Market Overview

The global smartphone market size reached 1,517.0 million units in 2024 and is expected to grow to 1,998.2 million units by 2033, exhibiting a CAGR of 3.08% during the forecast period 2025-2033. Key growth drivers include increasing internet penetration, technological advancements such as 5G adoption, and rising demand for multimedia and gaming capabilities.

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Smartphone Market Key Takeaways

- Current Market Size: 1,517.0 million units in 2024

- CAGR: 3.08% during 2025-2033

- Forecast Period: 2025-2033

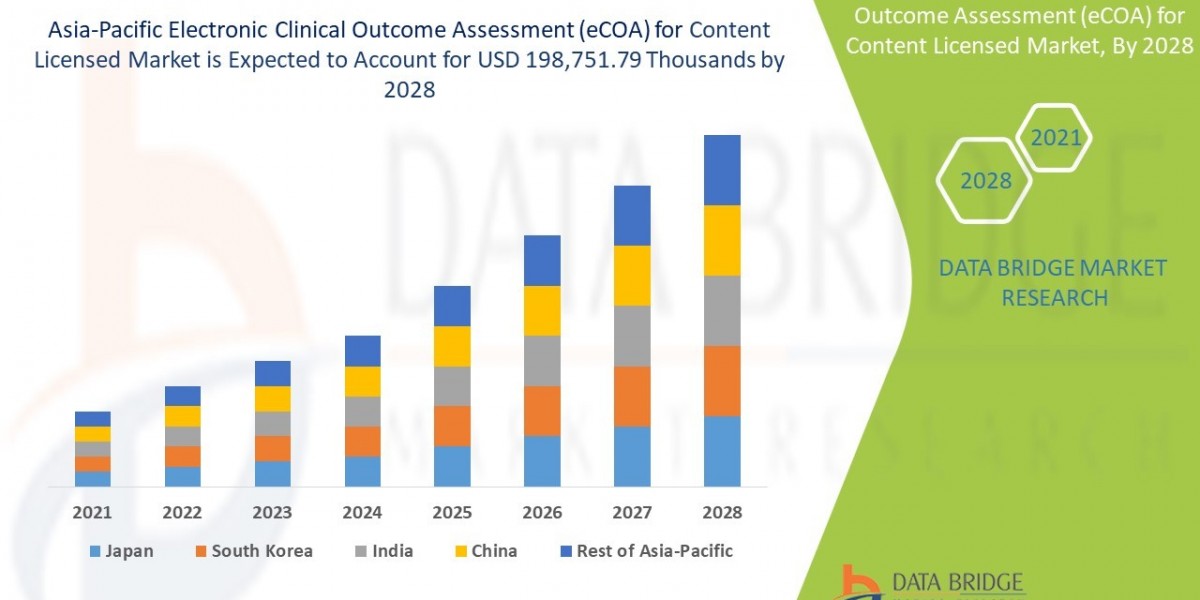

- Asia Pacific dominates the smartphone market, accounting for the largest share in 2024.

- Android holds the largest share in the operating system segment due to its easy availability and cost-effectiveness.

- LCD technology represents the leading display technology, owing to affordability and established manufacturing infrastructure.

- The 4GB - 8GB RAM capacity segment is the largest consumer preference category.

- The market is driven by technological advancements including integration of 5G, AI, and AR.

Sample Request Link: https://www.imarcgroup.com/smartphone-market/requestsample

Market Growth Factors

The smartphone market expansion is mainly driven by the global enhancement of internet accessibility. On the whole, the internet has been categorized in the list of essential needs, and along with internet access, smartphones became the means to connect and perform activities online, such as social networking, e-commerce, content streaming, and messaging apps. The trend of using smartphones is very clear in the developing countries where they offer to the customers affordable devices with access to the internet along with the expanding demand of the consumers for online connectivity.

Another important factor in the market growth is technological innovations. Constantly changing and very competitive manufacturers are always partnering with the designers resulting in the invention of new smart robots plus the complete replacement of the ordinary with the high-tech. The inclusion of 5G, augmented realities (AR), and artificial intelligence (AI) are just among the few innovations that have changed the face of the users, is turning devices into more than just marketable products, and, thus, indirectly accelerating the prolongation of the market.

