Market Overview

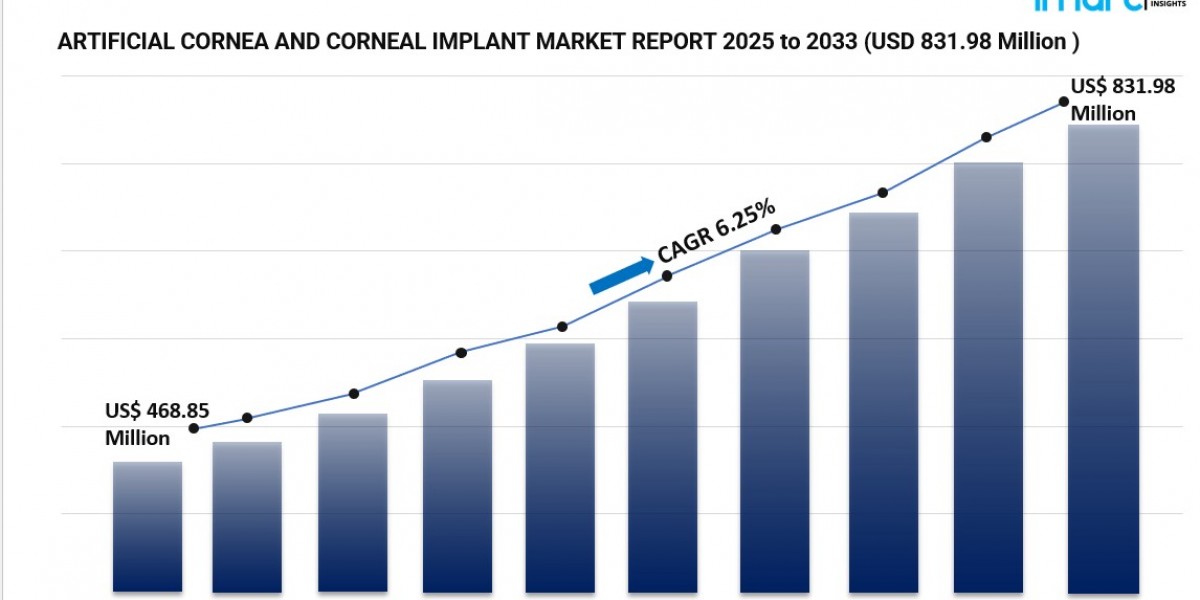

The global artificial cornea and corneal implant market was valued at USD 468.85 Million in 2024 and is expected to reach USD 831.98 Million by 2033. It is projected to grow at a CAGR of 6.25% during the forecast period 2025-2033. The market is driven by the rising prevalence of corneal infections, increased healthcare infrastructure, and the demand for full-thickness corneal transplantation. North America holds the largest share, boosted by technological advances and donor programs. More details at Artificial Cornea and Corneal Implant Market.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

Artificial Cornea and Corneal Implant Market Key Takeaways

- Current Market Size: USD 468.85 Million in 2024

- CAGR: 6.25%

- Forecast Period: 2025-2033

- North America dominates the market with 50.5% share in 2024

- Human cornea segment leads by type due to superior biocompatibility

- Penetrating keratoplasty is the leading transplant type, addressing severe corneal conditions

- Fuchs’ dystrophy accounts for the largest disease indication segment at 52.5%

- Hospitals are the primary end users with a 57.5% market share

Request for sample copy of this report: https://www.imarcgroup.com/artificial-cornea-corneal-implant-market/requestsample

Market Growth Factors

The artificial cornea and corneal implant market growth is propelled by the increased incidence of corneal infections and eye-related disorders globally. Approximately 6 million individuals suffer from corneal opacity worldwide, ranking as the sixth leading cause of blindness and visual impairment. The expansion of healthcare facilities such as hospitals and eye clinics enhances treatment availability, contributing significantly to market growth. Moreover, younger populations facing vision issues due to prolonged use of digital devices further boost demand.

The aging global population creates significant demand, as degenerative eye diseases like corneal opacities and endothelial dysfunction become more prevalent. Nearly 12 million adults over 40 in the U.S. suffer from visual impairments. Projections indicate that by 2050, up to 895 million people may suffer from distant vision impairment, with 61 million blind, driving the need for vision restoration and innovative corneal transplant solutions like artificial implants as alternatives for those unfit for conventional transplants.

Healthcare expenditure increases and improved access to advanced treatments drive the market forward. For example, in the U.S., the CDC allocated USD 6.5 million for vision and eye health programs in 2023, reflecting growing governmental focus. Enhanced healthcare budgets in developed and emerging economies facilitate availability of innovative artificial corneas and implants. Outreach and awareness campaigns by health organizations also encourage adoption by patients and providers worldwide, particularly in underserved regions.

Market Segmentation

By Type:

- Human Cornea: Holds the largest market share in 2024, favored for high biocompatibility and effectiveness. It integrates well with human tissue and reduces rejection risk.

- Artificial Cornea: Used as an alternative where human donor corneas are limited or not viable.

By Transplant Type:

- Penetrating Keratoplasty: Largest segment in 2024, widely used for full-thickness corneal transplants to treat degenerative diseases and scarring.

- Endothelial Keratoplasty: A transplantation targeting the endothelial layer of the cornea.

- Anterior Lamellar Keratoplasty: Partial thickness corneal transplant preserving healthy tissue.

- Keratoprosthesis: Artificial cornea implants used when donor corneas fail or are unavailable.

By Disease Indication:

- Fuchs' Dystrophy: Leading segment at 52.5% due to high incidence among aging populations and effective treatment options.

- Fungal Keratitis: Corneal infection segment.

- Keratoconus: Progressive thinning of the cornea.

- Others: Includes other corneal diseases requiring implants.

By End User:

- Hospitals: Lead with 57.5% share, offering advanced surgical infrastructure and post-operative care.

- Ambulatory Surgical Centers: Provide outpatient services.

- Specialty Clinics: Focused eye care centers offering specific corneal treatments.

Regional Insights

North America dominates the global artificial cornea and corneal implant market with a 50.5% share in 2024. This leadership is supported by a robust healthcare system, substantial investments in medical research, and extensive access to advanced surgical technologies and qualified ophthalmologists. Favorable organ and tissue donation programs improve donor cornea availability. Combined with strong adoption and reimbursement policies, North America continues as the primary growth engine for the market.

Recent Developments & News

- October 2024: Iran’s Ophthalmology Association announced successful use of locally produced artificial corneas, improving accessibility and affordability.

- September 2024: Aurion Biotech launched Vyznova® in Japan, the first approved cell therapy for corneal endothelial disease.

- August 2024: Kerato Ltd partnered with University of Montreal to develop in-situ gelling cornea treatment using stromal cells and synthetic matrix.

- June 2024: CorneaGen launched Corneal Tissue Addition for Keratoplasty (CTAK) providing custom gamma-irradiated tissue segments.

- January 2024: LV Prasad Eye Institute received a 20-year patent for a stem cell therapy for corneal repair, currently in clinical trials.

Key Players

- AJL Ophthalmic S.A.

- CorNeat Vision

- Eye Care of San Diego

- EyeYon Medical

- KeraMed, Inc

- LinkoCare Life Sciences AB

- Lions World Vision Institute

- LJ Eye Institute

- Lv Prasad Eye Institute

Request for customization: https://www.imarcgroup.com/request?type=report&id=4961&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302