Market Overview

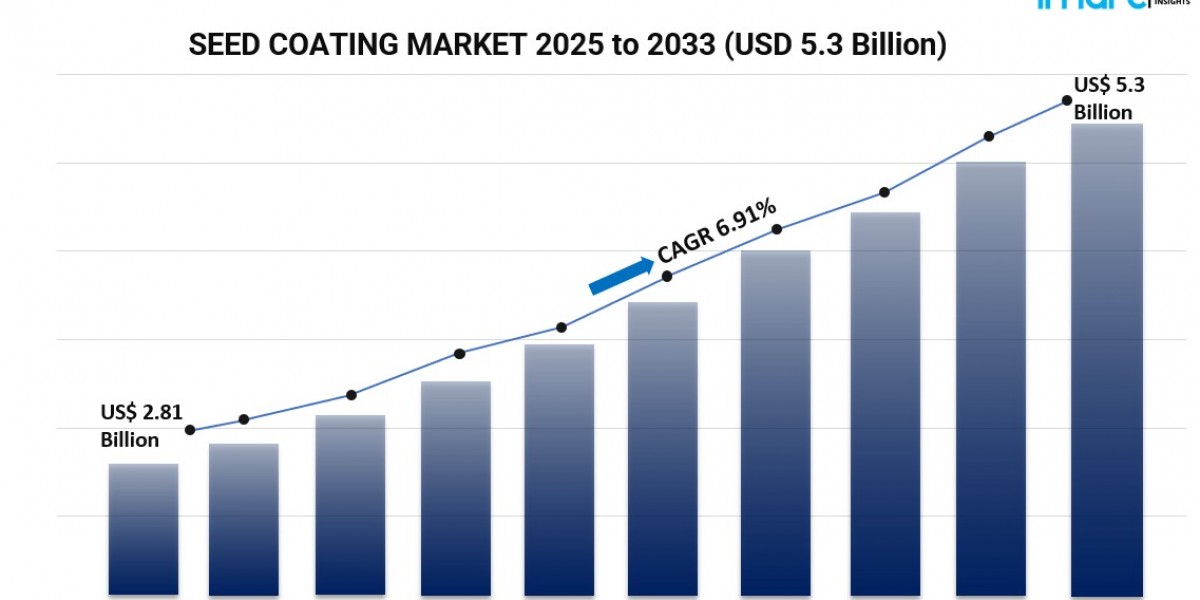

The global seed coating market was valued at USD 2.81 Billion in 2024 and is projected to reach USD 5.3 Billion by 2033, growing at a CAGR of 6.91% during the forecast period from 2025 to 2033. The market is driven by the growing need to improve crop productivity through advanced seed coatings that enhance germination rates, protect seeds, and promote sustainability. North America dominates with over 39.8% market share, supported by innovations and R&D initiatives. The Seed Coating Market is expanding as sustainable and precision agriculture practices rise.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Seed Coating Market Key Takeaways

- Current Market Size: USD 2.81 Billion in 2024

- CAGR: 6.91%

- Forecast Period: 2025-2033

- North America dominates with a 39.8% share in 2024, driven by advanced farming technologies and strong R&D.

- Polymers represent the largest additive type segment with 30.2% market share, due to their durable and uniform film-forming properties.

- Film coating leads the market by process because it offers uniform protective layers, improving seed performance and reducing environmental impact.

- Cereals and grains dominate the crop type segment with 26.8% share, driven by their global dietary importance and the need for enhanced germination.

- Key regional markets include Asia Pacific, Europe, Latin America, and Middle East & Africa, each showing adoption driven by sustainable agriculture and government support.

- Precision agriculture adoption, with a global market valued at USD 9.3 billion in 2024, is a key growth driver enhancing seed coating demand.

