Market Overview

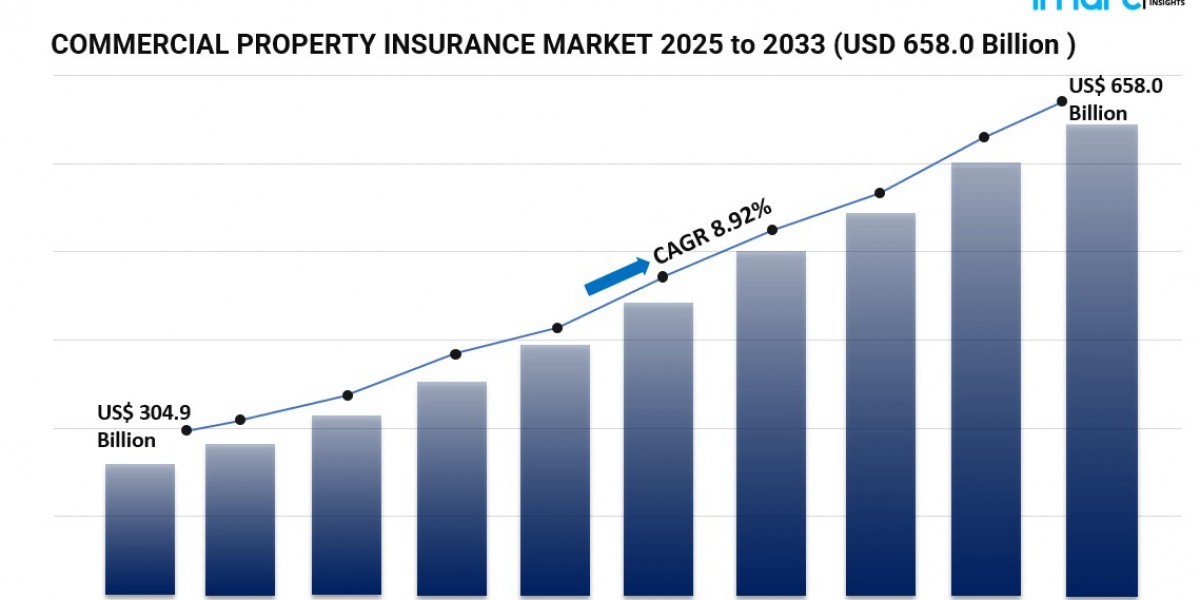

The global commercial property insurance market size reached USD 304.9 Billion in 2024, and is expected to grow to USD 658.0 Billion by 2033. The market is projected to exhibit a robust CAGR of 8.92% during the forecast period from 2025 to 2033. Key growth drivers include increased ownership of commercial properties, a rise in natural disasters, thefts, frauds, and heightened digitalization in the insurance sector. These factors collectively foster market expansion and evolving coverage demands. For detailed insights, visit the Commercial Property Insurance Market

Study Assumption Years

- Base Year: 2024

- Historical Year/Period: 2019-2024

- Forecast Year/Period: 2025-2033

Commercial Property Insurance Market Key Takeaways

- Current Market Size: USD 304.9 Billion (2024)

- CAGR: 8.92% (2025-2033)

- Forecast Period: 2025-2033

- Rising incidents of catastrophic events, burglary, and theft are primary market growth drivers.

- The expanding corporate sector is increasing ownership of commercial properties, positively impacting the market.

- Increased demand for specialty insurance products protecting against cyber threats and fraud is notable due to growing business complexity.

- Europe currently dominates the global commercial property insurance market, driven by an expanding real estate sector and presence of key insurance providers.

- Insurance providers are expanding coverage to include emerging risks such as cyber threats, environmental damages, and pandemics.

Request for a sample copy of this report : https://www.imarcgroup.com/commercial-property-insurance-market/requestsample

Market Growth Factors

The commercial property insurance market growth is propelled by rising incidents of catastrophic events, burglary, and theft. Insured losses from natural catastrophes totaled US$ 130 Billion, 76% above the 21st-century average and 18% higher than in 2020. These events compel businesses like general stores, restaurants, and SMEs to rely increasingly on commercial property insurance to mitigate financial risks, fostering market expansion.

Increasing ownership of commercial property is another significant driver. Large enterprises owning multiple buildings and the expanding corporate sector contribute to higher demand for commercial property insurance. The commercial real estate market worldwide was projected to reach US$ 118.80 Trillion by 2024, growing annually at 2.96% CAGR from 2024 to 2028. This rising ownership necessitates comprehensive insurance solutions to guard against unforeseen events, reducing business risks and enhancing goodwill.

Product offerings are also evolving to meet client needs, with providers expanding coverage for emerging risks such as cyber threats, environmental damages, and pandemics. New insurtech initiatives like Janover Insurance and product offerings like DUAL Asset’s title insurance for real estate and securities are examples of market innovation. This expansion into specialty and customized insurance policies enhances client value and drives market growth.

Market Segmentation

By Type:

- Buildings Insurance: Leads the market by protecting businesses against risks like fire, vandalism, natural disasters, and theft, ensuring financial security.

- Contents Insurance: Covers damage or loss of business contents.

- Flood Insurance: Provides protection specifically against flood-related damages.

- Earthquake Insurance: Protects against damages from earthquakes.

- Others: Encompasses other niche or less common commercial property insurance types.

By Enterprise Size:

- Small and Medium-sized Enterprises: Businesses with comparatively smaller assets requiring adequate insurance coverage.

- Large-Scale Enterprise: Often owning extensive buildings, equipment, and inventory needing comprehensive insurance due to high financial stakes.

By Application:

- Open Perils: Coverage against all risks except those explicitly excluded, offering broader protection.

- Named Perils: Coverage only for risks explicitly listed such as fire, theft, vandalism, or certain natural disasters.

By Region:

- North America: Includes the United States and Canada.

- Europe: Includes Germany, France, the United Kingdom, Italy, Spain, Russia, and others.

- Asia-Pacific: Includes China, Japan, India, South Korea, Australia, Indonesia, and others.

- Latin America: Includes Brazil, Mexico, and others.

- Middle East and Africa: Covers various countries in these regions.

Regional Insights

Europe currently dominates the global commercial property insurance market, driven by the expanding real estate sector. According to the European Public Real Estate Association, the EU's commercial real estate sector contributed more than US$ 15.3 Trillion GDP in 2021, including 177 REITs with a market cap of US$ 133 Billion and 261 non-REITs with a market cap of US$ 308 Billion. The presence of leading insurance providers and market players introducing wide-coverage policies further supports Europe’s market leadership.

Recent Developments & News

In May 2024, Janover launched Janover Insurance, its AI-enabled insurtech subsidiary for commercial property insurance. In the same month, DUAL Australia introduced a new business line in the Asia Pacific region via its specialized title insurance team, DUAL Asset, offering coverage for real estate titles and securities. Additionally, in June 2023, Chubb launched an aviation hub in Singapore to strengthen its general aviation and aerospace business, demonstrating commitment to innovation and growth.

Key Players

- Aegon Life Insurance Company Limited

- Allianz SE

- Aviva plc

- Axa S.A.

- Insureon (HUB International Limited)

- Nationwide Mutual Insurance Company

- Prudential Financial Inc.

- State Farm Mutual Automobile Insurance Company

- The Hartford Financial Services Group Inc.

If you require any specific information that is not currently covered within the scope of the report, we will provide the same as a part of the customization.

Request for a customization: https://www.imarcgroup.com/request?type=report&id=5396&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302