Asphalt is a crucial material widely used in road construction, roofing, and various industrial applications due to its durability, waterproofing properties, and versatility. As one of the most commonly used construction materials globally, the price of asphalt plays a key role in shaping construction and infrastructure costs. Fluctuations in asphalt prices can significantly impact the overall cost of projects, making it essential for procurement professionals, contractors, and businesses to monitor the price trend closely. This article explores the factors driving asphalt price trend historical pricing data, and forecasts for the future.

Market Overview

The asphalt market is influenced by a variety of factors, including raw material costs, supply-demand imbalances, global trade dynamics, and environmental regulations. Asphalt is primarily produced from crude oil, which means its price is closely tied to fluctuations in oil prices. In addition to the oil market, factors like the demand for infrastructure projects, seasonal fluctuations in construction activity, and regional supply chain conditions also play a significant role in asphalt pricing.

Over the years, asphalt prices have shown volatility, particularly due to changes in crude oil prices, geopolitical tensions, and shifts in demand from the construction sector. As of 2025, asphalt prices are expected to continue rising due to increased demand for infrastructure development, growing transportation networks, and higher raw material costs.

Historical Price Trends

Historically, asphalt prices have been highly correlated with crude oil prices, as oil is the primary raw material for asphalt production. Throughout the 2010s, asphalt prices experienced moderate fluctuations, typically tracking the movement of oil prices. For example, during the 2014 oil price crash, asphalt prices saw a decline, as the global oil surplus resulted in lower production costs.

However, between 2016 and 2019, asphalt prices experienced a steady increase due to rising oil prices and growing demand for road construction and infrastructure projects. In 2020, asphalt prices were impacted by the COVID-19 pandemic, with a temporary reduction in construction activity globally. As many infrastructure projects were delayed or halted, the demand for asphalt dropped, leading to a decline in prices.

As the global economy started recovering in late 2020 and 2021, asphalt prices rebounded sharply. The resurgence in construction activity, particularly in North America, Asia, and parts of Europe, along with a recovery in crude oil prices, led to an increase in asphalt prices. By 2022 and 2023, prices remained elevated, supported by rising demand for road infrastructure, particularly in emerging economies, and global supply chain disruptions.

Key Factors Influencing Asphalt Prices

Several key factors contribute to the fluctuation of asphalt prices:

- Crude Oil Prices: Asphalt is derived from crude oil through a refining process, making oil prices a significant determinant of asphalt pricing. Fluctuations in crude oil prices, driven by supply-demand factors, geopolitical events, and OPEC production decisions, directly affect asphalt production costs. When crude oil prices rise, asphalt prices tend to follow suit, and vice versa.

- Demand from Infrastructure and Construction: Asphalt is primarily used for road construction and maintenance. As demand for road infrastructure projects increases globally, particularly in developing economies, the demand for asphalt also rises. The construction and maintenance of highways, urban roads, and residential developments drive significant demand for asphalt.

- Transportation and Logistics Costs: Asphalt is a heavy, bulky material, and transportation costs can constitute a substantial portion of its final price. Regional fluctuations in fuel prices, logistical bottlenecks, and global shipping challenges can affect asphalt prices. For instance, disruptions in shipping and increased transportation costs due to factors like port congestion can contribute to higher asphalt prices.

- Supply Chain Dynamics: Asphalt supply is often subject to disruptions due to raw material availability, refinery output, and transportation challenges. Weather events, such as hurricanes or flooding, can disrupt production and delivery, leading to price increases. Additionally, refinery maintenance and capacity constraints in key producing regions can affect asphalt availability and price levels.

- Seasonal Variations: Asphalt production and demand can experience seasonal variations, especially in colder climates where road construction is typically limited during the winter months. This can cause asphalt prices to fluctuate, with higher demand and production during warmer months, followed by slower activity in winter. Regional differences in construction activity can also influence seasonal price trends.

- Government Policies and Environmental Regulations: Government infrastructure spending, especially in developing regions, can significantly impact asphalt demand. Policies that encourage infrastructure development or provide stimulus funding for road construction can drive up prices. Additionally, environmental regulations aimed at reducing carbon emissions from asphalt production may lead to higher manufacturing costs, influencing prices in the long term.

Regional Price Insights

- North America: In North America, asphalt prices are primarily influenced by construction demand, seasonal factors, and crude oil price fluctuations. The U.S. is a major consumer of asphalt for road construction, with demand driven by federal and state-level infrastructure projects. Price fluctuations in this region are also impacted by raw material availability and logistical costs, particularly in areas like the Gulf Coast, where asphalt production and distribution are concentrated.

- Asia-Pacific: Asia-Pacific, particularly countries like China and India, represents a significant share of global asphalt demand. The construction boom in these regions, fueled by urbanization and infrastructure expansion, continues to drive asphalt consumption. Additionally, countries like Japan and South Korea contribute to asphalt demand for road repair and maintenance projects. Price fluctuations in this region are closely linked to both oil prices and local supply-demand conditions.

