Market Overview

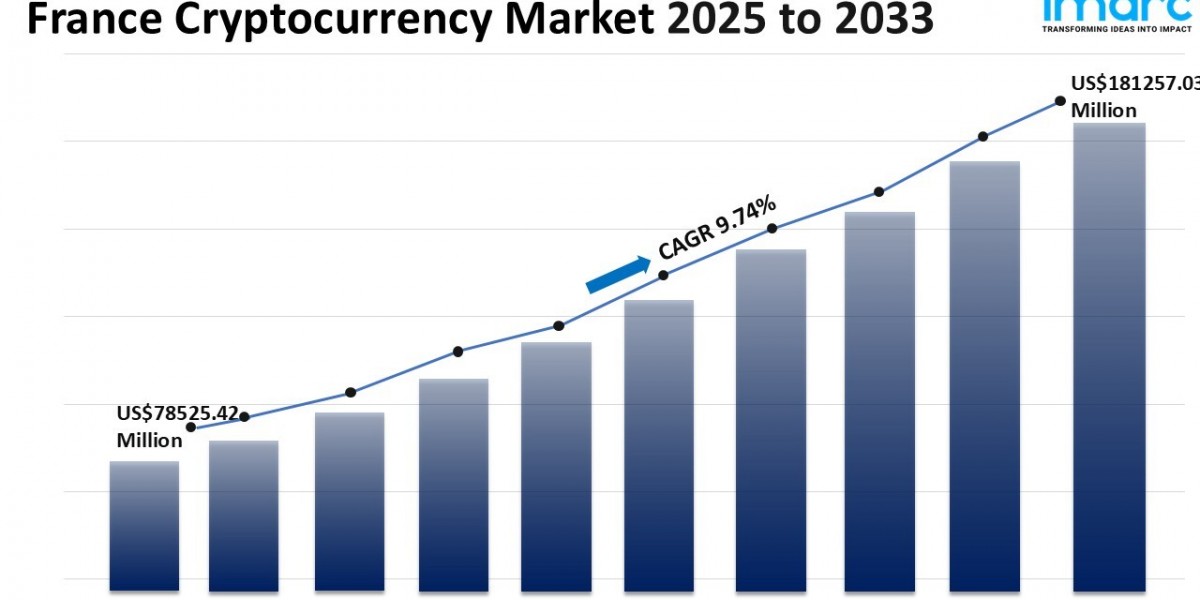

The France cryptocurrency market was valued at USD 78,525.42 Million in 2024 and is projected to reach USD 181,257.03 Million by 2033, growing at a CAGR of 9.74% during the forecast period of 2025 to 2033. The market growth is driven by increased demand for secure platforms, innovations in blockchain security, and government policies safeguarding users. Additionally, rising bitcoin mining activities are amplifying investments in hardware, clean energy, and blockchain infrastructure, creating jobs and enhancing network security.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

France Cryptocurrency Market Key Takeaways

- Current Market Size: USD 78,525.42 Million (2024)

- CAGR: 9.74% (2025-2033)

- Forecast Period: 2025-2033

- Rising security concerns are encouraging demand for secure trading platforms and blockchain safety innovations such as cold storage and biometric verifications.

- Government policies in France are proactively protecting crypto entrepreneurs and investors with tighter regulations and safety initiatives.

- Growing interest in bitcoin mining is driving demand for mining hardware, renewable energy, and blockchain infrastructure, leading to increased crypto activity.

- Public curiosity and reinvestment by miners are boosting liquidity and network security in the French crypto ecosystem.

- The government’s strategy includes using excess clean energy for mining, aiming at economic benefits and ecological sustainability.

Sample Request Link: https://www.imarcgroup.com/france-cryptocurrency-market/requestsample

Market Growth Factors

The growing concerns about security are favorable for cryptocurrency growth in France. The growing adoption of cryptocurrencies also poses problems. More phishing, hacking and fraud targeting users and online cryptocurrency exchange platforms is expected. So investors and service providers in the cryptocurrency sector are adopting secure online platforms with strong authentication mechanisms, encrypted wallets, and blockchain security such as cold storage, multi-signature wallets and biometric security. Regulators also more rigorously enforce and require licenses for safety and investor protection. In May 2025, France decided on providing police support as a priority, visiting homes, and briefing on safety to build trust and attract hesitant investors.

Bitcoin mining became popular and drives growth within France's cryptocurrency market. People and businesses mine bitcoin to gain profit along with an increase that contributes to demanding the mining hardware and electricity needed to mine. This trend can encourage building data centers and renewable energy sources. They provide mining that is cheaper and greener. Mines validate transactions, secure the network, and help build investor confidence. Mining also creates jobs in engineering and support services to the mining industry. In July 2025, the French government proposed bitcoin mining as a way to utilize excess clean energy and enable sustainable growth.

Investments triggered by the growth in the mining sector will contribute to France's blockchain infrastructure and the security of its networks. Innovations in clean energy technologies and equipment to promote sustainable mining are emerging. Investment results in the creation of jobs that generate public interest. Miners reinvest their earnings so as to create liquidity, activity, and transactions in the crypto ecosystem. Thus, the infrastructural improvement and the governmental policies lead to the growth of the market and position France as a responsible and innovative country in the cryptocurrency ecosystem.

Market Segmentation

Type Insights:

- Bitcoin: Leading cryptocurrency type, driving major market share with extensive user adoption.

- Ethereum: Popular blockchain platform supporting decentralized applications and smart contracts.

- Bitcoin Cash: A peer-to-peer electronic cash system with faster transactions than Bitcoin.

- Ripple: Real-time gross settlement system emphasizing cross-border payments.

- Litecoin: Peer-to-peer cryptocurrency offering faster transaction confirmation.

- Dashcoin: Digital currency focused on privacy-centric transactions.

- Others: Includes other lesser-known cryptocurrencies active in the market.

Component Insights:

- Hardware: Physical devices used for cryptocurrency mining and transactions.

- Software: Applications and platforms supporting crypto trading, transactions, and mining.

Process Insights:

- Mining: Process of verifying transactions and adding them to the blockchain ledger.

- Transaction: Activities involving the transfer of cryptocurrency between users.

Application Insights:

- Trading: Buying and selling of cryptocurrencies on exchanges.

- Remittance: Transfer of funds using cryptocurrency for cross-border payments.

- Payment: Use of cryptocurrencies as a medium of exchange for goods and services.

- Others: Additional applications beyond trading, remittance, and payment.

Regional Insights

The report identifies Paris Region, Auvergne-Rhône-Alpes, Nouvelle-Aquitaine, Hauts-de-France, Occitanie, Provence Alpes Côte d’Azur, Grand Est, and others as major regional markets. The Paris Region is dominant due to its status as an economic and financial hub fostering cryptocurrency adoption. Not provided in source specific market share or CAGR per region.

Recent Developments & News

In July 2025, CoinShares, a European cryptocurrency investment firm, received the 'Markets in Crypto-Assets' (MiCA) license in France through its subsidiary CoinShares Asset Management. This made it the first continental European asset manager operating under the EU’s new crypto framework established in June 2025. In March 2025, Thsyu CRYPTO GROUP LIMITED launched THSYU, a new cryptocurrency exchange in France featuring advanced security and AI-based monitoring for real-time fraud detection.

Competitive Landscape

The market research report has provided a comprehensive competitive analysis covering market structure, key player positioning, winning strategies, and company evaluation quadrants. Detailed profiles of major companies are included.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302