Moreover, the increased product offerings on e-commerce sites are a significant contributing factor to the market enlargement. Internet marketplaces are providing the public with a wide range of different brands, types, and colors that are often not available in regular shops. The ease of price comparison, reading reviews, and making wise choices all the more, combined with the availability of online payments and installment plans, result in higher sales of smartphones through these channels. Simple return rules and good discounts make online shopping many consumers' favored way to buy.

Market Segmentation

Breakup by Operating System:

- Android

- iOS

- Others

_Android dominates the market due to its easy availability, cost-effectiveness, and a vast ecosystem of applications through the Google Play Store. It caters to a wide spectrum of consumers across different price points._

Breakup by Display Technology:

- LCD Technology

- OLED Technology

_LCD technology is the leading display technology segment, widely used due to affordability, versatility, excellent color reproduction, visibility, and an established manufacturing infrastructure._

Breakup by RAM Capacity:

- Below 4GB

- 4GB - 8GB

- Over 8GB

_The 4GB RAM segment caters to budget consumers for basic usage. The 4GB-8GB segment balances performance and affordability, appealing for multitasking and moderate gaming. The over 8GB category targets power users needing high performance for intensive tasks like video editing and gaming._

Breakup by Price Range:

- Ultra-Low-End (Less Than $100)

- Low-End ($100-<$200)

- Mid-Range ($200-<$400)

- Mid- to High-End ($400-<$600)

- High-End ($600-<$800)

- Premium ($800-<$1000)

- Ultra-Premium ($1000 and Above)

_Ultra-low-end smartphones offer basic features targeting price-sensitive consumers or emerging markets. Low-end devices have improved cameras and storage over ultra-low-end. Mid-range phones provide balanced features and decent performance. Mid- to high-end offers advanced features and better build quality. High-end includes flagship devices with top specifications. Premium and ultra-premium represent luxury phones with exceptional performance and design for tech enthusiasts._

Breakup by Distribution Channel:

- OEMs

- Online Stores

- Retailers

_OEMs sell directly often via official sites or stores. Online stores/e-commerce platforms provide extensive brand access and convenience. Retailers include physical stores and carriers offering personalized service and presence._

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Regional Insights

Asia Pacific holds the largest smartphone market share in 2024, attributed to rapid urbanization, growing population (notably China and India), and rising disposable incomes. Technological advancements and presence of major manufacturers in the region further boost dominance. The proliferation of 4G/5G networks and high-speed internet availability enhances product adoption, enabling access to advanced features and seamless online services.

Recent Developments & News

ASUS introduced the Zenfone 12 Ultra on the 6th of February, 2025, boasting a massive 6.78-inch display and an under-the-hood Snapdragon® 8 Elite Mobile Platform, along with the top-notch AI-powered tri-camera system, 5500mAh battery, IP68 resistance, and eco-friendly design.

On the 17th of February, 2025, Nothing Technology Ltd. revealed the phone (3a) Series as coming with a Snapdragon chipset that would triple the Phone (2a) Plus' CPU power and multiply its NPU speed by 1.72 times, making March 4, 2025, the date for the unveiling.

Samsung unveiled on the 17th of April 2025, the Galaxy M56 5G as the squishiest phone of its category with only 7.2mm thickness, besides having Gorilla Glass Victus+ shielding, a 50MP triple-camera, a 6.7 inches Full HD+ Super AMOLED+ screen with 120Hz refresh rate, and the 4nm Exynos 1480 Processor; all this at a price point of $300-$340, including 45W fast charging and a maximum of 6 years of software support.

Besides, there are earlier launches like Samsung's Galaxy Z Flip3 and Z Fold3 5G (August 2021), Huawei Mate 30 series (September 2019), and Apple's iPhone 14 and 14 Plus (September 2022) with advanced camera and safety features.

Key Players

- Apple Inc.

- Google LLC

- Huawei Device Co., Ltd.

- Motorola Mobility LLC (Lenovo Group Limited)

- OnePlus

- Oppo

- Realme

- Samsung Electronics Co., Ltd.

- Shenzhen Transsion Holdings Co., Ltd.

- Vivo

- Xiaomi Corporation

- ZTE Devices

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Get insights that fit your strategy — Request your customized version now!

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302