- Europe: In Europe, asphalt prices are driven by demand for road infrastructure and the adoption of new, environmentally friendly asphalt technologies. The European Union has implemented regulations aimed at improving sustainability in road construction, which could impact asphalt production costs. Furthermore, demand for high-quality, durable asphalt for roads, airports, and other transport infrastructure keeps prices stable, though regional differences exist, with Western European countries generally seeing higher demand.

Market Forecast

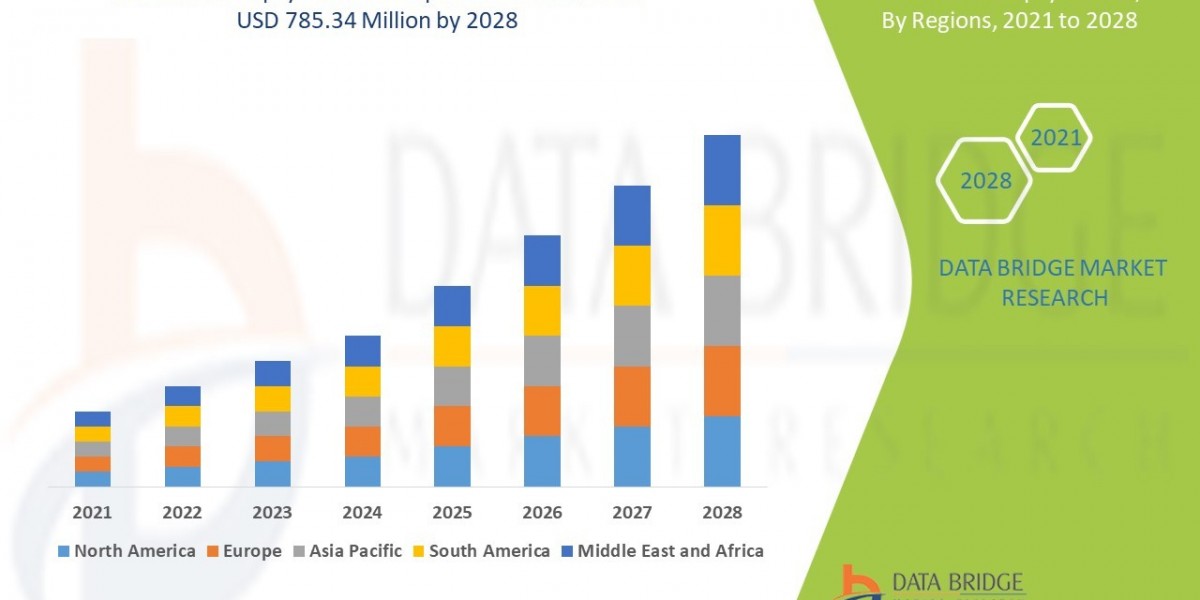

The global asphalt market is expected to experience moderate growth over the next several years. Infrastructure development and urbanization, particularly in developing regions like Asia-Pacific and Latin America, will continue to drive demand for asphalt. Additionally, ongoing improvements in road networks, including maintenance and repair projects, will keep the need for asphalt high.

However, the market will face challenges in the form of fluctuating crude oil prices, which may cause price volatility. Supply chain disruptions, particularly in the transportation and logistics sectors, will also continue to impact asphalt pricing. Additionally, the increasing emphasis on sustainability in construction may lead to higher production costs as new, environmentally friendly production methods are adopted.

In the long term, the global shift toward more energy-efficient and sustainable infrastructure may affect asphalt production methods, leading to more cost-effective processes. The adoption of recycled asphalt, for example, could help mitigate raw material price increases and stabilize asphalt prices.

Request for Real-Time Prices: https://www.procurementresource.com/resource-center/asphalt-price-trends/pricerequest

Procurement Resource

To navigate the complexities of the asphalt market, procurement professionals can benefit from utilizing comprehensive market intelligence resources. These platforms provide valuable insights into pricing trends, raw material availability, and supply chain conditions, helping businesses make more informed purchasing decisions.

By leveraging these platforms, businesses can forecast price movements, assess supply chain risks, and identify reliable suppliers. Accurate data and insights allow procurement teams to optimize sourcing strategies and minimize risks related to price fluctuations.

Contact Information

Company Name: Procurement Resource

Contact Person: Ashish Sharma (Sales Representative)

Email: sales@procurementresource.com

Location: 30 North Gould Street, Sheridan, WY 82801, USA

Phone:

UK: +44 7537171117

USA: +1 307 363 1045

Asia-Pacific (APAC): +91 1203185500

Connect With Us Online:

https://www.linkedin.com/company/procurement-resource-official/