Every car that rolls off an assembly line is a complex puzzle, and fasteners are the pieces that hold it all together. The Automotive Fasteners Market Size, which measures the total annual global revenue from the sale of these critical components, is a colossal industry in its own right. This substantial valuation is not just a function of the number of cars produced, but a reflection of the sheer volume of fasteners in each vehicle and the increasing technological value of these components. As vehicles become lighter and more electrified, the demand for specialized, high-value fasteners is pushing the market's value steadily upward.

Deconstructing the Market Size: Volume x Value

The market's valuation is driven by a simple equation on a massive scale:Market Size = (Total Fastener Units Sold) x (Average Price per Fastener)

The Volume Driver: The primary driver is the enormous global production of vehicles. With nearly 100 million vehicles (cars, trucks, buses, two-wheelers) produced annually, and each containing thousands of fasteners, the total unit volume is measured in the trillions. The Asia-Pacific (APAC) region, led by the manufacturing powerhouses of China and India, is the largest market by far in terms of sheer volume. India's massive two-wheeler market, for example, consumes billions of fasteners annually.

The Value Driver: The market's revenue is increasingly being driven by a higher Average Selling Price (ASP) per fastener. This "premiumization" is due to:

Increasing Complexity: A simple steel bolt is cheap. A custom-designed, high-tensile, lightweight aluminum bolt with a specialized anti-corrosion coating is not.

Electrification (EVs): EVs require a new class of high-value fasteners. This includes large, high-strength bolts for the heavy battery pack, non-conductive plastic fasteners for safety in high-voltage areas, and specialized connectors that are part of the fastener family.

Lightweighting: The shift to lighter vehicles requires fasteners made from more expensive materials like aluminum, titanium, or composites, which have a much higher ASP than traditional steel.

Electronic Content: The increasing number of electronic modules, sensors, and displays in a car adds to the demand for small, high-precision fasteners, including specialized clips and brackets.

Market Size by Key Segments

By Product Type:

Threaded Fasteners (Bolts, Screws, Nuts): This is the largest segment by value, as these components are critical for all high-load and structural applications (engine, chassis, suspension, battery mounting).

Non-Threaded Fasteners (Rivets, Pins): A substantial segment, used in bodywork and interior assembly.

Clips and Clamps: A massive high-volume market, especially with the growth of plastic fasteners for interior trim and wiring harnesses.

By Sales Channel:

Original Equipment (OE): This is the largest segment by a wide margin, representing all fasteners sold directly to automakers for new vehicle assembly.

Aftermarket: This is the replacement market, serving collision repair shops and mechanics. While smaller, it's a stable and significant market, especially for body panel fasteners and clips that are often single-use.

By Region:

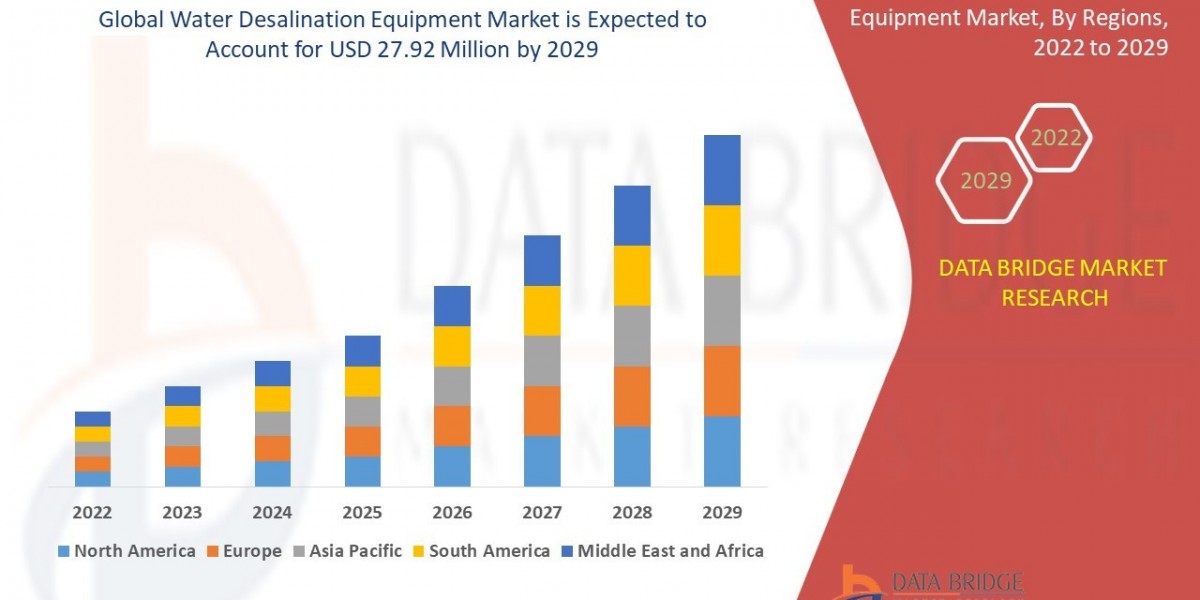

Asia-Pacific (APAC): The dominant market leader, holding the largest share of the global market size. This is due to its status as the world's primary automotive manufacturing hub (China, Japan, South Korea, India, Thailand) and its massive domestic demand.

Europe & North America: Mature, high-value markets with strong demand for advanced, specialized fasteners for their premium and electric vehicle segments.

Conclusion

The Automotive Fasteners Market Size is a powerful indicator of the health and complexity of the global auto industry. Its tens-of-billions-dollar valuation is built on the trillions of components it supplies. While the product itself is small, the market is a giant. As vehicles continue to evolve into lightweight, electric supercomputers, the demand for smarter, lighter, and more specialized fasteners will only increase, ensuring this foundational market continues its steady and valuable growth.

Frequently Asked Questions (FAQ)

Q1: What is the estimated global market size for automotive fasteners in 2025?A1: As of late 2025, the global automotive fasteners market is estimated to be valued between $30.7 billion and $35.5 billion USD annually, with strong projections for continued growth.

Q2: Which region is the largest market for automotive fasteners?A2: The Asia-Pacific (APAC) region is the largest market in the world, both in terms of production volume and consumption. This is driven by the massive automotive manufacturing industries in China, India, Japan, and South Korea.

Q3: How do electric vehicles (EVs) affect the market size?A3: EVs are a major growth driver for the market's value. While an EV might have fewer engine bolts, it introduces a significant new demand for high-value, specialized fasteners, such as high-strength bolts for the heavy battery pack and non-conductive plastic fasteners for safety, which increases the average fastener cost per vehicle.

Q4: Is the aftermarket (replacement) a big part of the fastener market?A4: The

More Related Report

Automotive LiDAR Sensors Market Size

Automotive Terminals Market Size