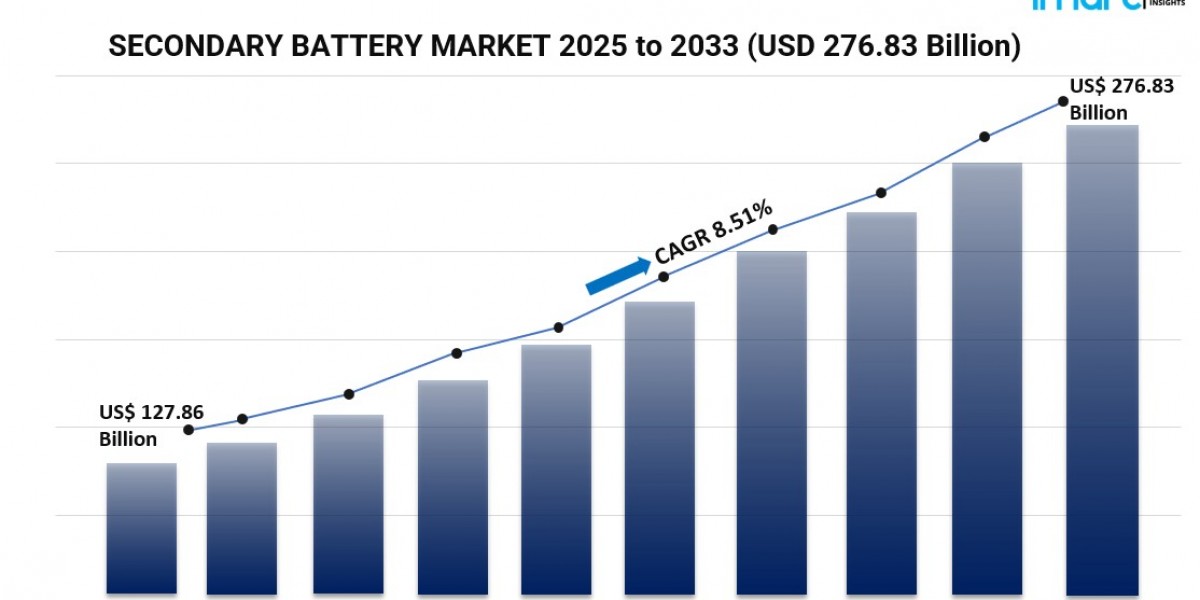

The global Secondary Battery Market was valued at USD 127.86 Billion in 2024 and is anticipated to reach USD 276.83 Billion by 2033, exhibiting a CAGR of 8.51% during the forecast period of 2025-2033. The market expansion is driven by rising electric vehicle adoption, energy storage for renewables, and consumer electronics demand. Technological innovations, environmental awareness, and government support further fuel growth.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Secondary Battery Market Key Takeaways

- Current Market Size: USD 127.86 Billion in 2024

- CAGR: 8.51%

- Forecast Period: 2025-2033

- Asia Pacific dominates with over 46.8% market share in 2024.

- Leading growth drivers include rising EV adoption, renewable energy storage needs, and expanding consumer electronics.

- Government policies such as EV incentives and environmental regulations accelerate market adoption.

- Lithium-ion batteries lead in EV and portable device segments; lead acid batteries still significant in automotive and industrial uses.

- Increasing investments in battery manufacturing and recycling enhance market prospects.

Request for sample copy of this report: https://www.imarcgroup.com/secondary-battery-market/requestsample

Market Growth Factors

The growing demand for electric vehicles (EVs) is a major driver of the secondary battery market. Globally, electric vehicles accounted for nearly one in five cars sold in 2023, totaling close to 14 million units. The increased enforcement of stringent carbon emission regulations and attractive government incentives, such as up to $7,500 tax credits in the U.S., have significantly boosted EV adoption. Lithium-ion batteries dominate this segment due to their high energy density, long lifespan, and fast charging capabilities. Advancements including solid-state batteries promise improved performance, addressing challenges like range anxiety and securing automakers’ supply chains.

