Market Overview

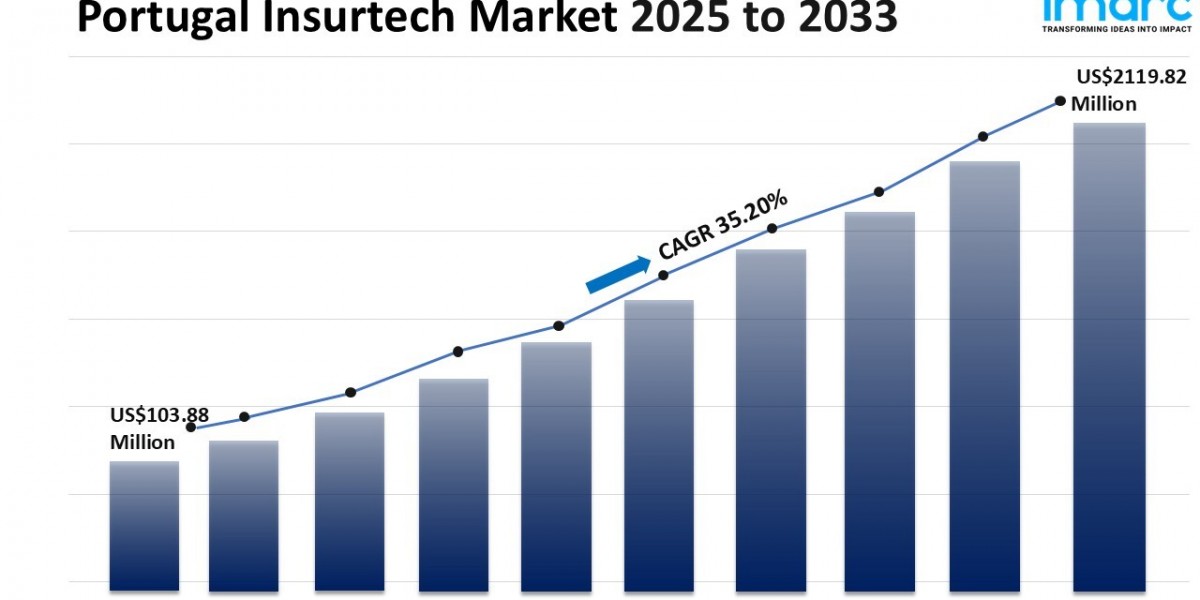

The Portugal insurtech market size reached USD 103.88 Million in 2024 and is expected to grow to USD 2,119.82 Million by 2033, registering a CAGR of 35.20% during the forecast period of 2025-2033. This growth is driven by accelerating digital transformation initiatives across the insurance sector, strong adoption of AI, machine learning, and blockchain technologies, along with supportive government fintech frameworks and evolving regulations. The increasing demand for personalized digital insurance solutions is also propelling the market.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Portugal Insurtech Market Key Takeaways

- Current Market Size: USD 103.88 Million (2024)

- CAGR: 35.20%

- Forecast Period: 2025-2033

- The market is driven by digital transformation and the integration of AI and machine learning technologies enhancing customer interactions and operational efficiency.

- Portugal is a leading European hub for blockchain adoption in fintech, significantly influencing the insurtech sector.

- Government programs and a favorable regulatory framework support fintech and insurtech innovation and market expansion.

- Portuguese insurers use AI and blockchain for improved risk assessment, claims handling, and fraud detection.

- The InvestEU Fomento-FEI initiative aims to generate over €6.5 billion for SMEs, positively impacting fintech and insurtech growth.

Sample Request Link: https://www.imarcgroup.com/portugal-insurtech-market/requestsample

Market Growth Factors

The rapid rise of digitalization and the implementation of AI/ML in the Portuguese insurance industry are the main factors driving the growth of the insurtech market in the region; insurers are using chatbots, voice assistants, and predictive analytics to improve customer experience. Easier insurance-related services, better risk assessment, and proactive claims management are the factors contributing to the growth of this market.

The quick adoption of blockchain technology in Portugal is another major driver. The Portugal insurtech scene has a strong number of blockchain fintech startups. Many have adopted the technology to improve services and create immutable records for underwriting, processing claims and combatting fraud. The Portuguese regulatory environment is more relaxed than some other jurisdictions, while the European Union is also supportive of insurtech blockchain efforts.

The growth of the Portugal insurtech market is being driven by an increased focus on regulation and the growing interest of fintech investors. Portugal's regulators are favorable to innovation and have introduced consumer protection policies in line with EU rules for digital financial services and data protection. Greatly, the InvestEU Fomento-FEI program recently announced in 2025 has eased over €6.5 billion in investments into SMEs and fintech firms, building market confidence and promoting growth strategies.

Market Segmentation

Type Insights:

- Auto: Includes insurance products related to motor vehicles.

- Business: Covers insurance services tailored for businesses.

- Health: Encompasses health insurance products.

- Home: Pertains to home insurance offerings.

- Specialty: Specialized insurance services for specific needs.

- Travel: Insurance covering travel-related risks.

- Others: Other miscellaneous insurance types.

Service Insights:

- Consulting: Advisory services supporting insurtech development.

- Support and Maintenance: Ongoing technical and operational assistance.

- Managed Services: Outsourced management of insurtech solutions.

Technology Insights:

- Block Chain: Adoption of blockchain technology for security and transparency.

- Cloud Computing: Use of cloud infrastructure and services.

- IoT: Internet of Things integration in insurance solutions.

- Machine Learning: Application of ML algorithms for analytics and automation.

- Robo Advisory: Automated advisory services leveraging AI.

- Others: Additional technologies employed in the insurtech market.

Regional Insights:

- Norte

- Centro

- A. M. Lisboa

- Alentejo

- Others

Each segment is analyzed in the report with forecasts at country and regional levels for 2025-2033.

Regional Insights

Norte, Centro, A. M. Lisboa, Alentejo, and other regions are covered for comprehensive market analysis. The report does not specify a single dominant region or provide specific market share figures by region. It includes detailed forecasts and trends at regional levels for the period 2025-2033, underscoring the market's geographic distribution across Portugal.

Recent Developments & News

In June 2025, the EuroPA alliance, represented by Bancomat, Bizum, MB WAY (SIBS), and Vipps MobilePay, in collaboration with EPI Company, announced efforts to address Europe's payment sovereignty issue, facilitating seamless cross-border transactions benefiting over 50 million users across Andorra, Italy, Portugal, and Spain.

In May 2025, Mollie, a rapidly expanding European financial service provider, officially commenced operations in Portugal to support tailored and scalable digital payment solutions for Portuguese companies amid growth in ecommerce and digital payments.

Key Players

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302