Market Overview

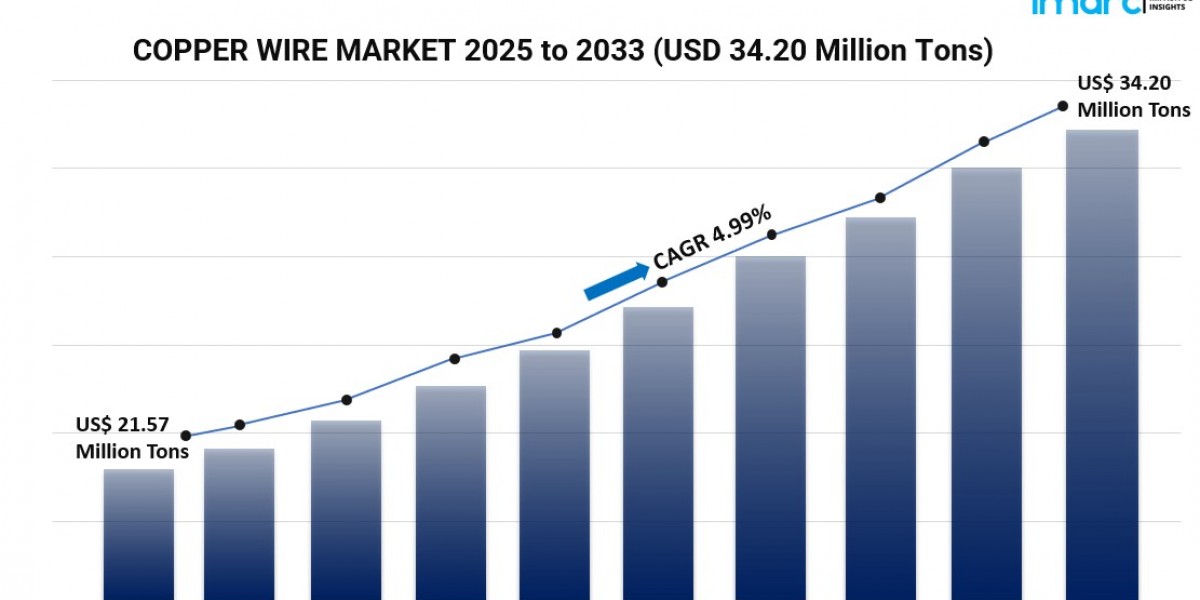

The global Copper Wire Market was valued at 21.57 Million Tons in 2024 and is projected to reach 34.20 Million Tons by 2033, expanding at a CAGR of 4.99% during 2025-2033. This growth is propelled by increasing deployment of renewable energy infrastructure, rising electric vehicle production, and modernization of aging electrical grids, particularly in Asia-Pacific which holds a 56.7% market share currently.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Copper Wire Market Key Takeaways

- Current Market Size: 21.57 Million Tons in 2024

- CAGR: 4.99%

- Forecast Period: 2025-2033

- Asia-Pacific dominates with a 56.7% market share in 2024 driven by industrialization and infrastructure investments.

- Building and construction is the largest application segment with approximately 33.3% market share in 2024.

- The United States holds 80.40% share of the North America copper wire market in 2024.

- Growth in electric vehicle production and renewable energy projects significantly boost demand.

- Technological advancements in wire coatings enhance durability and conductivity, enabling usage in demanding environments.

Request for a sample copy of this report: https://www.imarcgroup.com/copper-wire-market/requestsample

Market Growth Factors

The global copper wire market is primarily propelled by the expanding renewable energy infrastructure which demands extensive cabling for transmission and distribution. For example, in April 2025, Hengtong Cable Australia secured a contract to supply 40,000 cable harnesses for a solar farm project in Victoria, demonstrating growing renewable energy investments. The International Energy Agency forecasts global renewable electricity generation to rise by nearly 90% from 2023 to 2030, fueling copper demand in wind turbines, solar panels, and associated wiring due to copper’s excellent conductivity.

Electric vehicle (EV) production constitutes another critical growth driver. With nearly 14 million new electric cars registered globally in 2023, copper wiring is indispensable for battery systems, charging networks, and motors. Asia-Pacific’s automotive sector leverages copper wire extensively for EV batteries and charging infrastructure. The regional shift toward sustainable transportation, including buses and four-wheelers accounting for 54% and 36% copper usage respectively by 2030, reflects this trend.

In the United States, modernization of aging electrical infrastructure also plays a significant role. Approximately USD 73 Billion from the USD 1.2 Trillion Infrastructure Investment and Jobs Act supports grid upgrades, with solar power comprising over 1,000 GW of queued projects. Rising investments in smart grids, broadband expansion, and semiconductor manufacturing have augmented copper wire demand. Commercial retrofitting for energy efficiency and rising utility-scale solar and wind installations bolster sustained growth.

Market Segmentation

Application:

- Building and Construction: The largest segment with 33.3% share in 2024, this sector uses copper wire extensively in electrical wiring for residential, commercial, and industrial buildings, enhanced by urbanization and smart city initiatives.

- Telecommunication and Power: Copper wiring is crucial for broadband expansion, 5G rollout, power grid modernization, and transmission & distribution networks.

- Transport: Copper wire supports automotive applications notably in electric vehicles with wiring systems integral to motors and batteries.

- Industrial Equipment: Copper wire’s conductivity and durability support various machinery and manufacturing equipment.

- Electronics: Used widely in consumer electronics and chip fabrication facilities requiring reliable wiring.

- Others: Encompasses various residual sectors utilizing copper wire for specialized electrical applications.

Regional Insights

Asia-Pacific dominates the copper wire market with over 56.7% share in 2024, fueled by rapid industrialization, infrastructure expansion, and growth in automotive and electronics manufacturing, especially in China, India, Japan, and South Korea. The region benefits from government-led power network modernization and strong copper smelting and refining industries ensuring steady wire production supply. Initiatives like the launch of smelting operations at Adani Enterprises' Kutch Copper facility in India underline this growth.

Recent Developments & News

- April 2025: Met-Ed, a FirstEnergy Corp. subsidiary, announced an energy delivery upgrade in York County, Pennsylvania, replacing aging copper wire with larger-diameter cables to improve service for 300 customers.

- February 2025: UltraTech Cement entered the wires and cables segment, investing INR 1,800 crore to build a manufacturing plant near Bharuch, Gujarat.

- October 2024: Aurubis and COFICAB renewed a multi-year contract supplying copper wire rods to the automotive sector, emphasizing recycled materials.

- October 2024: Remee Wire & Cable launched stranded copper ground wires designed for solar arrays and wind farms.

- August 2024: Bedra Vietnam Alloy Material introduced advanced copper alloy rods and wires for new energy vehicles and electronics, emphasizing environmental friendliness.

- April 2024: Prysmian Group partnered with Aurubis for a long-term copper wire rod supply supporting sustainability goals and net-zero emission targets.

Key Players

- Schneider Electric SE

- Prysmian Group

- Mitsubishi Materials Corp.

- Southwire Company

- Nexans SA

- Furukawa Electric Co. Ltd.

- Belden Inc.

- Hindalco Industries Ltd.

- Polycab India Ltd.

- Finolex Cables Ltd.

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=5188&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201-971-6302