Request for sample copy of this report: https://www.imarcgroup.com/seed-coating-market/requestsample

Market Growth Factors

The rising global population coupled with limited agricultural land is intensifying the need to increase crop productivity, which is increasingly encouraging the adoption of seed coatings. Seed coatings enhance germination rates and seedling vigor, resulting in better yields and optimized resource use. Innovations in coating materials, particularly polymers and biodegradable options, are improving seed protection while supporting environmental sustainability. Moreover, seed coatings enable the integration of nutrients, pesticides, and growth stimulants to improve overall seed performance and reduce chemical dependency, promoting soil health and ecological balance.

Governments around the world are facilitating the use of seed coatings through subsidies and educational initiatives aimed at boosting agricultural development and food security. In North America, particularly the United States, innovative seed treatment products that combine proprietary technologies with seed finishers have advanced the market significantly. For instance, in 2024, Lallemand Plant Care launched LALRISE SHINE DS, which enhances root vigor and nutrient absorption. The rising adoption of precision agriculture practices further fuels demand, as coated seeds enable precise planting, reduce seed wastage, and contribute to uniform crop growth.

Advancements in seed coating materials, especially biopolymer technologies, are revolutionizing conventional farming by increasing seed protection and crop yields. The Indian Institute of Oilseeds Research's patented biopolymer technology, introduced in 2024, aims to boost crop yields by 25-30% while lowering costs and mitigating climate challenges. These innovations align with the growing preference for sustainable farming, offering affordable, eco-friendly seed coatings. The increasing use of precision agriculture, valued at USD 9.3 billion in 2024 globally, is also driving demand as coated seeds support efficient machinery use and precise resource application, essential for modern, sustainable farming practices.

Market Segmentation

By Additive Type:

- Polymers: Largest segment in 2024 with 30.2% share; polymers form durable, uniform films around seeds, enhancing physical properties, flowability, and protection against environmental stresses. Compatibility with active ingredients allows customized solutions boosting germination and early plant growth.

- Colorants

- Pellets

- Binders

- Active Ingredients

- Others

By Process:

- Film Coating: Largest segment; provides a thin, uniform protective layer without significantly altering seed size or weight, enhancing flowability, precision in mechanical sowing, reducing dust-off, and allowing integration of active ingredients for targeted seed protection.

- Encrusting

- Pelleting

By Crop Type:

- Cereals and Grains: Leading segment with 26.8% share, owing to their significance in global food production. Seed coatings address pest resistance, disease management, and environmental stress tolerance to improve yield and uniform growth.

- Fruits and Vegetables

- Flowers and Ornamentals

- Oilseeds and Pulses

- Others

Regional Insights

North America leads the global seed coating market with a 39.8% share in 2024, propelled by its advanced agricultural sector and widespread use of innovative farming technologies. The region's focus on high-yield and sustainable crops drives significant investment in seed enhancement solutions. The United States holds 70% of North America's market share, where farmers adopt coated seeds to combat climate and soil challenges for improved germination and seedling health. Collaboration between agricultural companies and research institutions supports continuous improvements. The precision agriculture sector in North America is expected to reach USD 10.7 Billion by 2032, at a CAGR of 10.4%.

Recent Developments & News

- December 2024: BioConsortia partnered with New Zealand’s H&T to launch FixiN 33, a nitrogen-fixing microbial seed treatment for crops such as corn, brassicas, and cereals. This product reduces nitrogen fertilizer dependency while maintaining yields, offering unmatched shelf stability and regulatory compliance in New Zealand.

- January 2024: Lucent BioSciences introduced Nutreos, a plant-based, non-toxic, biodegradable micronutrient seed coating aligned with anticipated EU microplastic ban laws, advancing sustainable seed treatments.

Key Players

- BASF SE

- Brett-Young Seeds Limited

- Centor Oceania

- Chromatech Incorporated

- Cistronics Innovations Pvt. Ltd.

- Croda International plc

- Germains Seed Technology

- Precision Laboratories LLC

- Sensient Colors LLC (Sensient Technologies Corporation)

- Solvay

Request for customization: https://www.imarcgroup.com/request?type=report&id=7081&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302