Market Overview

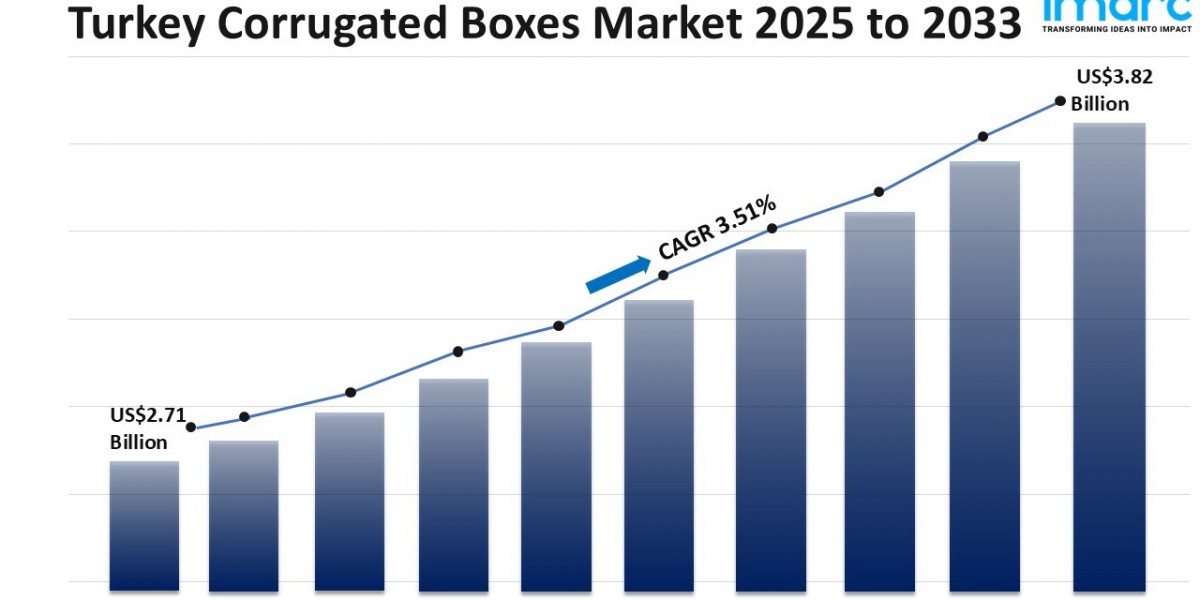

The Turkey corrugated boxes market was valued at USD 2.71 Billion in 2024 and is projected to reach USD 3.82 Billion by 2033. The market is expected to grow at a CAGR of 3.51% during the forecast period of 2025-2033. Growth is driven by Turkey's export-oriented industrial base, organized retail chains, expanding e-commerce sector, and increasing demand for specialized, branded, and retail-ready packaging solutions that enhance product visibility and delivery efficiency.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Turkey Corrugated Boxes Market Key Takeaways

- Current Market Size: USD 2.71 Billion in 2024

- CAGR: 3.51%

- Forecast Period: 2025-2033

- Turkey serves as an export hub due to its strategic location linking Europe, the Middle East, and Central Asia, supporting export-led growth.

- Packaging is specialized with ventilated, humidity-resistant, and heavy-duty cartons for automotive, machinery, and agrifood shipments.

- The surge in organized retail and e-commerce drives demand for tamper-proof, branded, and retail-ready boxes.

- Increasing sustainability pressure encourages higher recycled content, certified fiber sourcing, and lightweight design innovation.

- Digital printing and modular production systems enable customization, short runs, and waste reduction.

Sample Request Link: https://www.imarcgroup.com/turkey-corrugated-boxes-market/requestsample

Market Growth Factors

It is generally thought that the export-oriented nature of Turkey's industrial base will drive the demand for corrugated boxes. Turkey is geographically located in the center of Europe, Middle East and Central Asia; it is a hub for textiles, automotive parts, white goods and agrifoods. All these categories use corrugated packaging that can negotiate the vagaries of multimodal transport. Automotive manufacturers and machinery exporters may use heavy-duty cartons with die-cut edges or molded products. As fruit and vegetable exporters move towards longer periods of cold-chain storage, ventilated cartons with moisture-proof liners are used. The rise of free trade agreements and new logistics corridors has led to increased demand from packaging suppliers for a higher pallet load density as well for meeting a wider range of destination specifications.

Domestic retailing and e-commerce sales are increasing rapidly, as is demand for functional and high-graphic corrugated boxes. Organized retail chains and discount supermarkets, as well as e-commerce sites, prefer retail-ready boxes because they ease easy shelf replenishment, increase product visibility, and reduce labor costs. E-commerce companies prefer packaging that is tamper-obvious, returnable, and space-efficient, while Turkish SMEs that are making their transition to a web-based commercial setting prefer corrugated as it allows branded packaging to increase brand recognition. Joint packaging between logistics service providers and converters to optimize multi-size cartons, in conjunction with demand forecasting systems, have led to a meaningful reduction in stockouts and packaging waste in the domestic market.

Increasing sustainability pressures, due to the gradual adoption of EU environmental legislation and increasing consumer awareness, are expected to drive sustainable packaging production demand in Turkey. EPR schemes and municipal investments in recycling practices are expected to improve the supply of secondary fiber, stabilize input prices, and lower environmental impacts. Converters invest in digital printers and modular production technologies so that they can run short runs and custom products. They lightweight their products to reduce material usage and transportation emissions. Corrugated packaging is now a key factor in branding and company resilience due to regulations, environmental factors, and corporate pressure.

Market Segmentation

Material Used Insights:

- Recycled Corrugates: Corrugated boxes made primarily from recycled fibers, supporting sustainability and cost efficiency.

- Virgin Corrugates: Boxes produced from fresh, non-recycled fibers, typically offering higher strength and durability.

End Use Insights:

- Food Products and Beverages: Packaging solutions tailored to meet hygiene, ventilation, and preservation requirements.

- Paper Products: Boxes designed to package and protect various paper-based goods.

- Electrical and Electronic Goods: Specialized cartons for delicate and high-value technological products.

- Personal Care and Household Goods: Packaging that enhances brand visibility and protects daily use items.

- Chemicals: Corrugated boxes built to safely contain chemical products.

- Glassware and Ceramics: Protective packaging designed to prevent breakage and damage.

- Textile Goods: Boxes tailored for textile industry shipments.

- Others: Additional end-use segments not classified above.

Regional Insights

Marmara, Central Anatolia, Mediterranean, Aegean, Southeastern Anatolia, Black Sea, and Eastern Anatolia constitute the major regional markets in Turkey. Among these, Marmara stands out as a dominant region given its industrial and export capabilities. Notably, export corridors and logistics expansions enhance the market presence of corrugated boxes across these regions, catering to diverse industrial and retail demands. [Specific market share and CAGR by region not provided in source.]

Recent Developments & News

In June 2025, BHS Corrugated inaugurated a new production facility in Eskişehir, Turkey. This 12,500 m² plant specializes in manufacturing guide rollers and sheet metal components for corrugator systems, strengthening BHS Corrugated's global footprint and innovation capabilities. The facility features advanced sustainability elements, including rooftop solar power. With over 130 employees, it bolsters the company's support capacity for the global packaging industry across its nine international sites.

Key Players

- Not provided in source.

Competitive Landscape

The competitive landscape of the industry has also been examined along with the profiles of the key players.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302