The intricate network of wires that powers and connects a modern vehicle represents a colossal global market. The Automotive Wiring Harness Market Analysis, measuring the total annual global revenue generated from the sale of these essential components, stands as a testament to the scale and complexity of automotive electronics. As of late 2025, this market is valued in the tens of billions of US dollars, making it one of the largest component sectors in the automotive supply chain. Its substantial size is driven by the sheer volume of vehicles produced globally and, more significantly, by the rapidly increasing value and complexity of the harness required for each new car, truck, and bus.

Calculating the Market's Value: Volume x Complexity

The market size is fundamentally determined by: Market Size = (Total Number of Wiring Harness Sets Sold) x (Average Selling Price per Set)

Both factors are contributing to the market's substantial valuation:

Massive Volume: With nearly 100 million new vehicles produced globally each year, and each requiring a complex set of harnesses, the unit volume is enormous. This demand comes from passenger cars, commercial vehicles, and two-wheelers.

Increasing Average Selling Price (ASP): This is the key driver of value growth. The ASP per vehicle harness set is rising significantly due to increasing complexity:

More Circuits: More electronic features (sensors, screens, ADAS, connectivity) mean more wires and connectors are needed.

Higher-Value Wires: The need for high-speed data transmission requires more expensive shielded cables or specialized wiring like Automotive Ethernet pairs.

High-Voltage EV Content: Electric vehicles require entirely new, very expensive high-voltage harnesses made with thick, heavily shielded cables and specialized connectors to handle the power for the battery and motors.

Advanced Materials: The push for lightweighting drives the use of more expensive, lighter-gauge wires or even aluminum wiring in some low-power applications.

Market Size by Segments

The global market valuation is an aggregation of various segments:

By Vehicle Type:

Passenger Cars: Represent the largest segment by far, due to the sheer volume of production. Premium and luxury cars contribute disproportionately to the value due to their high electronic content.

Commercial Vehicles: A significant segment, especially heavy-duty trucks which have complex and robust harness requirements.

Two-Wheelers: Particularly important in markets like India, this high-volume segment adds considerably to the overall market size, though the harnesses are simpler and lower cost per unit.

By Application/Voltage:

Body & Convenience Harness: Traditionally the largest part.

Engine/Powertrain Harness: A complex and critical segment.

ADAS/Infotainment Harness: Rapidly growing segment requiring high-speed data cables.

High-Voltage EV Harness: The fastest-growing segment in terms of value, driven by EV adoption.

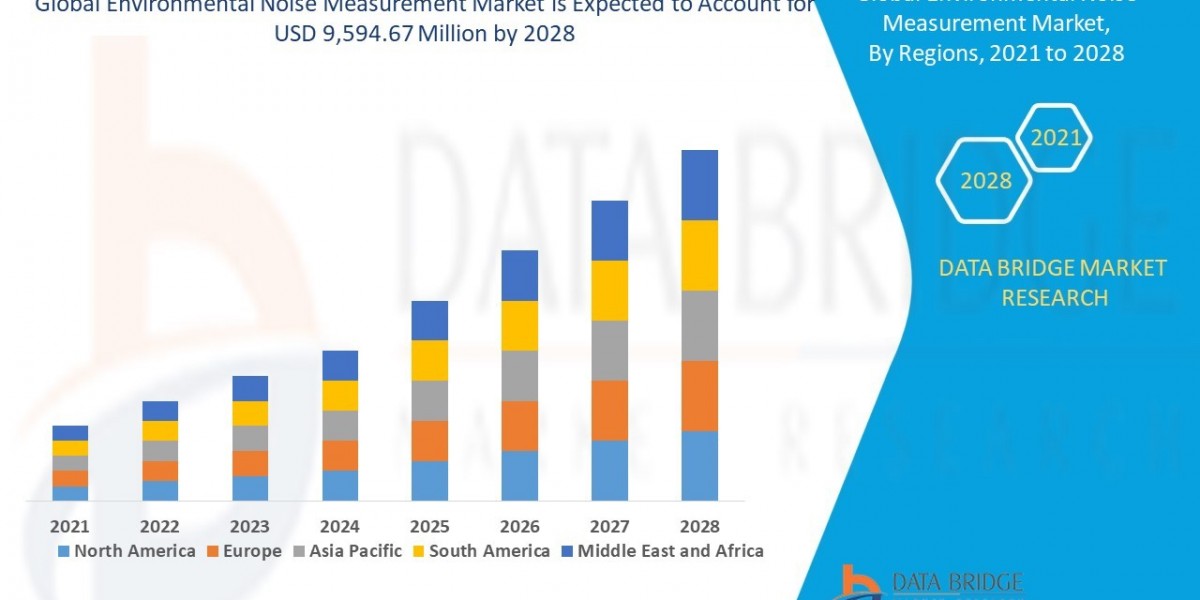

By Region:

Asia-Pacific (APAC): The largest market globally, both in terms of production and consumption, driven by the massive automotive industries in China, Japan, South Korea, and India.

Europe & North America: Mature but high-value markets with significant demand driven by complex vehicle features and electrification.

Growth Outlook The market size is projected to continue its strong growth trajectory, significantly outpacing the growth of overall vehicle production. This is because the primary driver – increasing electronic content per vehicle – shows no signs of slowing down as cars become ever more connected, electrified, and autonomous.

Frequently Asked Questions (FAQ)

Q1: How big is the global automotive wiring harness market? A1: As of 2025, the global automotive wiring harness market is a massive industry with annual revenues estimated to be between $50 billion and $60 billion USD, and it is projected to continue growing strongly.

Q2: Why is the market size growing if car sales are sometimes flat? A2: The market size (in terms of revenue) is growing primarily because the value and complexity of the wiring harness in each new car are increasing significantly. More electronics, high-voltage EV systems, and high-speed data requirements mean each harness set is more expensive, driving up total market revenue even if unit sales are stable.

Q3: Does the market size include the connectors and terminals? A3: Yes, typically the market size valuation includes the complete harness assembly, which encompasses the wires, connectors, terminals, protective coverings, and fasteners as a single integrated product supplied to the automaker.

Q4: How does the Indian market contribute to the global size? A4: India contributes significantly in two ways: firstly, through its huge domestic demand for harnesses for its massive two-wheeler and growing passenger car markets, and secondly, as a major global manufacturing hub where harnesses are produced for export to automakers worldwide.

More Related Report

Automotive Light Weight Body Panel Market Growth

Automotive Valve Market Growth