Renewable energy integration and grid storage needs are fueling demand for secondary batteries, especially lithium-ion and flow batteries. In 2023, a record 473 GW of renewable energy capacity was added worldwide, increasing renewable power stock by 13.9%. Large-scale battery storage projects by governments and utilities stabilize power grids by balancing fluctuating solar and wind generation. These investments support grid modernization and decarbonization efforts, rendering secondary batteries vital for a reliable renewable energy infrastructure.

The expanding portable consumer electronics market, including smartphones, laptops, and wearables, also drives secondary battery growth. Lithium-ion batteries are the technology of choice for their lightweight construction, high energy density, and rapid charging. The proliferation of Internet of Things (IoT) devices, with a 16% increase reaching 16.7 billion active endpoints in 2023, further increases battery demand. Manufacturers focus on battery chemistries enhancing safety and lifespan while exploring sustainable battery manufacturing and recycling methods to comply with environmental regulations and consumer expectations.

Market Segmentation

Analysis by Type

- Lead Acid: Affordable and reliable, widely used in automotive, industrial, and backup power systems. Favored for starting, lighting, and ignition (SLI) functions and industrial applications. Developments improve efficiency and lifespan, maintaining significant market share.

- Lithium-Ion (Li-ion): High energy density and durability make these batteries essential for EVs, consumer electronics, and renewable energy storage.

- Nickel Metal Hydride

- Others

Analysis by Application

- Electronics: Powers consumer devices like smartphones and laptops, prioritizing lithium-ion for compact size and energy density.

- Motor Vehicles: Lead acid dominates traditional vehicles’ SLI requirements; lithium-ion powers electric and hybrid vehicles.

- Industrial Batteries: Used in forklifts, UPS, and renewable energy storage, with lead acid preferred for durability. Lithium-ion gains traction for efficiency.

- Portable Devices: Includes power tools, medical equipment, and cameras; lithium-ion leads due to superior energy density and rechargeability.

- Others: Includes aerospace, marine, and grid energy storage applications requiring reliable and durable batteries.

Analysis by Industry Vertical

- Chemical and Petrochemical

- Oil and Gas

- Energy and Power: Secondary batteries support renewable integration and grid stabilization.

- Automotive: Largest market share at 32.0%; driven by traditional and electric vehicles with lead acid and lithium-ion batteries.

- Others

Regional Insights

Asia Pacific dominates the secondary battery market with over 46.8% market share in 2024. The region benefits from strong manufacturing capabilities, high demand across multiple industries, and supportive government policies. China, Japan, South Korea, and India lead in electric vehicle adoption, electronics manufacturing, and renewable energy storage applications, supported by incentives and regulations that drive market growth.

Recent Developments & News

- January 2025: Ministry of Electronics and Information Technology (MeitY), India, established the "Centre of Excellence (COE) on Rechargeable Battery Technology (Pre-cell)" at CMET, Pune, to foster innovation.

- November 2024: Amara Raja Energy & Mobility Ltd announced plans to invest over USD 120 Million in New Energy Business focused on lithium-ion cell R&D and manufacturing for FY 2026.

- August 2022: Contemporary Amperex Technology Co., Limited (CATL) announced USD 8,074 million investment to build a 100 GWh battery plant in Debrecen, Hungary, marking its second European facility.

Key Players

- Amperex Technology Limited (TDK Corporation)

- Byd Company Limited

- Duracell Inc. (Berkshire Hathaway Inc.)

- Energizer Holdings Inc.

- EnerSys

- LG Chem Ltd.

- Panasonic Corporation

- Saft (TotalEnergies SE)

- Samsung SDI Co. Ltd.

- Showa Denko K. K.

- Sony Group Corporation

- Tianjin Lishen Battery Joint-Stock Co. Ltd.

Request for customization: https://www.imarcgroup.com/request?type=report&id=5241&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302